Institutional landlords manage extensive real estate portfolios for large organizations, leveraging significant capital and professional expertise to optimize returns. Family offices oversee private wealth by investing in real estate with a long-term, personalized approach aligned with family goals and legacy planning. Explore the key differences between institutional landlords and family offices to understand their distinct strategies and investment impacts.

Why it is important

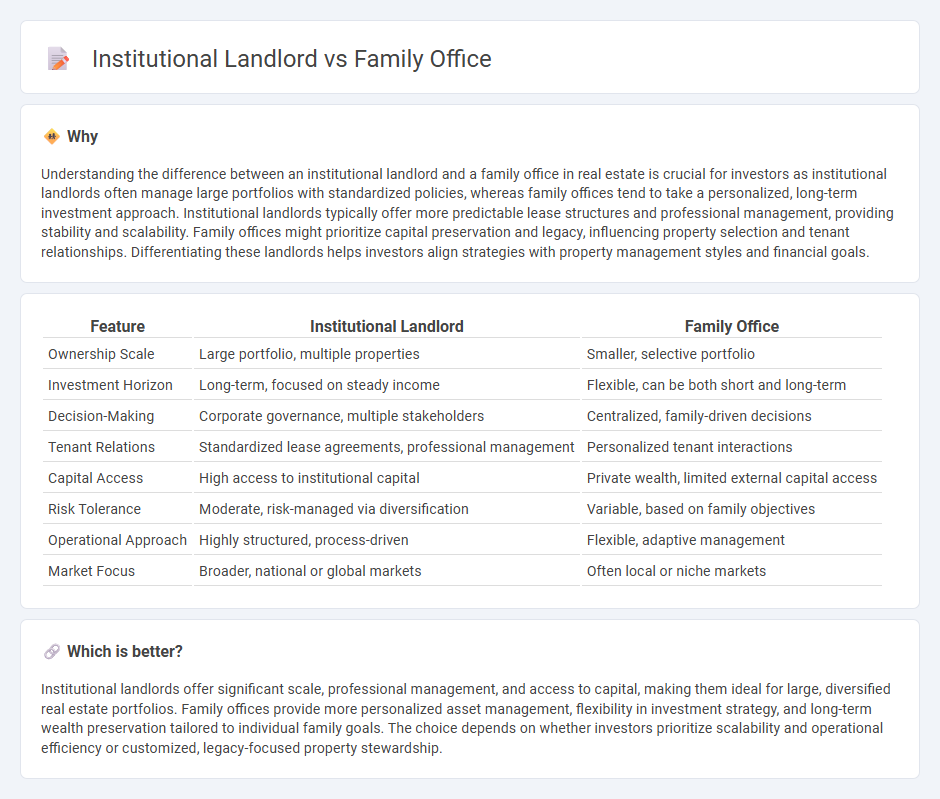

Understanding the difference between an institutional landlord and a family office in real estate is crucial for investors as institutional landlords often manage large portfolios with standardized policies, whereas family offices tend to take a personalized, long-term investment approach. Institutional landlords typically offer more predictable lease structures and professional management, providing stability and scalability. Family offices might prioritize capital preservation and legacy, influencing property selection and tenant relationships. Differentiating these landlords helps investors align strategies with property management styles and financial goals.

Comparison Table

| Feature | Institutional Landlord | Family Office |

|---|---|---|

| Ownership Scale | Large portfolio, multiple properties | Smaller, selective portfolio |

| Investment Horizon | Long-term, focused on steady income | Flexible, can be both short and long-term |

| Decision-Making | Corporate governance, multiple stakeholders | Centralized, family-driven decisions |

| Tenant Relations | Standardized lease agreements, professional management | Personalized tenant interactions |

| Capital Access | High access to institutional capital | Private wealth, limited external capital access |

| Risk Tolerance | Moderate, risk-managed via diversification | Variable, based on family objectives |

| Operational Approach | Highly structured, process-driven | Flexible, adaptive management |

| Market Focus | Broader, national or global markets | Often local or niche markets |

Which is better?

Institutional landlords offer significant scale, professional management, and access to capital, making them ideal for large, diversified real estate portfolios. Family offices provide more personalized asset management, flexibility in investment strategy, and long-term wealth preservation tailored to individual family goals. The choice depends on whether investors prioritize scalability and operational efficiency or customized, legacy-focused property stewardship.

Connection

Institutional landlords and family offices often collaborate in real estate by pooling capital to invest in large-scale commercial properties, leveraging their combined resources for higher returns. Family offices provide patient capital and long-term investment strategies, while institutional landlords contribute operational expertise and property management infrastructure. This partnership optimizes asset performance and risk diversification in real estate portfolios.

Key Terms

Capital Structure

Family offices often leverage a more flexible capital structure, utilizing a mix of long-term equity and selective debt tailored to preserve legacy wealth and maintain control. Institutional landlords typically employ a more complex capital stack, including syndicated debt, preferred equity, and Mezzanine financing to optimize leverage and scale large portfolios efficiently. Explore further to understand how these capital strategies impact investment risk and return profiles.

Investment Horizon

Family offices typically adopt a long-term investment horizon, prioritizing wealth preservation and intergenerational wealth transfer through stable, income-generating assets. Institutional landlords, such as real estate investment trusts (REITs) and pension funds, often balance long-term holdings with more active portfolio management strategies aimed at maximizing returns within defined timeframes. Discover how these differing investment horizons impact asset allocation and risk management strategies in the real estate market.

Asset Management

Family offices prioritize personalized asset management strategies tailored to long-term wealth preservation and multi-generational growth, often leveraging bespoke investment portfolios and direct property ownership. Institutional landlords emphasize scalable asset management through standardized processes, portfolio diversification, and risk mitigation to maximize returns across large real estate holdings. Explore deeper insights into how these distinct approaches impact portfolio performance and tenant relations.

Source and External Links

Family office - A family office is a privately held company that handles investment management and wealth management for a wealthy family, typically exceeding $50-100 million in investable assets.

What is a Family Office? - A family office provides comprehensive services to high-net-worth families, including wealth management, succession planning, and philanthropy.

What Is a Family Office and Do I Need One? - A family office is a private wealth management firm offering personalized services beyond investment management, catering to ultra-high-net-worth individuals and families.

dowidth.com

dowidth.com