Blockchain technology enhances real estate transactions by providing secure, transparent, and tamper-proof property records that reduce fraud risk. Anti-fraud verification methods leverage digital identity verification, transaction monitoring, and smart contracts to ensure buyer and seller authenticity and safeguard funds. Explore how blockchain and anti-fraud verification transform real estate security and trust.

Why it is important

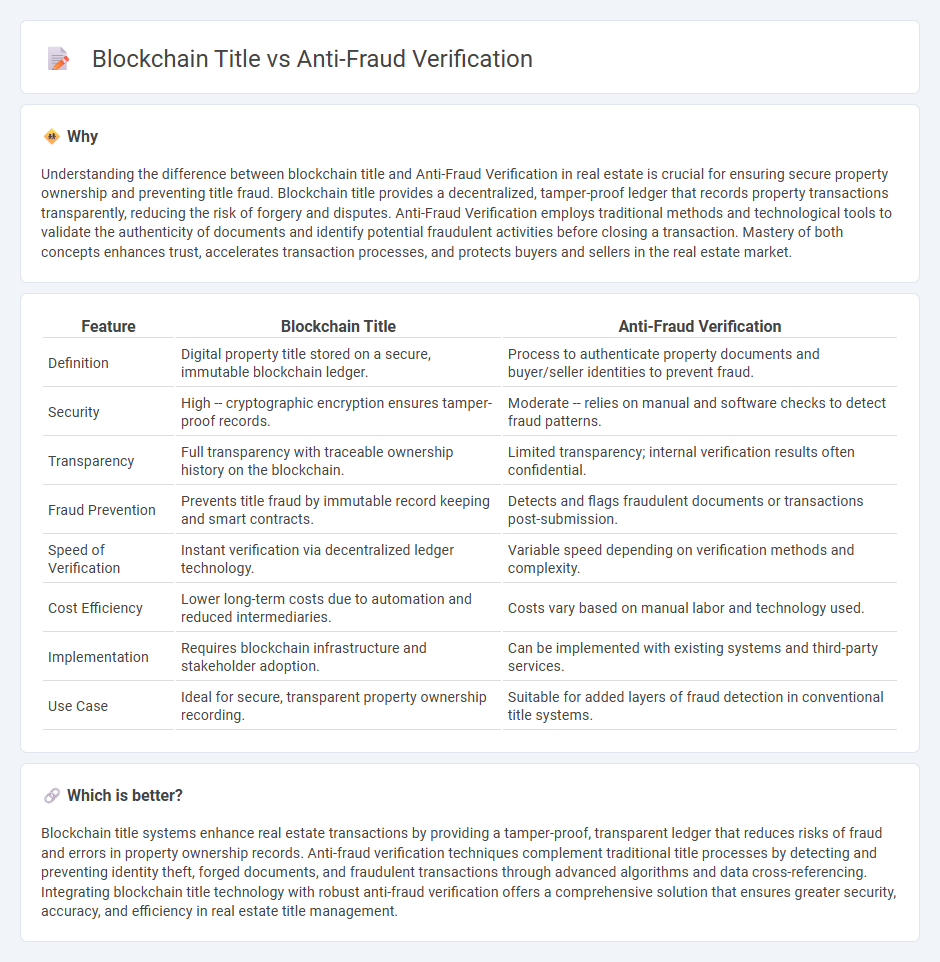

Understanding the difference between blockchain title and Anti-Fraud Verification in real estate is crucial for ensuring secure property ownership and preventing title fraud. Blockchain title provides a decentralized, tamper-proof ledger that records property transactions transparently, reducing the risk of forgery and disputes. Anti-Fraud Verification employs traditional methods and technological tools to validate the authenticity of documents and identify potential fraudulent activities before closing a transaction. Mastery of both concepts enhances trust, accelerates transaction processes, and protects buyers and sellers in the real estate market.

Comparison Table

| Feature | Blockchain Title | Anti-Fraud Verification |

|---|---|---|

| Definition | Digital property title stored on a secure, immutable blockchain ledger. | Process to authenticate property documents and buyer/seller identities to prevent fraud. |

| Security | High -- cryptographic encryption ensures tamper-proof records. | Moderate -- relies on manual and software checks to detect fraud patterns. |

| Transparency | Full transparency with traceable ownership history on the blockchain. | Limited transparency; internal verification results often confidential. |

| Fraud Prevention | Prevents title fraud by immutable record keeping and smart contracts. | Detects and flags fraudulent documents or transactions post-submission. |

| Speed of Verification | Instant verification via decentralized ledger technology. | Variable speed depending on verification methods and complexity. |

| Cost Efficiency | Lower long-term costs due to automation and reduced intermediaries. | Costs vary based on manual labor and technology used. |

| Implementation | Requires blockchain infrastructure and stakeholder adoption. | Can be implemented with existing systems and third-party services. |

| Use Case | Ideal for secure, transparent property ownership recording. | Suitable for added layers of fraud detection in conventional title systems. |

Which is better?

Blockchain title systems enhance real estate transactions by providing a tamper-proof, transparent ledger that reduces risks of fraud and errors in property ownership records. Anti-fraud verification techniques complement traditional title processes by detecting and preventing identity theft, forged documents, and fraudulent transactions through advanced algorithms and data cross-referencing. Integrating blockchain title technology with robust anti-fraud verification offers a comprehensive solution that ensures greater security, accuracy, and efficiency in real estate title management.

Connection

Blockchain title technology enhances real estate transactions by providing a secure, immutable ledger for property ownership records, reducing the risk of title fraud. Anti-fraud verification systems leverage blockchain's transparency to authenticate titles instantly, ensuring the integrity of ownership data. This connection streamlines due diligence processes, increasing trust and efficiency in real estate title transfers.

Key Terms

Title Authenticity

Title authenticity ensures the legal ownership and history of assets, preventing fraud through verification processes that cross-check documentation and ownership records. Blockchain technology offers a decentralized and immutable ledger that enhances title authentication by securely storing and verifying asset transactions in real-time. Explore how integrating blockchain strengthens title authenticity and combats fraud more effectively.

Immutable Ledger

Anti-fraud verification relies on advanced algorithms and real-time data analysis to detect and prevent fraudulent activities, whereas blockchain utilizes an immutable ledger that records every transaction with unalterable timestamps and cryptographic security. The decentralized nature of blockchain ensures data integrity and transparency, making it exceptionally resistant to tampering and fraud. Explore how combining anti-fraud strategies with blockchain technology can revolutionize security frameworks.

Identity Verification

Identity verification is a critical component in both anti-fraud verification and blockchain technologies, ensuring the authenticity of users and preventing unauthorized access. Anti-fraud systems rely on multi-factor authentication, biometric analysis, and real-time data checks to detect and mitigate fraudulent activities. Explore how evolving identity verification methods enhance security in digital transactions and blockchain applications.

Source and External Links

Identity Verification: How to Use It to Prevent Fraud & Money - This webpage discusses how identity verification works to prevent fraud by comparing identity credentials with trusted records.

Fraud Detection & Prevention Solution - Sumsub offers AI-driven fraud prevention tools to empower businesses with accurate detection and protective measures against various forms of fraud.

FraudFighter - FraudFighter provides ID authentication and counterfeit detection solutions to help organizations prevent transaction fraud.

dowidth.com

dowidth.com