Smart lease agreements leverage technology to automate rent collection, maintenance requests, and lease renewals, offering tenants and landlords greater convenience and transparency. Full service leases include all operating expenses such as property taxes, insurance, and maintenance within the rent, providing tenants with predictable monthly costs and simplified management. Discover how these leasing options can optimize your real estate investments and tenant experiences.

Why it is important

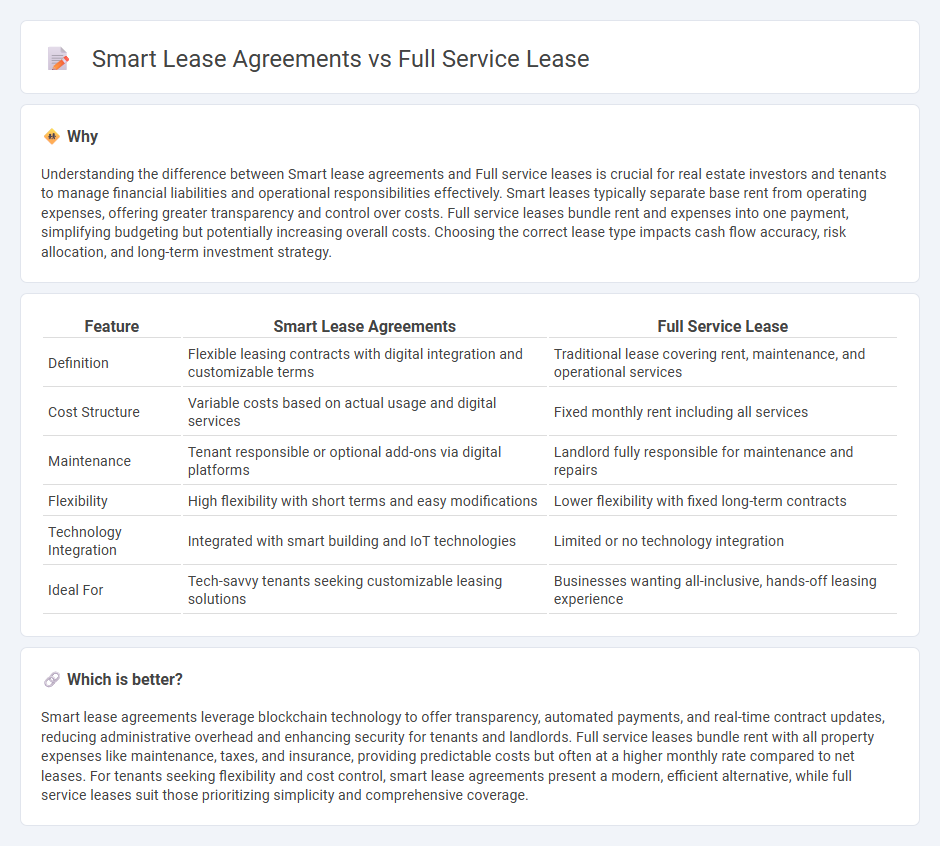

Understanding the difference between Smart lease agreements and Full service leases is crucial for real estate investors and tenants to manage financial liabilities and operational responsibilities effectively. Smart leases typically separate base rent from operating expenses, offering greater transparency and control over costs. Full service leases bundle rent and expenses into one payment, simplifying budgeting but potentially increasing overall costs. Choosing the correct lease type impacts cash flow accuracy, risk allocation, and long-term investment strategy.

Comparison Table

| Feature | Smart Lease Agreements | Full Service Lease |

|---|---|---|

| Definition | Flexible leasing contracts with digital integration and customizable terms | Traditional lease covering rent, maintenance, and operational services |

| Cost Structure | Variable costs based on actual usage and digital services | Fixed monthly rent including all services |

| Maintenance | Tenant responsible or optional add-ons via digital platforms | Landlord fully responsible for maintenance and repairs |

| Flexibility | High flexibility with short terms and easy modifications | Lower flexibility with fixed long-term contracts |

| Technology Integration | Integrated with smart building and IoT technologies | Limited or no technology integration |

| Ideal For | Tech-savvy tenants seeking customizable leasing solutions | Businesses wanting all-inclusive, hands-off leasing experience |

Which is better?

Smart lease agreements leverage blockchain technology to offer transparency, automated payments, and real-time contract updates, reducing administrative overhead and enhancing security for tenants and landlords. Full service leases bundle rent with all property expenses like maintenance, taxes, and insurance, providing predictable costs but often at a higher monthly rate compared to net leases. For tenants seeking flexibility and cost control, smart lease agreements present a modern, efficient alternative, while full service leases suit those prioritizing simplicity and comprehensive coverage.

Connection

Smart lease agreements streamline the management of full service leases by automating rent calculations, maintenance requests, and expense tracking within commercial real estate contracts. Full service leases provide tenants with a comprehensive rental price that includes utilities, maintenance, and taxes, which smart lease technology monitors and adjusts dynamically. Integrating smart lease agreements with full service leases enhances transparency, reduces administrative overhead, and improves tenant satisfaction through real-time data analytics.

Key Terms

Operating Expenses

Full service leases typically bundle operating expenses such as maintenance, taxes, and insurance into the monthly rent, offering tenants predictable costs and simplified budgeting. Smart leases, however, provide greater transparency by itemizing operating expenses separately, allowing tenants to monitor and control specific charges more closely. Explore detailed comparisons to determine which lease structure best suits your financial and operational needs.

Maintenance Responsibilities

Full service leases include comprehensive maintenance responsibilities covered by the landlord, ensuring tenants pay a single, predictable rent amount without handling repair costs. Smart lease agreements shift maintenance duties to tenants, requiring them to manage and fund routine upkeep and repairs, often resulting in lower base rent but increased operational involvement. Explore detailed comparisons to determine which lease structure best suits your business needs.

Rent Structure

Full service lease agreements typically include rent that covers all operating expenses such as utilities, maintenance, taxes, and insurance, providing tenants with a fixed monthly cost and reduced financial uncertainty. Smart lease agreements, on the other hand, feature a flexible rent structure where tenants pay base rent plus variable expenses based on actual usage or consumption, promoting cost efficiency and transparency. Learn more about how each lease type impacts budgeting and financial planning for tenants and landlords.

Source and External Links

WHAT IS A FULL SERVICE LEASE? - A full-service lease includes a single, all-inclusive rental rate covering both the base lease rate and operating expenses such as property taxes, insurance, and maintenance.

A Guide to Full Service Lease - This guide explains full-service leases as comprehensive agreements where the landlord charges one rental rate that covers base rent and all operating expenses, providing a stable monthly cost for tenants.

What is a Full Service Lease in Real Estate? - A full-service lease is a rental agreement where the landlord pays most operating expenses, allowing tenants to pay a single, inclusive rent amount that simplifies budgeting.

dowidth.com

dowidth.com