Single family rental portfolios consist of individual homes leased to tenants, offering diversified income streams and lower tenant turnover compared to retail property portfolios, which involve commercial spaces leased to businesses and typically provide higher rental yields but greater market sensitivity. Investors often prefer single family rentals for their resilience in economic downturns, while retail properties appeal for potential appreciation and long-term lease agreements. Explore the advantages and risks of both portfolio types to determine the best fit for your investment goals.

Why it is important

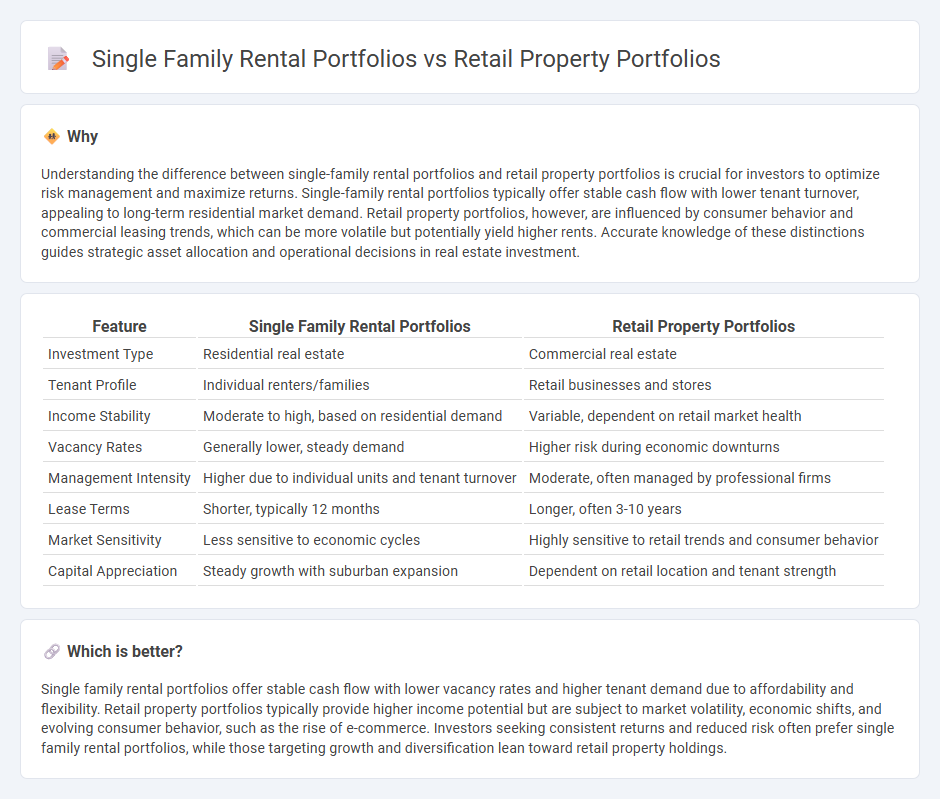

Understanding the difference between single-family rental portfolios and retail property portfolios is crucial for investors to optimize risk management and maximize returns. Single-family rental portfolios typically offer stable cash flow with lower tenant turnover, appealing to long-term residential market demand. Retail property portfolios, however, are influenced by consumer behavior and commercial leasing trends, which can be more volatile but potentially yield higher rents. Accurate knowledge of these distinctions guides strategic asset allocation and operational decisions in real estate investment.

Comparison Table

| Feature | Single Family Rental Portfolios | Retail Property Portfolios |

|---|---|---|

| Investment Type | Residential real estate | Commercial real estate |

| Tenant Profile | Individual renters/families | Retail businesses and stores |

| Income Stability | Moderate to high, based on residential demand | Variable, dependent on retail market health |

| Vacancy Rates | Generally lower, steady demand | Higher risk during economic downturns |

| Management Intensity | Higher due to individual units and tenant turnover | Moderate, often managed by professional firms |

| Lease Terms | Shorter, typically 12 months | Longer, often 3-10 years |

| Market Sensitivity | Less sensitive to economic cycles | Highly sensitive to retail trends and consumer behavior |

| Capital Appreciation | Steady growth with suburban expansion | Dependent on retail location and tenant strength |

Which is better?

Single family rental portfolios offer stable cash flow with lower vacancy rates and higher tenant demand due to affordability and flexibility. Retail property portfolios typically provide higher income potential but are subject to market volatility, economic shifts, and evolving consumer behavior, such as the rise of e-commerce. Investors seeking consistent returns and reduced risk often prefer single family rental portfolios, while those targeting growth and diversification lean toward retail property holdings.

Connection

Single family rental portfolios and retail property portfolios are connected through their shared role in diversified real estate investment strategies that balance income generation and risk management. Both asset classes benefit from localized market dynamics, including demographic trends and economic conditions, which influence occupancy rates and rental yields. Institutional investors often combine these portfolios to optimize cash flow stability and capitalize on varying demand cycles within residential and commercial sectors.

Key Terms

Tenant Mix

Retail property portfolios benefit from a diverse tenant mix that includes national chains, local boutiques, and service providers, enhancing foot traffic and revenue stability. Single-family rental portfolios primarily consist of residential tenants, offering consistent occupancy but less variety in lease structures or income streams compared to retail. Explore how optimizing tenant mix can maximize returns in both retail and single-family rental markets.

Lease Structure

Retail property portfolios typically feature long-term, triple-net leases where tenants are responsible for property expenses such as taxes, insurance, and maintenance, providing stable and predictable income streams. In contrast, single-family rental portfolios often involve shorter lease terms with tenants responsible primarily for rent, while landlords manage upkeep and repairs, resulting in more active property management. Explore detailed comparisons to optimize your portfolio strategy effectively.

Property Management

Managing retail property portfolios demands expertise in handling diverse tenant needs, lease negotiations, and maintaining high foot traffic to ensure consistent revenue streams. Single family rental portfolios require personalized tenant relationships, efficient maintenance coordination, and streamlined rent collection to optimize occupancy rates. Explore further to understand strategic approaches for excelling in property management across these portfolio types.

Source and External Links

Commercial Retail Real Estate Investments | Alliance CGC - This webpage highlights Alliance CGC's retail property investments, focusing on high-demand properties for stable income and growth potential.

Retail Investment Properties - LoanBase - This article provides an overview of retail investment properties, including types like shopping centers and strip malls, and discusses their potential for diversification.

How to Build a Strong Commercial Real Estate Portfolio - This guide outlines steps for building a strong commercial real estate portfolio, focusing on strategies for mitigating risk and achieving long-term returns.

dowidth.com

dowidth.com