Opportunity zones offer tax incentives to investors who fund real estate projects in economically underserved areas, fostering community development and potential long-term gains. Distressed asset funds specialize in acquiring undervalued or troubled properties, aiming to revitalize them and generate high returns through strategic asset management. Explore how these investment strategies differ and which aligns best with your real estate goals.

Why it is important

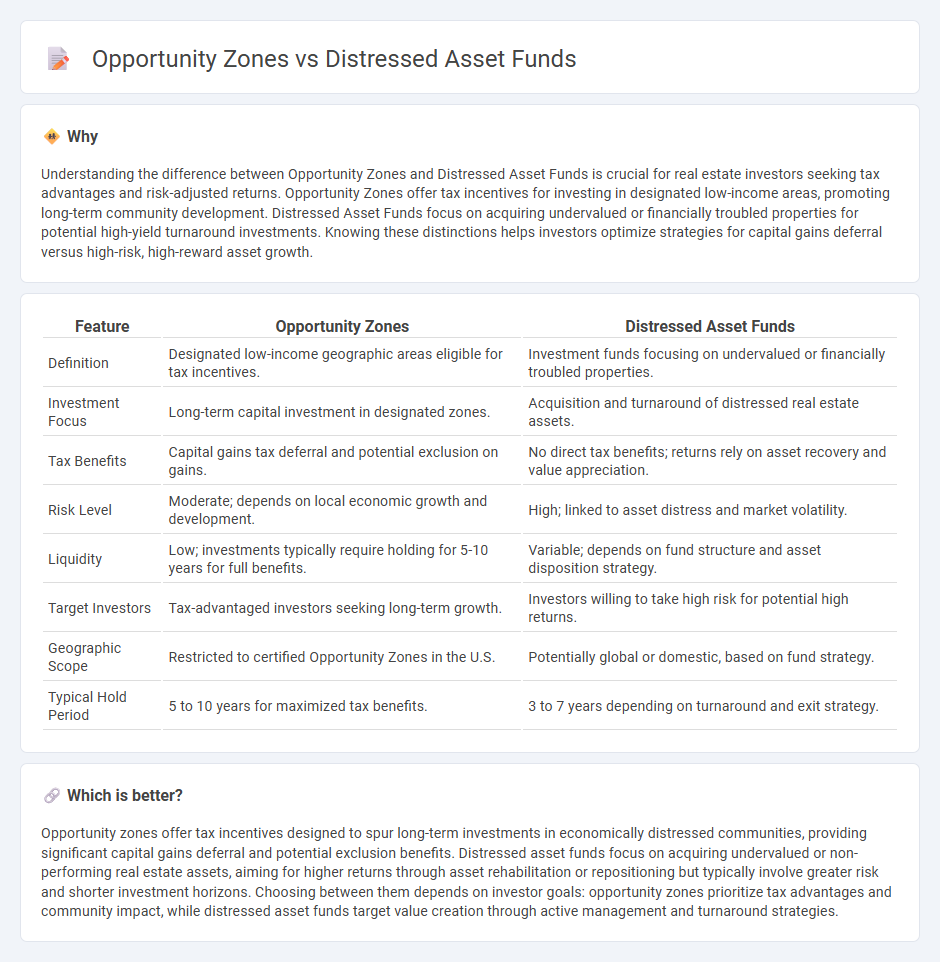

Understanding the difference between Opportunity Zones and Distressed Asset Funds is crucial for real estate investors seeking tax advantages and risk-adjusted returns. Opportunity Zones offer tax incentives for investing in designated low-income areas, promoting long-term community development. Distressed Asset Funds focus on acquiring undervalued or financially troubled properties for potential high-yield turnaround investments. Knowing these distinctions helps investors optimize strategies for capital gains deferral versus high-risk, high-reward asset growth.

