Walkability premium significantly influences real estate values by enhancing property desirability and lifestyle convenience, often leading to higher housing costs in highly walkable neighborhoods. Residential affordability tends to decline in areas with excellent walkability scores, posing challenges for buyers seeking cost-effective housing options near urban amenities. Explore how balancing walkability and affordability impacts real estate decisions and urban planning strategies.

Why it is important

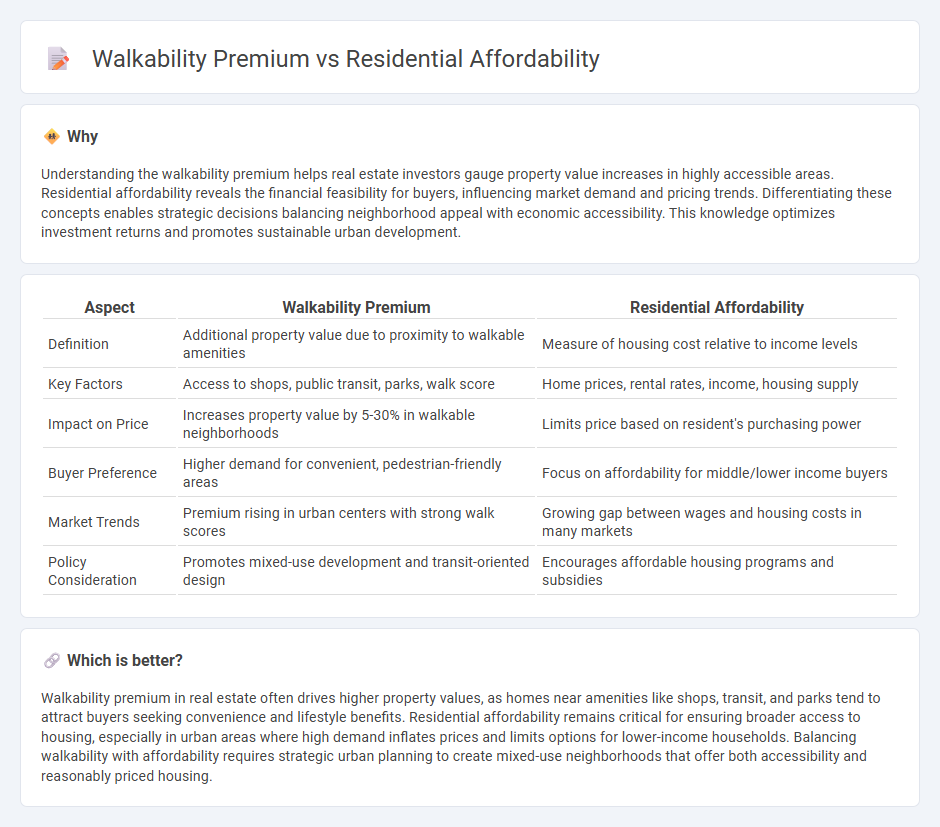

Understanding the walkability premium helps real estate investors gauge property value increases in highly accessible areas. Residential affordability reveals the financial feasibility for buyers, influencing market demand and pricing trends. Differentiating these concepts enables strategic decisions balancing neighborhood appeal with economic accessibility. This knowledge optimizes investment returns and promotes sustainable urban development.

Comparison Table

| Aspect | Walkability Premium | Residential Affordability |

|---|---|---|

| Definition | Additional property value due to proximity to walkable amenities | Measure of housing cost relative to income levels |

| Key Factors | Access to shops, public transit, parks, walk score | Home prices, rental rates, income, housing supply |

| Impact on Price | Increases property value by 5-30% in walkable neighborhoods | Limits price based on resident's purchasing power |

| Buyer Preference | Higher demand for convenient, pedestrian-friendly areas | Focus on affordability for middle/lower income buyers |

| Market Trends | Premium rising in urban centers with strong walk scores | Growing gap between wages and housing costs in many markets |

| Policy Consideration | Promotes mixed-use development and transit-oriented design | Encourages affordable housing programs and subsidies |

Which is better?

Walkability premium in real estate often drives higher property values, as homes near amenities like shops, transit, and parks tend to attract buyers seeking convenience and lifestyle benefits. Residential affordability remains critical for ensuring broader access to housing, especially in urban areas where high demand inflates prices and limits options for lower-income households. Balancing walkability with affordability requires strategic urban planning to create mixed-use neighborhoods that offer both accessibility and reasonably priced housing.

Connection

Walkability premium significantly influences residential affordability by increasing property values in highly walkable neighborhoods, which often leads to higher housing costs. This correlation limits affordability for lower-income families, creating challenges in access to essential amenities and public transport. Urban planners emphasize balancing walkability enhancements with inclusive housing policies to ensure equitable access to walkable communities while maintaining affordable living options.

Key Terms

Housing Cost-to-Income Ratio

The Housing Cost-to-Income Ratio is a critical metric for assessing residential affordability, indicating the proportion of income spent on housing expenses. Walkable neighborhoods often exhibit a walkability premium, where housing prices are higher due to proximity to amenities and transit options, potentially increasing this ratio. Explore further to understand how walkability affects housing affordability and urban planning strategies.

Location Efficiency

Location efficiency significantly influences residential affordability and walkability premiums, with areas offering high walkability often commanding higher housing costs due to demand for convenience and accessibility. Walkable neighborhoods provide residents access to amenities, public transit, and employment hubs, enhancing quality of life but driving up real estate prices. Explore how balancing affordability and walkability impacts urban development strategies and housing markets today.

Walk Score

Residential affordability often decreases in neighborhoods with higher Walk Scores, as walkability premiums drive up property values and rental prices. Walk Score measures the ease of access to amenities, public transit, and pedestrian infrastructure, which significantly influences housing demand and market dynamics. Explore how balancing affordability and walkability can shape urban living experiences.

Source and External Links

How Much House Can I Afford? Affordability Calculator - NerdWallet - Affordability is commonly evaluated with the 28/36 rule, recommending no more than 28% of gross monthly income on housing costs and no more than 36% total on debts, helping determine manageable home payments based on income and debts.

Affordability Calculator - How Much House Can I Afford? - Zillow - The lender-used debt-to-income (DTI) ratio for qualifying is typically 36% on mortgage costs and 43% on total monthly debts, reflecting a slightly more lenient affordability standard than the 28/36 rule.

What is housing affordability? | Cost of Home - Habitat for Humanity - Housing affordability is often defined by spending no more than 30% of income on housing; over 20 million U.S. households are cost-burdened by paying more than half their income toward housing, driven by stagnant wages and rapidly rising housing costs.

dowidth.com

dowidth.com