Build-to-rent properties provide single-family homes designed specifically for long-term rental, offering privacy and community-focused amenities that appeal to renters seeking suburban living. Multifamily development encompasses apartment complexes and condominiums that optimize land use and often include shared facilities, attracting a broader demographic with varying income levels. Explore the key differences and benefits of each housing model to determine the ideal investment strategy in real estate.

Why it is important

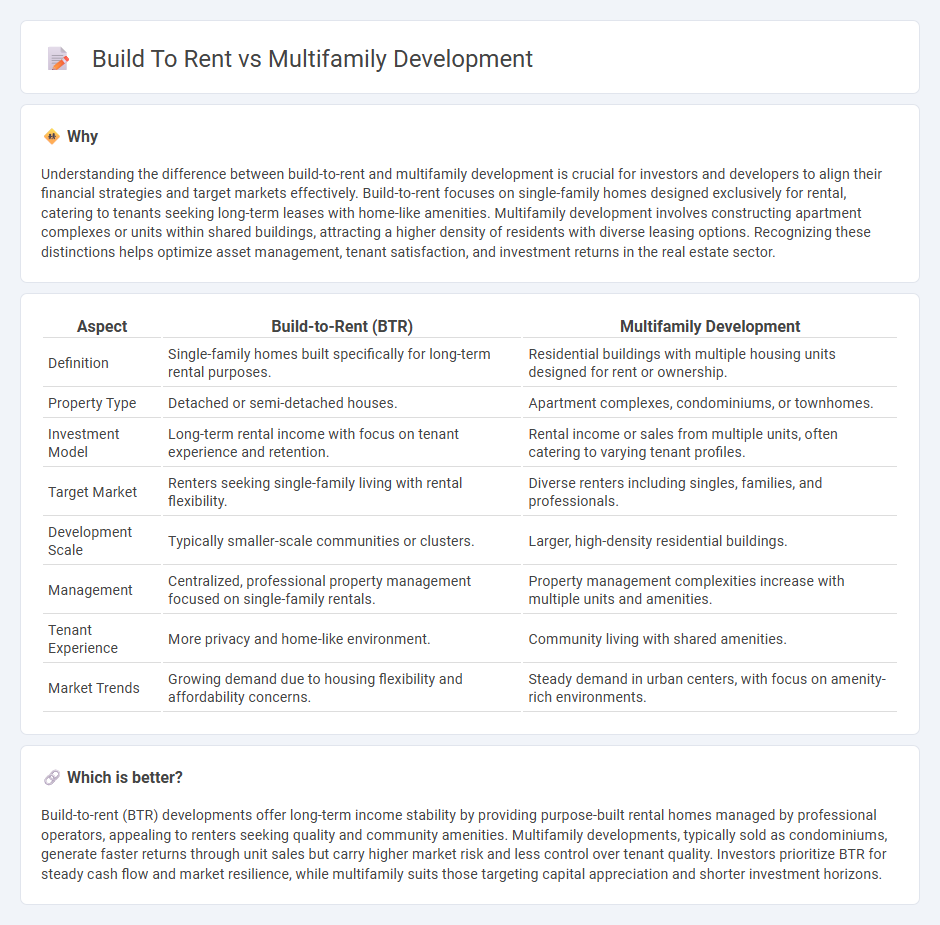

Understanding the difference between build-to-rent and multifamily development is crucial for investors and developers to align their financial strategies and target markets effectively. Build-to-rent focuses on single-family homes designed exclusively for rental, catering to tenants seeking long-term leases with home-like amenities. Multifamily development involves constructing apartment complexes or units within shared buildings, attracting a higher density of residents with diverse leasing options. Recognizing these distinctions helps optimize asset management, tenant satisfaction, and investment returns in the real estate sector.

Comparison Table

| Aspect | Build-to-Rent (BTR) | Multifamily Development |

|---|---|---|

| Definition | Single-family homes built specifically for long-term rental purposes. | Residential buildings with multiple housing units designed for rent or ownership. |

| Property Type | Detached or semi-detached houses. | Apartment complexes, condominiums, or townhomes. |

| Investment Model | Long-term rental income with focus on tenant experience and retention. | Rental income or sales from multiple units, often catering to varying tenant profiles. |

| Target Market | Renters seeking single-family living with rental flexibility. | Diverse renters including singles, families, and professionals. |

| Development Scale | Typically smaller-scale communities or clusters. | Larger, high-density residential buildings. |

| Management | Centralized, professional property management focused on single-family rentals. | Property management complexities increase with multiple units and amenities. |

| Tenant Experience | More privacy and home-like environment. | Community living with shared amenities. |

| Market Trends | Growing demand due to housing flexibility and affordability concerns. | Steady demand in urban centers, with focus on amenity-rich environments. |

Which is better?

Build-to-rent (BTR) developments offer long-term income stability by providing purpose-built rental homes managed by professional operators, appealing to renters seeking quality and community amenities. Multifamily developments, typically sold as condominiums, generate faster returns through unit sales but carry higher market risk and less control over tenant quality. Investors prioritize BTR for steady cash flow and market resilience, while multifamily suits those targeting capital appreciation and shorter investment horizons.

Connection

Build-to-rent and multifamily development are intrinsically linked through their focus on constructing residential properties designed for long-term rental occupancy, enhancing housing availability in urban and suburban markets. This connection supports scalable, professionally managed communities that cater to the growing demand for rental options from diverse demographics, including millennials and families. By integrating build-to-rent strategies into multifamily developments, investors and developers optimize operational efficiency, revenue stability, and tenant retention.

Key Terms

Ownership Structure

Multifamily development typically involves constructing residential buildings with units sold individually to multiple owners or investors, creating a diverse ownership structure. Build-to-rent (BTR) focuses on single ownership where the developer or investor retains all units, optimizing income streams through long-term rental management. Explore the advantages and challenges of ownership models in multifamily and build-to-rent sectors to deepen your understanding.

Rental Model

Multifamily development typically involves constructing residential buildings with multiple units for sale or lease, targeting both individual buyers and renters, while build-to-rent (BTR) centers exclusively on rental properties designed for long-term tenant occupancy. The BTR model emphasizes community-focused amenities, professional property management, and stable rental income, contrasting with the sales-driven approach of multifamily developments. Explore the distinct benefits and challenges of each rental model to determine which suits your investment strategy best.

Investor Strategy

Multifamily development offers investors the potential for long-term equity growth through property appreciation and rental income, appealing to those seeking value creation via asset management and market timing. Build to rent (BTR) focuses on delivering turnkey rental communities with stabilized cash flow, attracting investors aiming for consistent income and portfolio diversification in high-demand suburban and urban locations. Explore strategic insights to optimize returns by balancing development risk and rental yield in evolving residential markets.

Source and External Links

Community Impacts of Multifamily Development - Multifamily development is a key component of smart growth, offering resource efficiency and environmental benefits when integrated into existing communities.

2024 Top Multifamily Developers - The top multifamily developers in 2024 include companies like Greystar, with a significant number of units under construction and planned across the U.S.

Multifamily Housing & Real Estate News - Provides up-to-date news and analysis on trends and developments in the multifamily housing industry.

dowidth.com

dowidth.com