Build to rent developments focus on providing high-quality rental homes designed for long-term tenants, emphasizing modern amenities and community living. Affordable housing projects aim to deliver cost-effective residences for low- to moderate-income families, ensuring accessibility and social equity in urban areas. Explore the differences between these housing solutions to find the best fit for your investment or living needs.

Why it is important

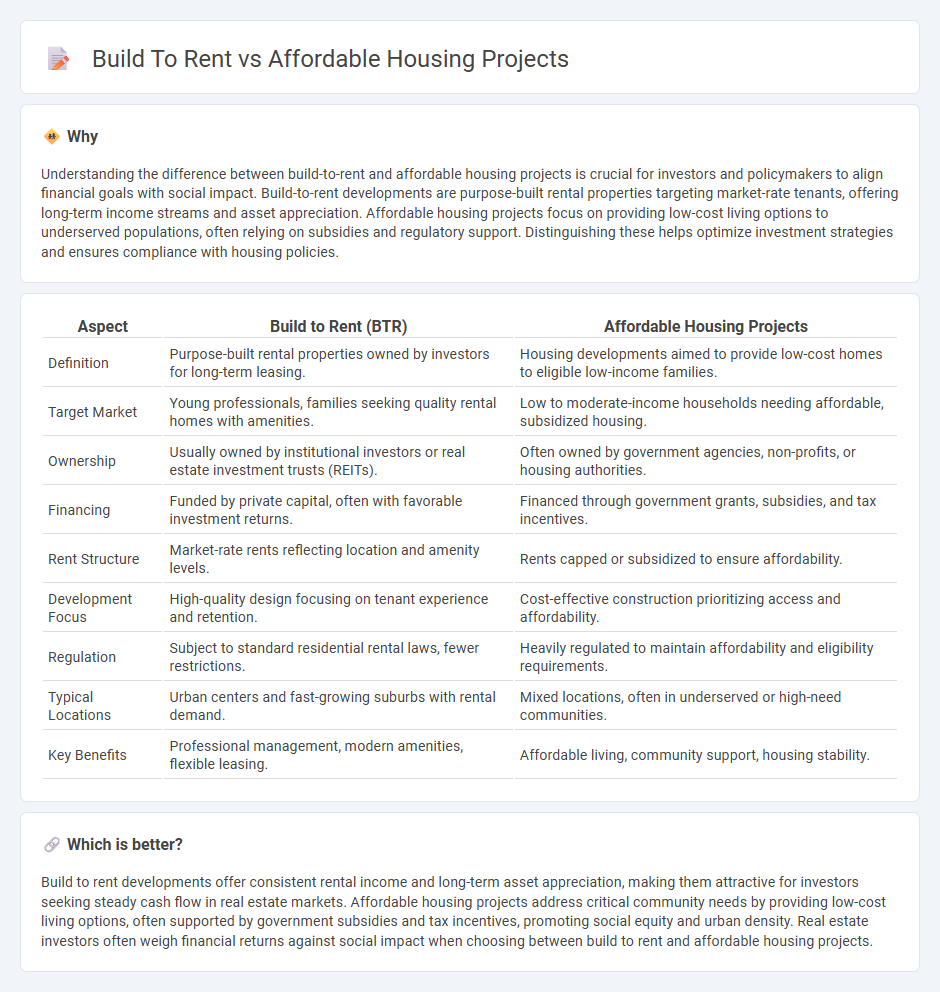

Understanding the difference between build-to-rent and affordable housing projects is crucial for investors and policymakers to align financial goals with social impact. Build-to-rent developments are purpose-built rental properties targeting market-rate tenants, offering long-term income streams and asset appreciation. Affordable housing projects focus on providing low-cost living options to underserved populations, often relying on subsidies and regulatory support. Distinguishing these helps optimize investment strategies and ensures compliance with housing policies.

Comparison Table

| Aspect | Build to Rent (BTR) | Affordable Housing Projects |

|---|---|---|

| Definition | Purpose-built rental properties owned by investors for long-term leasing. | Housing developments aimed to provide low-cost homes to eligible low-income families. |

| Target Market | Young professionals, families seeking quality rental homes with amenities. | Low to moderate-income households needing affordable, subsidized housing. |

| Ownership | Usually owned by institutional investors or real estate investment trusts (REITs). | Often owned by government agencies, non-profits, or housing authorities. |

| Financing | Funded by private capital, often with favorable investment returns. | Financed through government grants, subsidies, and tax incentives. |

| Rent Structure | Market-rate rents reflecting location and amenity levels. | Rents capped or subsidized to ensure affordability. |

| Development Focus | High-quality design focusing on tenant experience and retention. | Cost-effective construction prioritizing access and affordability. |

| Regulation | Subject to standard residential rental laws, fewer restrictions. | Heavily regulated to maintain affordability and eligibility requirements. |

| Typical Locations | Urban centers and fast-growing suburbs with rental demand. | Mixed locations, often in underserved or high-need communities. |

| Key Benefits | Professional management, modern amenities, flexible leasing. | Affordable living, community support, housing stability. |

Which is better?

Build to rent developments offer consistent rental income and long-term asset appreciation, making them attractive for investors seeking steady cash flow in real estate markets. Affordable housing projects address critical community needs by providing low-cost living options, often supported by government subsidies and tax incentives, promoting social equity and urban density. Real estate investors often weigh financial returns against social impact when choosing between build to rent and affordable housing projects.

Connection

Build-to-rent developments focus on long-term rental properties designed for institutional investors, creating a steady income stream and addressing housing demand. Affordable housing projects aim to provide cost-effective living options for low- to moderate-income families, often supported by government incentives or subsidies. Both models contribute to expanding rental housing availability, easing market pressure, and promoting sustainable urban development.

Key Terms

Affordable housing projects:

Affordable housing projects prioritize providing low-cost, quality homes to low- and moderate-income families through government subsidies, grants, and tax incentives that reduce construction costs. These developments often involve mixed-income communities, aiming to improve residents' living standards while promoting social equity and urban regeneration. Discover how affordable housing projects transform communities and offer sustainable living solutions.

Income limits

Affordable housing projects typically impose strict income limits to allocate units to low- and moderate-income households, ensuring accessibility for those earning below a specified percentage of the Area Median Income (AMI). Build-to-rent developments, while offering long-term rental options, often have less stringent income qualifications, targeting a broader market including middle-income renters without enforceable income caps. Explore detailed comparisons to understand which housing solution best meets specific financial and community needs.

Subsidies

Affordable housing projects often rely on government subsidies such as tax credits, grants, and low-interest loans to reduce construction costs and make units financially accessible to low-income families. Build-to-rent developments typically receive fewer direct subsidies but benefit from incentives like zoning flexibility and infrastructure support that encourage large-scale rental communities. Explore the nuances of subsidy allocations and their impact on housing affordability to understand which model best meets community needs.

Source and External Links

Affordable Housing Projects - Features projects like Good Neighbor Village, Canterwood, and Tahoma Place, offering affordable housing units in various locations across Pierce County, Washington.

Affordable Housing Projects - Lists projects such as Esperanza Place, Acalanes Court, Arboleda, and Casa Montego in Walnut Creek, California, providing affordable housing options through various subsidies.

SDHC Partnership Developments - Highlights developments like Kindred Apartments, SkyLINE Apartments, and Harrington Heights in San Diego, aiming to increase affordable rental housing for low-income families.

dowidth.com

dowidth.com