Community land trusts and land banking offer distinct approaches to managing and preserving real estate assets for long-term community benefit. Community land trusts focus on maintaining affordable housing by separating land ownership from homeownership, while land banking involves acquiring and holding land for future development or redevelopment opportunities. Explore the differences and advantages of these strategies to understand how they impact real estate development and community growth.

Why it is important

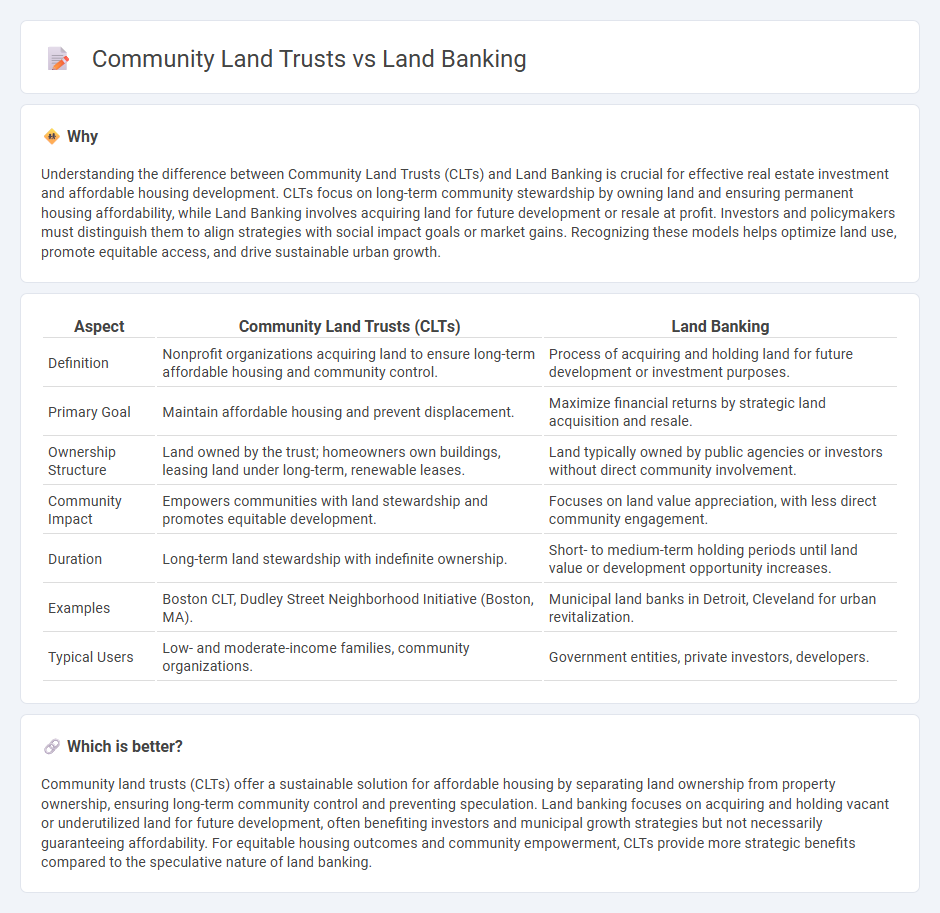

Understanding the difference between Community Land Trusts (CLTs) and Land Banking is crucial for effective real estate investment and affordable housing development. CLTs focus on long-term community stewardship by owning land and ensuring permanent housing affordability, while Land Banking involves acquiring land for future development or resale at profit. Investors and policymakers must distinguish them to align strategies with social impact goals or market gains. Recognizing these models helps optimize land use, promote equitable access, and drive sustainable urban growth.

Comparison Table

| Aspect | Community Land Trusts (CLTs) | Land Banking |

|---|---|---|

| Definition | Nonprofit organizations acquiring land to ensure long-term affordable housing and community control. | Process of acquiring and holding land for future development or investment purposes. |

| Primary Goal | Maintain affordable housing and prevent displacement. | Maximize financial returns by strategic land acquisition and resale. |

| Ownership Structure | Land owned by the trust; homeowners own buildings, leasing land under long-term, renewable leases. | Land typically owned by public agencies or investors without direct community involvement. |

| Community Impact | Empowers communities with land stewardship and promotes equitable development. | Focuses on land value appreciation, with less direct community engagement. |

| Duration | Long-term land stewardship with indefinite ownership. | Short- to medium-term holding periods until land value or development opportunity increases. |

| Examples | Boston CLT, Dudley Street Neighborhood Initiative (Boston, MA). | Municipal land banks in Detroit, Cleveland for urban revitalization. |

| Typical Users | Low- and moderate-income families, community organizations. | Government entities, private investors, developers. |

Which is better?

Community land trusts (CLTs) offer a sustainable solution for affordable housing by separating land ownership from property ownership, ensuring long-term community control and preventing speculation. Land banking focuses on acquiring and holding vacant or underutilized land for future development, often benefiting investors and municipal growth strategies but not necessarily guaranteeing affordability. For equitable housing outcomes and community empowerment, CLTs provide more strategic benefits compared to the speculative nature of land banking.

Connection

Community land trusts and land banking both serve as strategic tools to stabilize housing markets by acquiring and managing land to prevent speculation and ensure long-term affordability. Community land trusts focus on creating permanently affordable housing by separating land ownership from building ownership, while land banking involves purchasing and holding land for future development or community benefit. These methods intersect in promoting sustainable urban growth and equitable access to housing resources.

Key Terms

Speculation

Land banking involves purchasing and holding land primarily for speculative gains, aiming to profit from future appreciation without immediate development. Community land trusts focus on removing land from speculative markets by ensuring permanent community ownership and affordability through shared equity models. Explore deeper insights into how these approaches impact land use and community stability.

Stewardship

Land banking involves acquiring and holding land for future development or sale, often prioritizing financial returns. Community land trusts emphasize long-term stewardship by maintaining land ownership in trust to ensure affordable housing and community benefits. Explore more to understand how stewardship shapes sustainable land management models.

Affordability

Land banking involves government or nonprofit entities purchasing and holding land to control its use and increase affordable housing stock, often reducing speculation-driven price surges. Community land trusts (CLTs) maintain long-term affordability by separating land ownership from housing ownership, ensuring permanent housing affordability through ground leases and resident control. Explore the distinct impacts of land banking and CLTs on sustainable housing affordability to understand which model better supports community needs.

Source and External Links

Land Banking: A Sound Approach to Residential Real Estate Pre-Development - This approach involves a capital provider purchasing and holding undeveloped land, then conveying it to a developer using structured options, managing market risks while allowing pre-development activities.

Land Banking - Land banking generally refers to aggregating parcels of land for future sale or development, but in the U.S., it often involves quasi-governmental entities managing surplus land for public benefit.

Land Banking - Colorado Division of Housing - In Colorado, land banking involves protecting and preserving land until it can be developed or rehabilitated to meet community goals, often through nonprofit entities.

dowidth.com

dowidth.com