Single family rentals typically attract long-term tenants seeking privacy and space, resulting in stable income with lower turnover rates. Fourplex rentals offer diversified income streams by housing multiple tenants under one roof, reducing vacancy risk but often requiring more management effort. Explore the benefits and challenges of each rental type to determine the best fit for your real estate investment goals.

Why it is important

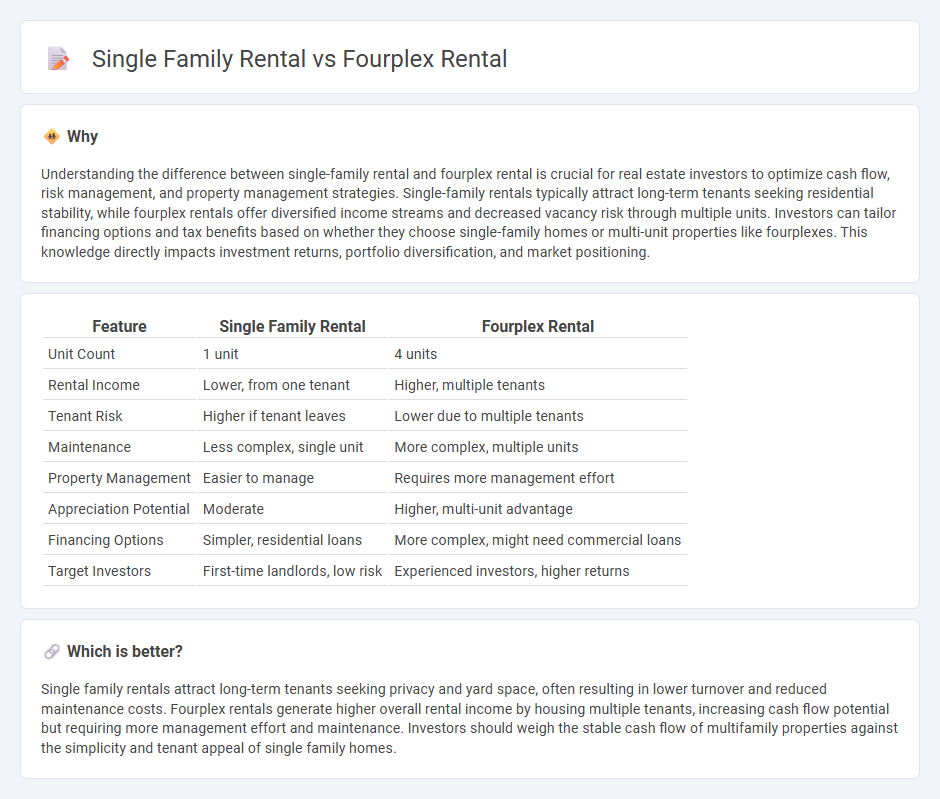

Understanding the difference between single-family rental and fourplex rental is crucial for real estate investors to optimize cash flow, risk management, and property management strategies. Single-family rentals typically attract long-term tenants seeking residential stability, while fourplex rentals offer diversified income streams and decreased vacancy risk through multiple units. Investors can tailor financing options and tax benefits based on whether they choose single-family homes or multi-unit properties like fourplexes. This knowledge directly impacts investment returns, portfolio diversification, and market positioning.

Comparison Table

| Feature | Single Family Rental | Fourplex Rental |

|---|---|---|

| Unit Count | 1 unit | 4 units |

| Rental Income | Lower, from one tenant | Higher, multiple tenants |

| Tenant Risk | Higher if tenant leaves | Lower due to multiple tenants |

| Maintenance | Less complex, single unit | More complex, multiple units |

| Property Management | Easier to manage | Requires more management effort |

| Appreciation Potential | Moderate | Higher, multi-unit advantage |

| Financing Options | Simpler, residential loans | More complex, might need commercial loans |

| Target Investors | First-time landlords, low risk | Experienced investors, higher returns |

Which is better?

Single family rentals attract long-term tenants seeking privacy and yard space, often resulting in lower turnover and reduced maintenance costs. Fourplex rentals generate higher overall rental income by housing multiple tenants, increasing cash flow potential but requiring more management effort and maintenance. Investors should weigh the stable cash flow of multifamily properties against the simplicity and tenant appeal of single family homes.

Connection

Single family rentals and fourplex rentals both serve as important residential investment properties attracting diverse tenant demographics and generating steady rental income. Single family homes offer privacy and space, appealing to families seeking long-term leases, while fourplexes maximize income through multiple units on a single property, ideal for investors focusing on cash flow. The connectivity between these rental types lies in their complementary roles within real estate portfolios, balancing risk, maintenance costs, and market demand.

Key Terms

Cash Flow

Fourplex rentals generate higher cash flow due to multiple income streams from four separate units, compared to a single family rental offering only one income source. Operating expenses and vacancy risks are distributed across units in a fourplex, enhancing overall financial stability. Explore the detailed cash flow analysis to optimize your investment strategy.

Vacancy Rate

Fourplex rentals generally exhibit lower vacancy rates compared to single-family rentals due to multiple units generating diversified income streams and reducing the risk of total income loss during tenant turnover. Market data shows fourplex vacancy rates average around 5%, whereas single-family homes can experience vacancy rates closer to 8-10%, influenced by higher sensitivity to market fluctuations. Explore deeper insights on how vacancy rates impact your rental property investment strategies.

Property Management

Fourplex rentals generate multiple income streams from a single property, increasing cash flow potential while requiring more complex property management due to multiple tenants and maintenance needs. Single-family rentals typically involve simpler management tasks and attract longer-term tenants, reducing turnover and vacancy risks but yielding lower total rental income. Explore more about optimizing property management strategies for both rental types to enhance returns and tenant satisfaction.

Source and External Links

Fourplex House Plans | Maximize Rental Income with Our Expertly ... - A fourplex is a single building divided into four independent living units, often designed with 2-3 bedrooms each, and it maximizes rental income by providing multiple streams from one property, with advantages like easier financing and potential to live in one unit while renting the others.

Fourplexes: What to know before investing | Rocket Mortgage - Fourplexes can be a profitable investment due to the ability to earn rental income from up to four units, easier residential loan options, and simplified property management compared to owning multiple single-family homes, though they require effort in tenant management and may face higher tenant turnover.

Understanding Residential Duplexes, Triplex, and Fourplexes - Financing a fourplex often requires a down payment between 5-25%, and owners must manage maintenance and tenant relations themselves, while fourplexes typically lack amenities offered by larger multifamily communities.

dowidth.com

dowidth.com