Automated Valuation Models (AVMs) utilize algorithms and extensive real estate data to provide rapid property value estimates, enhancing accuracy in dynamic markets. The Hedonic Pricing Model examines property attributes such as location, size, and amenities to quantify their individual impact on property prices. Explore these valuation techniques to understand their applications and choose the best approach for your real estate needs.

Why it is important

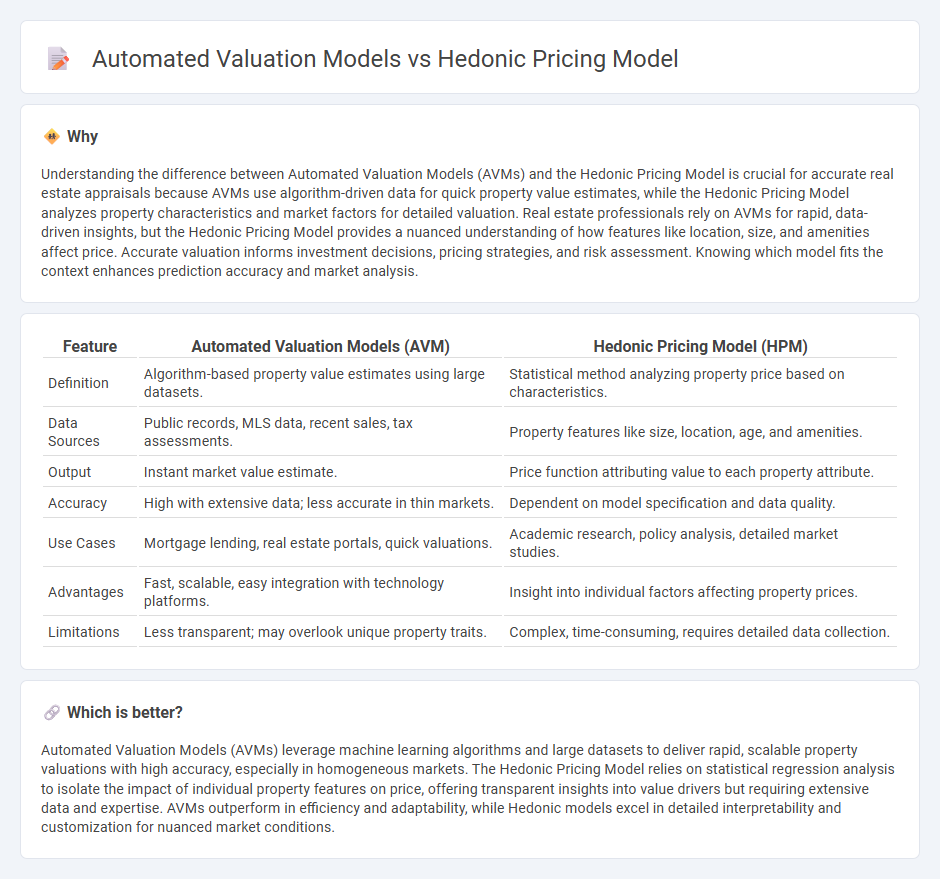

Understanding the difference between Automated Valuation Models (AVMs) and the Hedonic Pricing Model is crucial for accurate real estate appraisals because AVMs use algorithm-driven data for quick property value estimates, while the Hedonic Pricing Model analyzes property characteristics and market factors for detailed valuation. Real estate professionals rely on AVMs for rapid, data-driven insights, but the Hedonic Pricing Model provides a nuanced understanding of how features like location, size, and amenities affect price. Accurate valuation informs investment decisions, pricing strategies, and risk assessment. Knowing which model fits the context enhances prediction accuracy and market analysis.

Comparison Table

| Feature | Automated Valuation Models (AVM) | Hedonic Pricing Model (HPM) |

|---|---|---|

| Definition | Algorithm-based property value estimates using large datasets. | Statistical method analyzing property price based on characteristics. |

| Data Sources | Public records, MLS data, recent sales, tax assessments. | Property features like size, location, age, and amenities. |

| Output | Instant market value estimate. | Price function attributing value to each property attribute. |

| Accuracy | High with extensive data; less accurate in thin markets. | Dependent on model specification and data quality. |

| Use Cases | Mortgage lending, real estate portals, quick valuations. | Academic research, policy analysis, detailed market studies. |

| Advantages | Fast, scalable, easy integration with technology platforms. | Insight into individual factors affecting property prices. |

| Limitations | Less transparent; may overlook unique property traits. | Complex, time-consuming, requires detailed data collection. |

Which is better?

Automated Valuation Models (AVMs) leverage machine learning algorithms and large datasets to deliver rapid, scalable property valuations with high accuracy, especially in homogeneous markets. The Hedonic Pricing Model relies on statistical regression analysis to isolate the impact of individual property features on price, offering transparent insights into value drivers but requiring extensive data and expertise. AVMs outperform in efficiency and adaptability, while Hedonic models excel in detailed interpretability and customization for nuanced market conditions.

Connection

Automated Valuation Models (AVMs) utilize the Hedonic Pricing Model by analyzing property characteristics such as location, size, and features to estimate real estate values accurately. AVMs integrate large datasets and machine learning techniques, building on the Hedonic Pricing Model's principle that property prices are influenced by their attributes. This connection enhances precision in property valuation, facilitating faster and more reliable real estate market assessments.

Key Terms

Characteristics (Attributes)

The Hedonic Pricing Model (HPM) analyzes property values by examining individual characteristics such as location, size, age, and amenities, reflecting their contribution to market price based on historical data. Automated Valuation Models (AVMs) use algorithms and machine learning to assess multiple attributes concurrently, including market trends and comparable sales, providing rapid property valuations. Explore detailed comparisons of HPM and AVM attributes to enhance accuracy in real estate appraisal.

Regression Analysis

The Hedonic Pricing Model utilizes regression analysis to estimate property values by analyzing individual characteristics such as location, size, and amenities, capturing the contribution of each attribute to price. Automated Valuation Models (AVMs) employ advanced regression techniques combined with machine learning algorithms to process large datasets, enhancing prediction accuracy and efficiency in property valuation. Explore deeper insights into how regression analysis shapes both models for improved real estate pricing strategies.

Machine Learning

The Hedonic Pricing Model relies on statistical regression techniques to estimate property values based on attributes like location, size, and amenities, while Automated Valuation Models (AVMs) incorporate advanced machine learning algorithms to analyze vast datasets and identify complex patterns for more accurate real estate pricing. Machine learning enhances AVMs by enabling dynamic learning from new data, improving prediction accuracy beyond traditional hedonic models. Explore how cutting-edge machine learning techniques revolutionize property valuation methods.

Source and External Links

Hedonic Pricing Method - This webpage provides an overview of the hedonic pricing method, which estimates the economic value of various external and internal factors affecting housing market prices.

Hedonic Pricing - This resource defines hedonic pricing as a method to determine the economic value of ecosystem services or external factors influencing asset prices, particularly in real estate.

Hedonic Regression - This Wikipedia article explains hedonic regression as a revealed preference method used to estimate demand or value for characteristics of a differentiated good, commonly applied in real estate and environmental economics.

dowidth.com

dowidth.com