Senior living cohabitation involves seniors sharing a residence and living expenses without formal ownership rights, allowing flexibility and reduced costs. In contrast, senior living co-ownership grants each individual legal ownership stakes in the property, ensuring asset control and investment potential. Explore the advantages and challenges of both models to determine the best fit for senior housing needs.

Why it is important

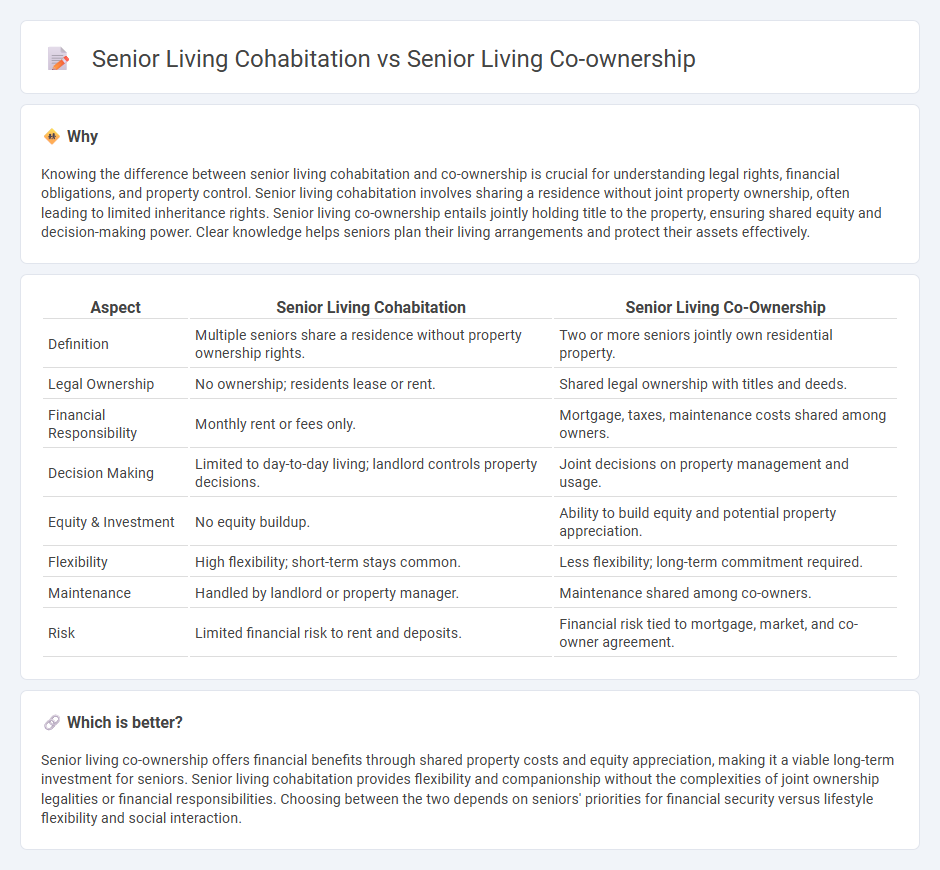

Knowing the difference between senior living cohabitation and co-ownership is crucial for understanding legal rights, financial obligations, and property control. Senior living cohabitation involves sharing a residence without joint property ownership, often leading to limited inheritance rights. Senior living co-ownership entails jointly holding title to the property, ensuring shared equity and decision-making power. Clear knowledge helps seniors plan their living arrangements and protect their assets effectively.

Comparison Table

| Aspect | Senior Living Cohabitation | Senior Living Co-Ownership |

|---|---|---|

| Definition | Multiple seniors share a residence without property ownership rights. | Two or more seniors jointly own residential property. |

| Legal Ownership | No ownership; residents lease or rent. | Shared legal ownership with titles and deeds. |

| Financial Responsibility | Monthly rent or fees only. | Mortgage, taxes, maintenance costs shared among owners. |

| Decision Making | Limited to day-to-day living; landlord controls property decisions. | Joint decisions on property management and usage. |

| Equity & Investment | No equity buildup. | Ability to build equity and potential property appreciation. |

| Flexibility | High flexibility; short-term stays common. | Less flexibility; long-term commitment required. |

| Maintenance | Handled by landlord or property manager. | Maintenance shared among co-owners. |

| Risk | Limited financial risk to rent and deposits. | Financial risk tied to mortgage, market, and co-owner agreement. |

Which is better?

Senior living co-ownership offers financial benefits through shared property costs and equity appreciation, making it a viable long-term investment for seniors. Senior living cohabitation provides flexibility and companionship without the complexities of joint ownership legalities or financial responsibilities. Choosing between the two depends on seniors' priorities for financial security versus lifestyle flexibility and social interaction.

Connection

Senior living cohabitation and senior living co-ownership both address the increasing demand for affordable and community-focused housing solutions for seniors. These models promote shared responsibilities and resources, enhancing social interaction while reducing individual living costs. Incorporating cohabitation into co-ownership structures allows seniors to maintain independence while benefiting from collective property management and support systems.

Key Terms

Ownership Structure

Senior living co-ownership involves multiple seniors jointly holding legal property rights, ensuring clear asset division and decision-making authority. In contrast, senior living cohabitation typically implies shared living without formal ownership ties, leading to potential ambiguities in property rights and responsibilities. Explore further to understand which arrangement aligns best with your long-term senior living goals.

Legal Rights

Senior living co-ownership grants residents legally recognized property rights, allowing them to hold title and share responsibilities for maintenance and decision-making, whereas senior living cohabitation typically involves shared living without formal ownership or equitable property claims. Residents in co-ownership arrangements benefit from clearer legal protections related to inheritance, financial obligations, and dispute resolution compared to cohabiting seniors who rely more on personal agreements and tenancy laws. Explore in-depth legal distinctions and implications between co-ownership and cohabitation to make informed senior living decisions.

Financial Responsibility

Senior living co-ownership involves multiple seniors jointly owning property, sharing mortgage payments, property taxes, and maintenance costs, which fosters financial stability and asset building. Senior living cohabitation typically means sharing living expenses without joint ownership, potentially limiting long-term financial benefits and increasing dependency on individual contributions. Explore the key financial differences and benefits of both arrangements to make an informed decision.

Source and External Links

Senior Living Cooperatives Explained - This explains the concept of senior living cooperatives where residents buy shares to own a portion of the building, reducing maintenance and expense burdens.

Senior Cooperative Housing - This details how senior cooperative housing allows residents to purchase stock in the community, providing a form of homeownership without full property ownership.

Equity Ownership in Senior Living - Discusses the equity ownership model in senior living communities, offering the benefits of homeownership combined with access to long-term care.

dowidth.com

dowidth.com