Green leases focus on sustainability by incorporating energy efficiency and environmental responsibilities into tenant agreements, promoting reduced utility costs and carbon footprints. Triple net leases require tenants to cover property taxes, insurance, and maintenance expenses, providing landlords with a predictable income stream and minimizing their financial risks. Discover how these leasing options impact investment strategies and operational costs in real estate.

Why it is important

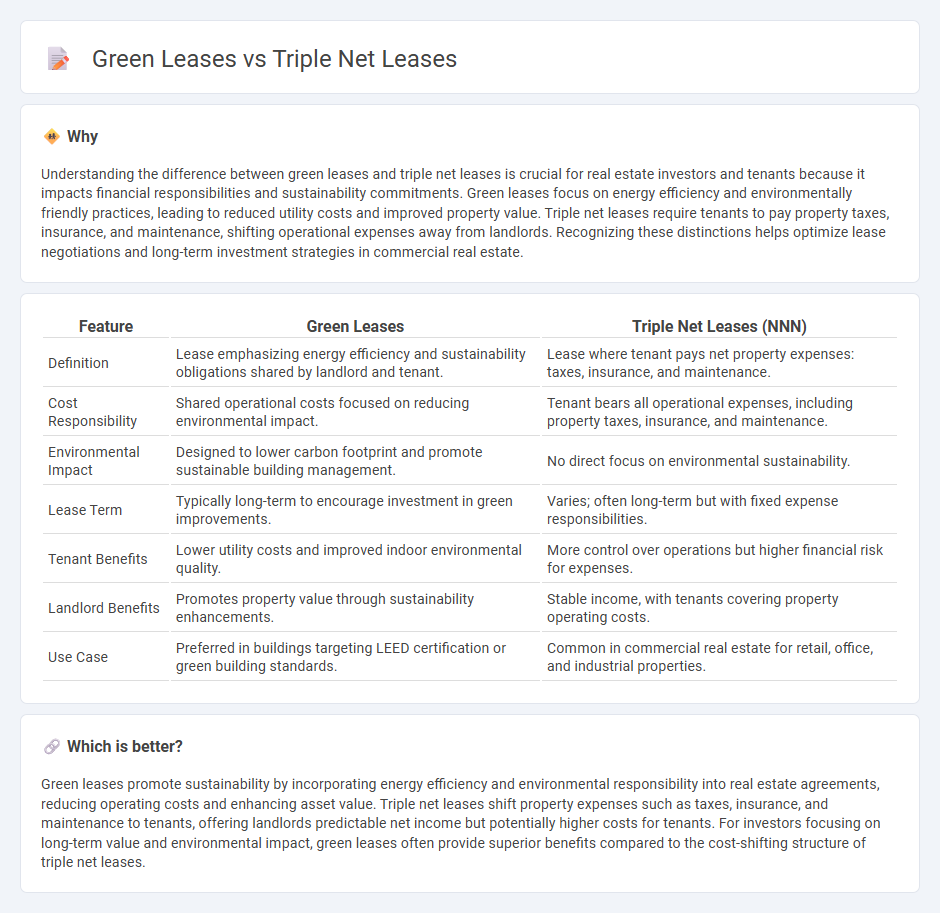

Understanding the difference between green leases and triple net leases is crucial for real estate investors and tenants because it impacts financial responsibilities and sustainability commitments. Green leases focus on energy efficiency and environmentally friendly practices, leading to reduced utility costs and improved property value. Triple net leases require tenants to pay property taxes, insurance, and maintenance, shifting operational expenses away from landlords. Recognizing these distinctions helps optimize lease negotiations and long-term investment strategies in commercial real estate.

Comparison Table

| Feature | Green Leases | Triple Net Leases (NNN) |

|---|---|---|

| Definition | Lease emphasizing energy efficiency and sustainability obligations shared by landlord and tenant. | Lease where tenant pays net property expenses: taxes, insurance, and maintenance. |

| Cost Responsibility | Shared operational costs focused on reducing environmental impact. | Tenant bears all operational expenses, including property taxes, insurance, and maintenance. |

| Environmental Impact | Designed to lower carbon footprint and promote sustainable building management. | No direct focus on environmental sustainability. |

| Lease Term | Typically long-term to encourage investment in green improvements. | Varies; often long-term but with fixed expense responsibilities. |

| Tenant Benefits | Lower utility costs and improved indoor environmental quality. | More control over operations but higher financial risk for expenses. |

| Landlord Benefits | Promotes property value through sustainability enhancements. | Stable income, with tenants covering property operating costs. |

| Use Case | Preferred in buildings targeting LEED certification or green building standards. | Common in commercial real estate for retail, office, and industrial properties. |

Which is better?

Green leases promote sustainability by incorporating energy efficiency and environmental responsibility into real estate agreements, reducing operating costs and enhancing asset value. Triple net leases shift property expenses such as taxes, insurance, and maintenance to tenants, offering landlords predictable net income but potentially higher costs for tenants. For investors focusing on long-term value and environmental impact, green leases often provide superior benefits compared to the cost-shifting structure of triple net leases.

Connection

Green leases and triple net leases intersect by integrating sustainability provisions within the tenant's responsibility framework for property expenses. In a triple net lease, tenants cover property taxes, insurance, and maintenance costs, which provides a clear structure to implement green lease clauses promoting energy efficiency and environmental performance. This connection encourages shared accountability for sustainable property management between landlords and tenants, driving long-term reductions in operational costs and environmental impact.

Key Terms

Operating Expenses

Triple net leases require tenants to cover operating expenses such as property taxes, insurance, and maintenance, shifting financial responsibility from landlords. Green leases include clauses that promote energy efficiency and sustainability by sharing operating expense savings and encouraging environmentally friendly building operations. Explore the differences in operating expense allocation to optimize lease agreements and enhance property performance.

Sustainability Clauses

Triple net leases require tenants to cover property taxes, insurance, and maintenance, often leading to limited sustainability initiatives due to fixed responsibilities. Green leases incorporate specific sustainability clauses, promoting energy efficiency, waste reduction, and environmentally responsible practices shared between landlords and tenants. Discover how integrating sustainability clauses in leases drives environmental performance and cost savings.

Maintenance Responsibilities

Triple net leases require tenants to cover maintenance costs, taxes, and insurance, shifting significant financial responsibility away from landlords. Green leases incorporate sustainability clauses, mandating both parties to share maintenance duties that promote energy efficiency and environmental compliance. Explore the distinctions to optimize property management strategies and sustainability goals.

Source and External Links

Triple net lease | Wex | US Law | LII / Legal Information Institute - A triple net lease (NNN) is a commercial lease where the tenant pays rent plus all property expenses including insurance, maintenance, and taxes, often resulting in lower rent and long-term leases, typically 10-15 years or more.

Benefits and Drawbacks of a Triple Net Lease (NNN) in Commercial Real Estate - In a triple net lease, the tenant covers property taxes, insurance, and operating expenses on top of base rent and utilities, which can provide tenants more freedom for property alterations and landlords a low-risk, steady income with fewer management responsibilities.

The Benefits and Risks of Triple Net Leases - Triple net leases shift operating expense risks to tenants, who may face unexpected costs if landlords do not control expenses or deferred maintenance occurs, while landlords benefit from reduced management duties but risk tenant neglect of maintenance that lowers property value.

dowidth.com

dowidth.com