Vertical farming real estate focuses on transforming urban spaces into sustainable agricultural hubs using advanced technology to maximize crop yields within limited areas, emphasizing environmental sustainability and food security. Hospitality real estate centers on properties designed for lodging and tourism, prioritizing guest experience, location, and amenities to drive revenue and occupancy rates. Explore the unique investment opportunities and market dynamics of both sectors to make informed real estate decisions.

Why it is important

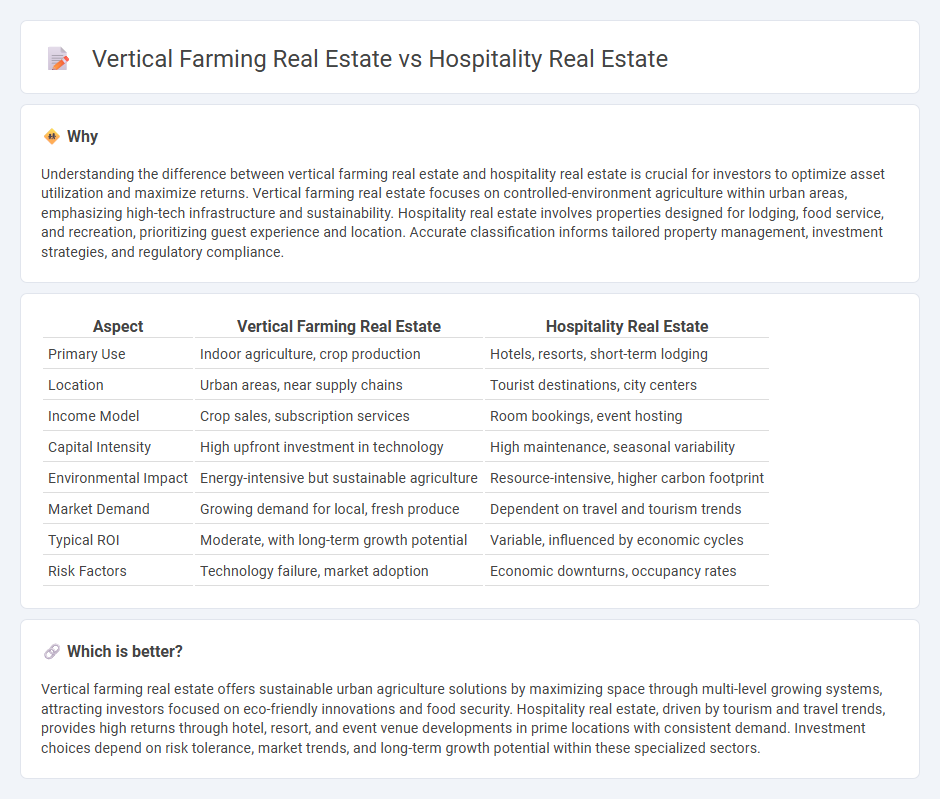

Understanding the difference between vertical farming real estate and hospitality real estate is crucial for investors to optimize asset utilization and maximize returns. Vertical farming real estate focuses on controlled-environment agriculture within urban areas, emphasizing high-tech infrastructure and sustainability. Hospitality real estate involves properties designed for lodging, food service, and recreation, prioritizing guest experience and location. Accurate classification informs tailored property management, investment strategies, and regulatory compliance.

Comparison Table

| Aspect | Vertical Farming Real Estate | Hospitality Real Estate |

|---|---|---|

| Primary Use | Indoor agriculture, crop production | Hotels, resorts, short-term lodging |

| Location | Urban areas, near supply chains | Tourist destinations, city centers |

| Income Model | Crop sales, subscription services | Room bookings, event hosting |

| Capital Intensity | High upfront investment in technology | High maintenance, seasonal variability |

| Environmental Impact | Energy-intensive but sustainable agriculture | Resource-intensive, higher carbon footprint |

| Market Demand | Growing demand for local, fresh produce | Dependent on travel and tourism trends |

| Typical ROI | Moderate, with long-term growth potential | Variable, influenced by economic cycles |

| Risk Factors | Technology failure, market adoption | Economic downturns, occupancy rates |

Which is better?

Vertical farming real estate offers sustainable urban agriculture solutions by maximizing space through multi-level growing systems, attracting investors focused on eco-friendly innovations and food security. Hospitality real estate, driven by tourism and travel trends, provides high returns through hotel, resort, and event venue developments in prime locations with consistent demand. Investment choices depend on risk tolerance, market trends, and long-term growth potential within these specialized sectors.

Connection

Vertical farming real estate and hospitality real estate intersect through the integration of sustainable agriculture within hotels and resorts, enhancing food sourcing and guest experience. Properties designed for vertical farming provide fresh, locally-grown produce directly to hospitality venues, reducing supply chain costs and carbon footprint. This synergy promotes eco-friendly practices and adds value to hospitality real estate investments by appealing to environmentally conscious consumers.

Key Terms

**Hospitality Real Estate:**

Hospitality real estate encompasses properties such as hotels, resorts, and other lodging facilities designed to accommodate travelers and tourists, often situated in prime locations to maximize guest experience and revenue potential. Key investment metrics include occupancy rates, average daily rate (ADR), and revenue per available room (RevPAR), with asset performance heavily influenced by tourism trends and economic cycles. Explore more about hospitality real estate dynamics, valuation methods, and market opportunities to enhance your investment strategy.

Occupancy Rate

Hospitality real estate typically boasts occupancy rates averaging 65-75% depending on location and seasonality, driven by transient guests and tourism cycles. Vertical farming real estate experiences occupancy rates often exceeding 85%, supported by consistent demand for controlled-environment agriculture spaces in urban areas. Explore further to understand how occupancy dynamics influence investment returns in these two distinct real estate sectors.

Revenue per Available Room (RevPAR)

Hospitality real estate focuses on maximizing Revenue per Available Room (RevPAR), a key performance metric that reflects room revenue efficiency and overall property profitability. In contrast, vertical farming real estate leverages space utilization and energy efficiency but does not use RevPAR as a relevant financial metric due to its agricultural focus. Explore the distinct financial metrics and real estate strategies that define hospitality and vertical farming sectors.

Source and External Links

Hospitality Real Estate in 2025: Investor Confidence Is Measured Amid Cost Pressures - Discusses the evolving landscape of hospitality real estate in 2025, including rising costs and investor interest in urban and resort assets.

Hospitality Properties For Sale - Provides information on the hospitality industry, including a wide range of properties such as hotels, resorts, and marinas, and the services offered by Marcus & Millichap for investment and sales.

Understanding Hospitality Real Estate - A Complete Guide - Offers an overview of the hospitality real estate sector, including various types of properties like hotels, resorts, and restaurants, and their roles in providing services for travelers and locals alike.

dowidth.com

dowidth.com