Escrow crowdfunding and seller financing represent innovative approaches to real estate investment and property acquisition. Escrow crowdfunding pools funds from multiple investors into a secure escrow account, enabling fractional ownership and diversification in property markets. Explore how these financing methods can transform your real estate strategies and investment opportunities.

Why it is important

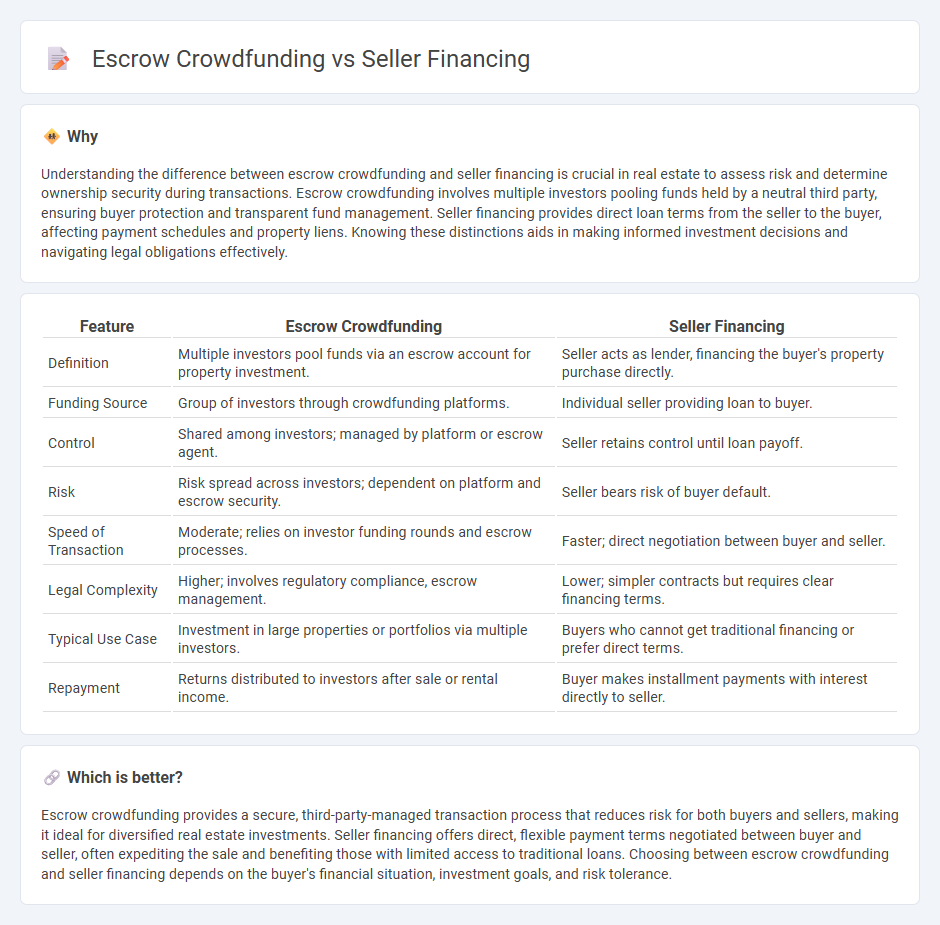

Understanding the difference between escrow crowdfunding and seller financing is crucial in real estate to assess risk and determine ownership security during transactions. Escrow crowdfunding involves multiple investors pooling funds held by a neutral third party, ensuring buyer protection and transparent fund management. Seller financing provides direct loan terms from the seller to the buyer, affecting payment schedules and property liens. Knowing these distinctions aids in making informed investment decisions and navigating legal obligations effectively.

Comparison Table

| Feature | Escrow Crowdfunding | Seller Financing |

|---|---|---|

| Definition | Multiple investors pool funds via an escrow account for property investment. | Seller acts as lender, financing the buyer's property purchase directly. |

| Funding Source | Group of investors through crowdfunding platforms. | Individual seller providing loan to buyer. |

| Control | Shared among investors; managed by platform or escrow agent. | Seller retains control until loan payoff. |

| Risk | Risk spread across investors; dependent on platform and escrow security. | Seller bears risk of buyer default. |

| Speed of Transaction | Moderate; relies on investor funding rounds and escrow processes. | Faster; direct negotiation between buyer and seller. |

| Legal Complexity | Higher; involves regulatory compliance, escrow management. | Lower; simpler contracts but requires clear financing terms. |

| Typical Use Case | Investment in large properties or portfolios via multiple investors. | Buyers who cannot get traditional financing or prefer direct terms. |

| Repayment | Returns distributed to investors after sale or rental income. | Buyer makes installment payments with interest directly to seller. |

Which is better?

Escrow crowdfunding provides a secure, third-party-managed transaction process that reduces risk for both buyers and sellers, making it ideal for diversified real estate investments. Seller financing offers direct, flexible payment terms negotiated between buyer and seller, often expediting the sale and benefiting those with limited access to traditional loans. Choosing between escrow crowdfunding and seller financing depends on the buyer's financial situation, investment goals, and risk tolerance.

Connection

Escrow crowdfunding and seller financing intersect in real estate by providing alternative funding methods that enhance transaction security and accessibility. Escrow accounts safeguard investor funds during crowdfunding campaigns until project milestones are met, while seller financing allows buyers to purchase property without traditional bank loans by paying the seller directly over time. This synergy facilitates smoother real estate deals by reducing reliance on conventional financing and ensuring transparent fund management throughout the process.

Key Terms

Promissory Note

Seller financing involves a promissory note as a legally binding document where the buyer agrees to repay the seller over time, outlining terms such as interest rate, payment schedule, and consequences of default. In escrow crowdfunding, a promissory note may be used to formalize individual investor contributions, held securely in escrow to protect both parties until funding milestones are met. Explore the distinct roles and legal implications of promissory notes in seller financing versus escrow crowdfunding by learning more about each method.

Escrow Account

An escrow account in seller financing securely holds buyer funds until transaction terms are met, minimizing risks for both parties through controlled disbursement by a neutral third party. In contrast, escrow crowdfunding pools capital from multiple investors into an escrow account, ensuring collective funds are managed transparently and released only when project milestones or regulatory requirements are satisfied. Explore further to understand how escrow accounts enhance trust and security in diverse real estate financing options.

Crowdfunding Platform

Crowdfunding platforms facilitate escrow crowdfunding by securely holding funds until project milestones are met, ensuring transparency and trust between sellers and buyers. Seller financing bypasses this intermediary step, allowing direct loans between parties but lacking the structured oversight crowdfunding platforms provide. Explore how different crowdfunding platforms optimize escrow services to maximize financial security and project success.

Source and External Links

M&A Seller Financing: A Complete Guide - This guide provides insights into how seller financing works, especially in business sales, including prequalification of buyers and structuring of payments.

Seller financing: Definition and how it's used in real estate - This article explains seller financing in real estate, including types such as holding mortgages, land contracts, and lease-options.

How does seller financing work? | Rocket Mortgage - This resource discusses seller financing in residential real estate, focusing on five common types, including land contracts and assumable mortgages.

dowidth.com

dowidth.com