Institutional landlords typically manage large portfolios of residential or commercial properties, focusing on long-term investment returns for pension funds, insurance companies, and real estate investment trusts (REITs). Corporate landlords are often subsidiaries of non-real estate companies that own properties primarily for their operational needs or strategic purposes, sometimes generating rental income from excess space. Explore the key differences between institutional and corporate landlords to understand their impact on the real estate market.

Why it is important

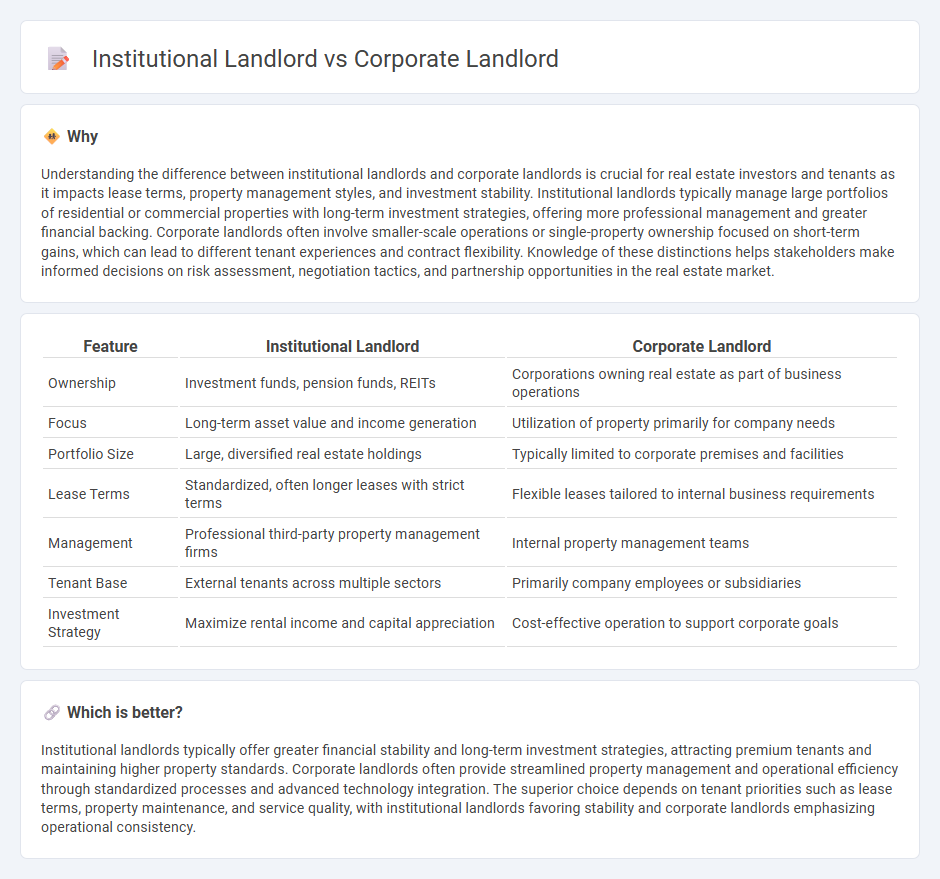

Understanding the difference between institutional landlords and corporate landlords is crucial for real estate investors and tenants as it impacts lease terms, property management styles, and investment stability. Institutional landlords typically manage large portfolios of residential or commercial properties with long-term investment strategies, offering more professional management and greater financial backing. Corporate landlords often involve smaller-scale operations or single-property ownership focused on short-term gains, which can lead to different tenant experiences and contract flexibility. Knowledge of these distinctions helps stakeholders make informed decisions on risk assessment, negotiation tactics, and partnership opportunities in the real estate market.

Comparison Table

| Feature | Institutional Landlord | Corporate Landlord |

|---|---|---|

| Ownership | Investment funds, pension funds, REITs | Corporations owning real estate as part of business operations |

| Focus | Long-term asset value and income generation | Utilization of property primarily for company needs |

| Portfolio Size | Large, diversified real estate holdings | Typically limited to corporate premises and facilities |

| Lease Terms | Standardized, often longer leases with strict terms | Flexible leases tailored to internal business requirements |

| Management | Professional third-party property management firms | Internal property management teams |

| Tenant Base | External tenants across multiple sectors | Primarily company employees or subsidiaries |

| Investment Strategy | Maximize rental income and capital appreciation | Cost-effective operation to support corporate goals |

Which is better?

Institutional landlords typically offer greater financial stability and long-term investment strategies, attracting premium tenants and maintaining higher property standards. Corporate landlords often provide streamlined property management and operational efficiency through standardized processes and advanced technology integration. The superior choice depends on tenant priorities such as lease terms, property maintenance, and service quality, with institutional landlords favoring stability and corporate landlords emphasizing operational consistency.

Connection

Institutional landlords and corporate landlords are connected through their large-scale ownership and professional management of real estate assets, focusing on maximizing return on investment. Both entities leverage economies of scale, advanced technology, and market analytics to efficiently manage residential, commercial, or industrial properties. Their shared goals include portfolio diversification, tenant retention, and capital appreciation within competitive real estate markets.

Key Terms

Ownership Structure

Corporate landlords are typically privately held companies or subsidiaries of larger corporations controlling multiple properties, whereas institutional landlords consist of entities like pension funds, insurance companies, and real estate investment trusts (REITs) focused on long-term asset management. Corporate landlords prioritize operational efficiency and higher short-term returns, while institutional landlords emphasize stable income and risk diversification across extensive portfolios. Explore the nuances of ownership structure to better understand their impact on real estate investment strategies.

Investment Strategy

Corporate landlords primarily focus on long-term operational control and enhancing property value through active management and tenant relations, aiming to support their core business objectives. Institutional landlords concentrate on diversified investment portfolios, prioritizing stable income streams and capital appreciation through strategic asset allocation across multiple property types and locations. Explore more to understand how these distinct investment strategies shape real estate market dynamics and portfolio performance.

Property Management

Corporate landlords typically manage their property portfolios with an emphasis on streamlined operations, tenant retention strategies, and centralized decision-making processes to enhance efficiency and profitability. Institutional landlords, often managing larger-scale assets such as REITs or pension funds, prioritize sophisticated property management systems, risk assessment, and long-term asset appreciation through professionalized oversight and strategic capital allocation. Explore deeper insights into how these landlord types optimize property management to maximize returns and tenant satisfaction.

Source and External Links

Understanding corporate landlords: Decoding a recent housing phenomenon - This article explores the concept of corporate landlords, varying from small LLCs to large REITs, and their impact on housing markets.

Asset Strategy - Corporate Landlord Model - The Corporate Landlord Model by Wirral Council aims to utilize local authority assets efficiently while complying with various legal and regulatory requirements.

What You Need to Know about Private Landlords vs. Corporate Landlords - This article compares the experiences of renting from private landlords versus corporate landlords, highlighting their respective advantages and disadvantages.

dowidth.com

dowidth.com