Leaseback programs offer property owners immediate capital by selling assets and leasing them back, providing long-term occupancy without ownership burdens. Full-service leases include rent, maintenance, insurance, and property taxes in a single payment, simplifying cost management for tenants. Explore the benefits and differences of these leasing options to determine the best fit for your real estate strategy.

Why it is important

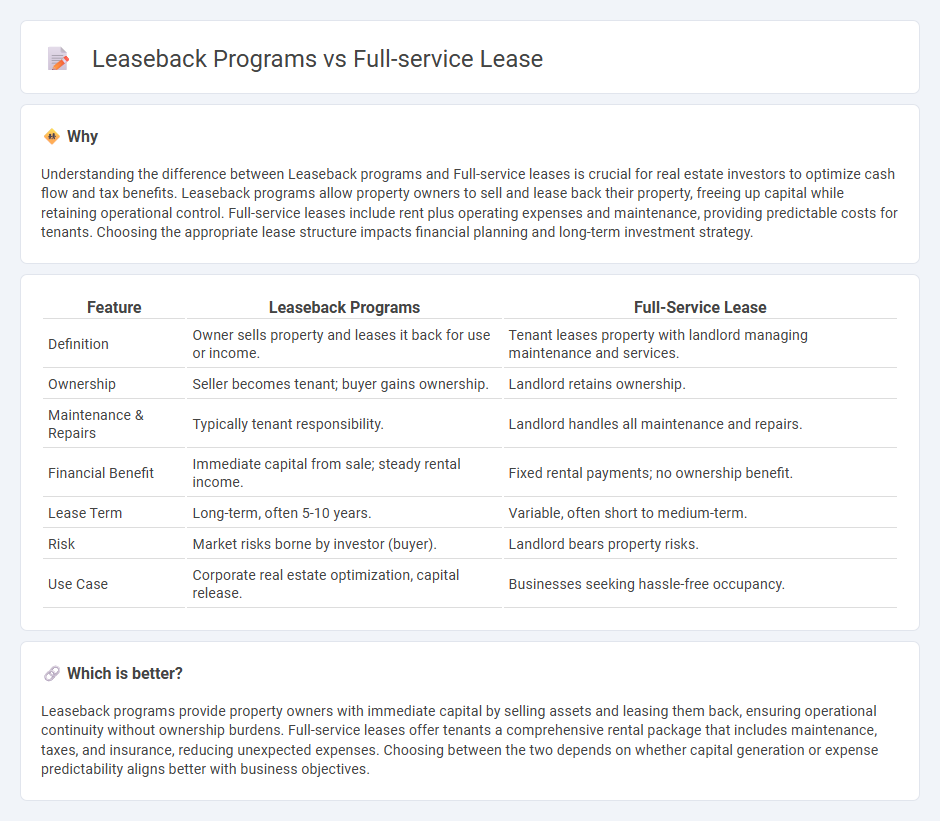

Understanding the difference between Leaseback programs and Full-service leases is crucial for real estate investors to optimize cash flow and tax benefits. Leaseback programs allow property owners to sell and lease back their property, freeing up capital while retaining operational control. Full-service leases include rent plus operating expenses and maintenance, providing predictable costs for tenants. Choosing the appropriate lease structure impacts financial planning and long-term investment strategy.

Comparison Table

| Feature | Leaseback Programs | Full-Service Lease |

|---|---|---|

| Definition | Owner sells property and leases it back for use or income. | Tenant leases property with landlord managing maintenance and services. |

| Ownership | Seller becomes tenant; buyer gains ownership. | Landlord retains ownership. |

| Maintenance & Repairs | Typically tenant responsibility. | Landlord handles all maintenance and repairs. |

| Financial Benefit | Immediate capital from sale; steady rental income. | Fixed rental payments; no ownership benefit. |

| Lease Term | Long-term, often 5-10 years. | Variable, often short to medium-term. |

| Risk | Market risks borne by investor (buyer). | Landlord bears property risks. |

| Use Case | Corporate real estate optimization, capital release. | Businesses seeking hassle-free occupancy. |

Which is better?

Leaseback programs provide property owners with immediate capital by selling assets and leasing them back, ensuring operational continuity without ownership burdens. Full-service leases offer tenants a comprehensive rental package that includes maintenance, taxes, and insurance, reducing unexpected expenses. Choosing between the two depends on whether capital generation or expense predictability aligns better with business objectives.

Connection

Leaseback programs and full-service leases are connected through their shared goal of providing comprehensive property management solutions within real estate investments. Leaseback programs involve the original owner selling the property and leasing it back, often under a full-service lease, which includes maintenance, taxes, and insurance costs covered by the landlord. This integration offers investors stable income streams and minimizes operational responsibilities, enhancing portfolio efficiency.

Key Terms

Operating Expenses

Full-service leases typically include fixed monthly payments covering all operating expenses such as maintenance, insurance, and taxes, offering predictable budgeting for businesses. Leaseback programs allow ownership transfer while converting assets into liquid capital but often require lessees to manage operating expenses separately, which can lead to variable costs. Explore detailed comparisons to determine which option best aligns with your financial strategy and operational needs.

Ownership Rights

Full-service leases transfer ownership rights to the lessor, offering lessees predictable expenses and maintenance coverage without owning the asset. Leaseback programs allow the original owner to sell the asset and lease it back, retaining operational control but relinquishing legal ownership. Discover how each option impacts your asset management strategy and financial flexibility.

Maintenance Responsibility

Full-service lease programs include maintenance responsibility, where the lessor handles all repairs, routine servicing, and upkeep costs, ensuring predictable expenses for the lessee. Leaseback programs shift maintenance responsibilities to the lessee, requiring them to manage repair schedules and bear related costs, which can impact operational budgets. Explore further to understand how maintenance obligations affect overall lease agreements.

Source and External Links

WHAT IS A FULL SERVICE LEASE? - CARR.us - A full-service lease is a commercial lease with one all-inclusive rental rate covering both base rent and operating expenses like taxes, insurance, and maintenance, providing tenants with predictable monthly payments without separate charges for these costs, though increases may apply after the first year based on "Base Year" or "Expense Stop" clauses.

What is a Full Service Lease in Real Estate? - A full-service lease is a rental agreement where the landlord pays most operating expenses such as utilities, janitorial services, maintenance, taxes, and insurance, allowing tenants to pay a single, inclusive rent amount that simplifies budgeting but often comes at a premium compared to other lease types.

A Guide to Full Service Lease (with Examples) - IPG - Full-service leases combine base rent and all operating costs (property taxes, insurance, maintenance) into one comprehensive rental payment, commonly used in offices and some industrial spaces, providing stable monthly costs without unexpected additional fees and sometimes including added services like equipment maintenance or redecoration assistance.

dowidth.com

dowidth.com