Short term rental arbitrage leverages residential properties for high-yield, flexible income through platforms like Airbnb, contrasting with commercial leasing's long-term stability and regulated agreements for business spaces. Investors capitalize on short term rental demand fluctuations, while commercial leasing offers predictable cash flow and tenant relationships. Explore key differences to determine the optimal strategy for your real estate investments.

Why it is important

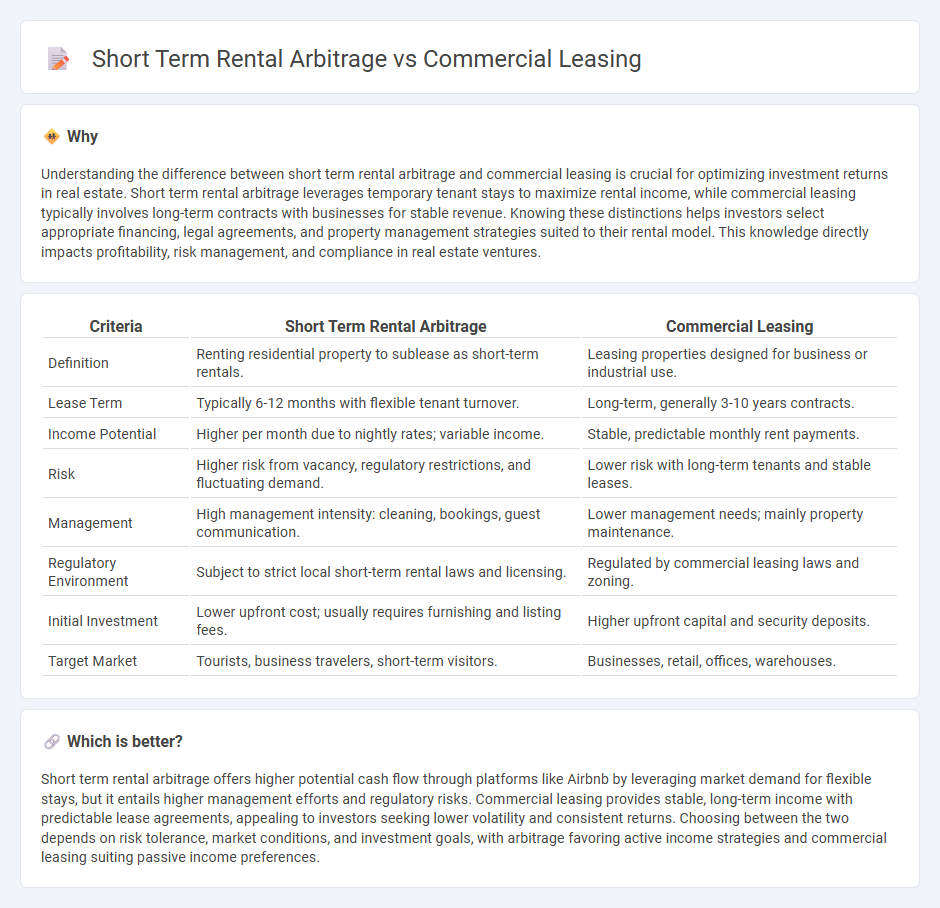

Understanding the difference between short term rental arbitrage and commercial leasing is crucial for optimizing investment returns in real estate. Short term rental arbitrage leverages temporary tenant stays to maximize rental income, while commercial leasing typically involves long-term contracts with businesses for stable revenue. Knowing these distinctions helps investors select appropriate financing, legal agreements, and property management strategies suited to their rental model. This knowledge directly impacts profitability, risk management, and compliance in real estate ventures.

Comparison Table

| Criteria | Short Term Rental Arbitrage | Commercial Leasing |

|---|---|---|

| Definition | Renting residential property to sublease as short-term rentals. | Leasing properties designed for business or industrial use. |

| Lease Term | Typically 6-12 months with flexible tenant turnover. | Long-term, generally 3-10 years contracts. |

| Income Potential | Higher per month due to nightly rates; variable income. | Stable, predictable monthly rent payments. |

| Risk | Higher risk from vacancy, regulatory restrictions, and fluctuating demand. | Lower risk with long-term tenants and stable leases. |

| Management | High management intensity: cleaning, bookings, guest communication. | Lower management needs; mainly property maintenance. |

| Regulatory Environment | Subject to strict local short-term rental laws and licensing. | Regulated by commercial leasing laws and zoning. |

| Initial Investment | Lower upfront cost; usually requires furnishing and listing fees. | Higher upfront capital and security deposits. |

| Target Market | Tourists, business travelers, short-term visitors. | Businesses, retail, offices, warehouses. |

Which is better?

Short term rental arbitrage offers higher potential cash flow through platforms like Airbnb by leveraging market demand for flexible stays, but it entails higher management efforts and regulatory risks. Commercial leasing provides stable, long-term income with predictable lease agreements, appealing to investors seeking lower volatility and consistent returns. Choosing between the two depends on risk tolerance, market conditions, and investment goals, with arbitrage favoring active income strategies and commercial leasing suiting passive income preferences.

Connection

Short term rental arbitrage leverages commercial leasing by securing long-term leases on commercial properties to sublet as short-term rentals, maximizing rental income through higher turnover rates. This strategy depends on commercial lease agreements that permit subleasing and adaptable zoning regulations allowing short-term stays. Effective arbitrage requires careful analysis of commercial lease terms, market demand for short-term rentals, and compliance with local real estate laws.

Key Terms

Lease Agreement

Commercial leasing typically involves long-term lease agreements with fixed terms, often spanning several years, providing stability and predictability for businesses. Short term rental arbitrage relies on short-term lease agreements or subleases, allowing more flexibility but requiring continuous tenant turnover and higher management efforts. Explore more to understand how lease agreements impact your rental strategy and profitability.

Occupancy Rate

Commercial leasing typically offers lower but more stable occupancy rates due to long-term contracts with businesses, ensuring steady revenue streams. Short-term rental arbitrage often experiences higher occupancy rates driven by dynamic pricing and flexible booking periods, yet it can be vulnerable to market fluctuations and seasonal demand. Explore detailed analyses and strategies to optimize occupancy rates for both models and maximize profitability.

Cash Flow

Commercial leasing typically requires long-term commitments and higher upfront costs, impacting cash flow stability. Short-term rental arbitrage offers more flexible terms with the potential for higher monthly returns by leveraging dynamic pricing strategies. Explore detailed comparisons to optimize your cash flow management in property investments.

Source and External Links

Rochester, MN Commercial Real Estate For Lease - CityFeet - Offers a wide range of commercial properties for lease in Rochester including office, retail, industrial, and coworking spaces, with average rents from $5 to $19 per square foot and important considerations for selecting the right space based on business needs and local economic strengths like the Mayo Clinic.

Rochester, MN Commercial Real Estate for Lease or Sale - CommercialCafe - Provides listings of over 80 commercial properties in Rochester, including detailed info on lease rates, square footage, and availability for retail, office, and industrial spaces, catering to diverse commercial leasing needs.

Industrial buildings - Loam Commercial Real Estate - Features Class A office and industrial spaces available for lease in Rochester and SE Minnesota, emphasizing amenities such as signage opportunities, fully furnished lobbies, shared conference rooms, and inclusive utilities to support professional business environments.

dowidth.com

dowidth.com