Comparison Table

| Feature | Opportunity Zones | Distressed Asset Funds |

|---|---|---|

| Definition | Designated low-income geographic areas eligible for tax incentives. | Investment funds focusing on undervalued or financially troubled properties. |

| Investment Focus | Long-term capital investment in designated zones. | Acquisition and turnaround of distressed real estate assets. |

| Tax Benefits | Capital gains tax deferral and potential exclusion on gains. | No direct tax benefits; returns rely on asset recovery and value appreciation. |

| Risk Level | Moderate; depends on local economic growth and development. | High; linked to asset distress and market volatility. |

| Liquidity | Low; investments typically require holding for 5-10 years for full benefits. | Variable; depends on fund structure and asset disposition strategy. |

| Target Investors | Tax-advantaged investors seeking long-term growth. | Investors willing to take high risk for potential high returns. |

| Geographic Scope | Restricted to certified Opportunity Zones in the U.S. | Potentially global or domestic, based on fund strategy. |

| Typical Hold Period | 5 to 10 years for maximized tax benefits. | 3 to 7 years depending on turnaround and exit strategy. |

Which is better?

Opportunity zones offer tax incentives designed to spur long-term investments in economically distressed communities, providing significant capital gains deferral and potential exclusion benefits. Distressed asset funds focus on acquiring undervalued or non-performing real estate assets, aiming for higher returns through asset rehabilitation or repositioning but typically involve greater risk and shorter investment horizons. Choosing between them depends on investor goals: opportunity zones prioritize tax advantages and community impact, while distressed asset funds target value creation through active management and turnaround strategies.

Connection

Opportunity Zones offer tax incentives to investors targeting economically distressed areas, making them attractive for Distressed Asset Funds seeking undervalued real estate. Distressed Asset Funds often acquire properties in these zones to maximize returns through rehabilitation and economic revitalization efforts. This strategic connection leverages tax benefits and turnaround potential to drive profitable real estate investments.

Key Terms

Foreclosure

Distressed asset funds specialize in acquiring foreclosed properties at below-market prices, aiming to rehabilitate and resell them for profit, while opportunity zones offer tax incentives to invest in economically disadvantaged areas, including properties facing foreclosure. Foreclosure investments in distressed asset funds typically involve faster acquisition and turnaround, whereas opportunity zones provide long-term tax benefits such as deferral and exclusion of capital gains taxes. Explore the differences and benefits further to determine which foreclosure investment strategy aligns best with your financial goals.

Capital Gains Tax

Distressed Asset Funds offer investors a chance to acquire undervalued properties with potential for high returns, but capital gains tax applies on profits upon sale. Opportunity Zones provide tax incentives, including deferred and potentially reduced capital gains taxes when investments are held for specific periods. Explore detailed comparisons to maximize tax benefits and investment potential.

Qualified Opportunity Fund (QOF)

Distressed Asset Funds invest in underperforming properties or loans to generate high returns through asset turnaround, while Qualified Opportunity Funds (QOFs) focus on investing capital gains in designated Opportunity Zones to provide tax incentives and promote economic growth. QOFs allow investors to defer and potentially reduce capital gains taxes by holding investments in Opportunity Zones for specific periods, enhancing both community development and portfolio diversification. Explore the benefits and strategies of Qualified Opportunity Funds to maximize your investment potential and tax advantages.

Source and External Links

Distressed Debt Hedge Funds: Detailed Guide - Mergers & Inquisitions - Distressed Asset Funds, often referred to as distressed debt hedge funds, buy debt trading at steep discounts due to the issuer's financial troubles and profit by betting on price changes or influencing restructuring or bankruptcy processes.

Distressed securities - Wikipedia - Distressed Asset Funds invest in securities of companies or entities experiencing financial distress, often purchasing at deep discounts and aiming for high returns through restructuring or turnaround efforts.

US Distressed Investing: A Guide - Chapman and Cutler LLP - Distressed Asset Funds capitalize on purchasing undervalued assets due to operational or financial distress, with significant potential upside as the assets recover, requiring specialized expertise and risk tolerance.

dowidth.com

dowidth.com