Smart lease agreements use digital platforms to automate rent payments, maintenance requests, and lease renewals, enhancing transparency and efficiency for both landlords and tenants. Gross leases require tenants to pay a fixed rent while landlords cover operating expenses like property taxes and utilities, making cost predictability a key feature for tenants. Explore more to understand which lease type best suits your real estate investment or rental needs.

Why it is important

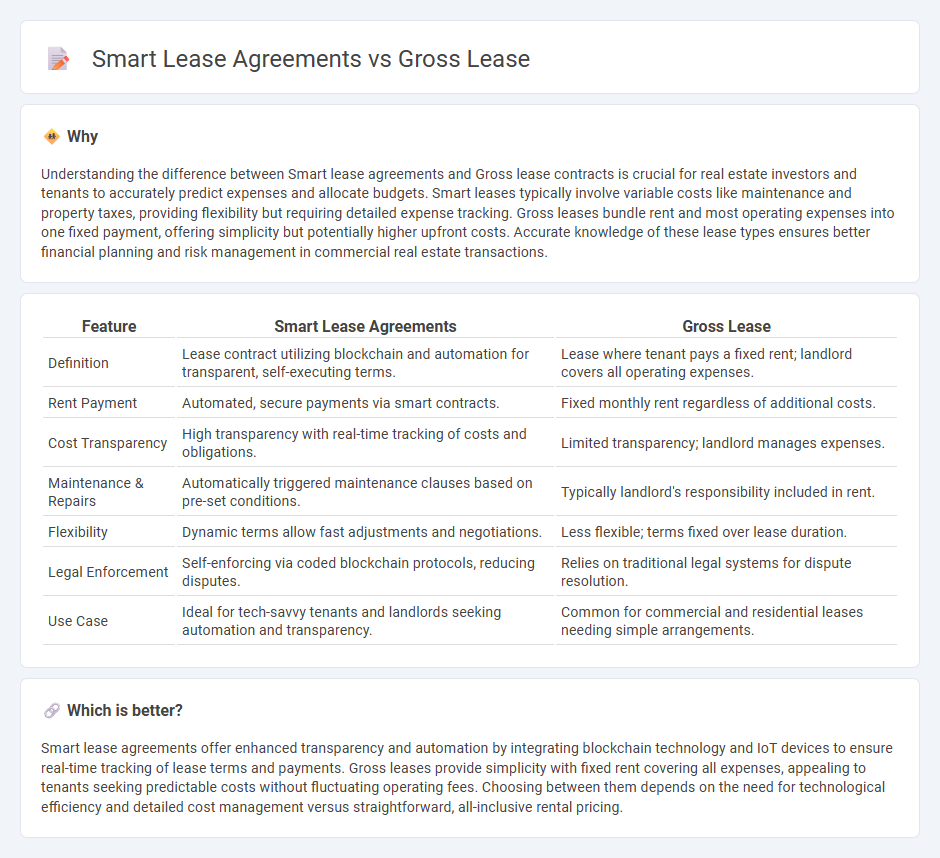

Understanding the difference between Smart lease agreements and Gross lease contracts is crucial for real estate investors and tenants to accurately predict expenses and allocate budgets. Smart leases typically involve variable costs like maintenance and property taxes, providing flexibility but requiring detailed expense tracking. Gross leases bundle rent and most operating expenses into one fixed payment, offering simplicity but potentially higher upfront costs. Accurate knowledge of these lease types ensures better financial planning and risk management in commercial real estate transactions.

Comparison Table

| Feature | Smart Lease Agreements | Gross Lease |

|---|---|---|

| Definition | Lease contract utilizing blockchain and automation for transparent, self-executing terms. | Lease where tenant pays a fixed rent; landlord covers all operating expenses. |

| Rent Payment | Automated, secure payments via smart contracts. | Fixed monthly rent regardless of additional costs. |

| Cost Transparency | High transparency with real-time tracking of costs and obligations. | Limited transparency; landlord manages expenses. |

| Maintenance & Repairs | Automatically triggered maintenance clauses based on pre-set conditions. | Typically landlord's responsibility included in rent. |

| Flexibility | Dynamic terms allow fast adjustments and negotiations. | Less flexible; terms fixed over lease duration. |

| Legal Enforcement | Self-enforcing via coded blockchain protocols, reducing disputes. | Relies on traditional legal systems for dispute resolution. |

| Use Case | Ideal for tech-savvy tenants and landlords seeking automation and transparency. | Common for commercial and residential leases needing simple arrangements. |

Which is better?

Smart lease agreements offer enhanced transparency and automation by integrating blockchain technology and IoT devices to ensure real-time tracking of lease terms and payments. Gross leases provide simplicity with fixed rent covering all expenses, appealing to tenants seeking predictable costs without fluctuating operating fees. Choosing between them depends on the need for technological efficiency and detailed cost management versus straightforward, all-inclusive rental pricing.

Connection

Smart lease agreements integrate digital technology to automate rent calculations, track payments, and update terms dynamically, enhancing the management of Gross leases where tenants pay a fixed rent covering all expenses. These agreements provide clarity on included costs such as taxes, insurance, and maintenance, reducing disputes in Gross lease contracts. Leveraging blockchain and smart contract features secures transparency and enforces compliance in complex real estate leases.

Key Terms

Rent Structure

Gross lease agreements involve a fixed rent amount covering base rent plus operating expenses such as maintenance, taxes, and insurance, offering predictable monthly payments. Smart lease agreements use advanced technology to dynamically adjust rent based on factors like usage, energy consumption, and market conditions, optimizing costs for tenants and landlords alike. Discover how each lease type impacts your financial planning and operational efficiency.

Operating Expenses

Gross lease agreements include all operating expenses such as maintenance, insurance, and property taxes within a fixed rent, providing tenants with predictable monthly costs. Smart lease agreements offer a more flexible approach by separating base rent from operating expenses, allowing tenants to pay only for their actual usage and encouraging efficient cost management. Explore how these lease structures impact your financial planning and operational control by learning more about their advantages and applications.

Property Management Technology

Gross lease agreements simplify budgeting by including all property expenses such as taxes, insurance, and maintenance in a single rent payment, reducing administrative oversight often managed via traditional property management software. Smart lease agreements leverage advanced property management technology like IoT sensors and AI-driven analytics to optimize energy use, automate maintenance scheduling, and enhance tenant experience through real-time data integration. Explore how integrating smart lease technologies can revolutionize property management efficiency and tenant satisfaction.

Source and External Links

Gross lease - Wikipedia - A gross lease is a commercial lease where the tenant pays a fixed rent amount and the landlord covers all operating expenses such as taxes, utilities, and maintenance, providing predictable payments for tenants.

gross lease | Wex | US Law | LII - A gross lease requires the tenant to pay a fixed periodic rent that covers rent plus operating costs like maintenance and taxes, reducing tenant liability for fluctuating expenses compared to net leases.

What is a Gross Lease? - TurboTenant - In a gross lease, the tenant pays a flat fee covering all operating expenses including property taxes, insurance, utilities, and maintenance, offering financial stability and simplicity for tenants.

dowidth.com

dowidth.com