House hacking leverages rental income from a primary residence to offset mortgage costs, providing immediate cash flow and building equity over time. The BRRRR strategy--Buy, Rehab, Rent, Refinance, Repeat--focuses on acquiring undervalued properties, renovating them for increased value, and recycling capital to scale a rental portfolio. Explore these methods in depth to discover which real estate investment approach aligns with your financial goals.

Why it is important

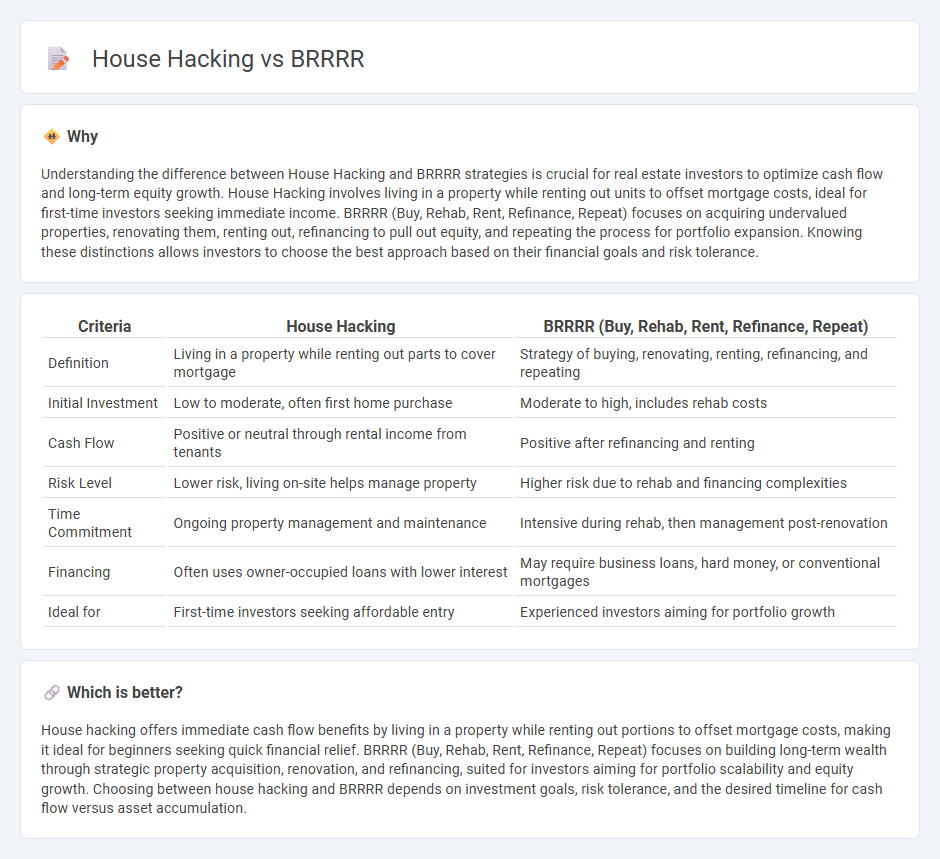

Understanding the difference between House Hacking and BRRRR strategies is crucial for real estate investors to optimize cash flow and long-term equity growth. House Hacking involves living in a property while renting out units to offset mortgage costs, ideal for first-time investors seeking immediate income. BRRRR (Buy, Rehab, Rent, Refinance, Repeat) focuses on acquiring undervalued properties, renovating them, renting out, refinancing to pull out equity, and repeating the process for portfolio expansion. Knowing these distinctions allows investors to choose the best approach based on their financial goals and risk tolerance.

Comparison Table

| Criteria | House Hacking | BRRRR (Buy, Rehab, Rent, Refinance, Repeat) |

|---|---|---|

| Definition | Living in a property while renting out parts to cover mortgage | Strategy of buying, renovating, renting, refinancing, and repeating |

| Initial Investment | Low to moderate, often first home purchase | Moderate to high, includes rehab costs |

| Cash Flow | Positive or neutral through rental income from tenants | Positive after refinancing and renting |

| Risk Level | Lower risk, living on-site helps manage property | Higher risk due to rehab and financing complexities |

| Time Commitment | Ongoing property management and maintenance | Intensive during rehab, then management post-renovation |

| Financing | Often uses owner-occupied loans with lower interest | May require business loans, hard money, or conventional mortgages |

| Ideal for | First-time investors seeking affordable entry | Experienced investors aiming for portfolio growth |

Which is better?

House hacking offers immediate cash flow benefits by living in a property while renting out portions to offset mortgage costs, making it ideal for beginners seeking quick financial relief. BRRRR (Buy, Rehab, Rent, Refinance, Repeat) focuses on building long-term wealth through strategic property acquisition, renovation, and refinancing, suited for investors aiming for portfolio scalability and equity growth. Choosing between house hacking and BRRRR depends on investment goals, risk tolerance, and the desired timeline for cash flow versus asset accumulation.

Connection

House hacking and the BRRRR (Buy, Rehab, Rent, Refinance, Repeat) strategy are connected through their shared goal of generating passive income and building real estate wealth. House hacking involves living in one part of a property while renting out other units to cover mortgage costs, which can serve as a stepping stone to acquiring properties using the BRRRR method. By leveraging house hacking income, investors can accumulate capital to buy undervalued properties, renovate them, rent them out, refinance to pull out equity, and repeat the process for portfolio growth.

Key Terms

Buy-and-Hold

BRRRR (Buy, Rehab, Rent, Refinance, Repeat) strategy accelerates portfolio growth by leveraging forced appreciation and refinancing opportunities to maximize equity extraction. House hacking involves living in part of the property while renting out other units to offset mortgage costs, emphasizing owner-occupied advantages and cash flow stability. Explore how these buy-and-hold methods differ in risk profile and cash-on-cash returns to optimize your real estate investment strategy.

Rental Income

BRRRR (Buy, Rehab, Rent, Refinance, Repeat) strategy maximizes rental income by acquiring undervalued properties, renovating them to increase rent potential, and leveraging refinancing to fund additional investments. House hacking involves living in one part of a multi-unit property while renting out others, reducing personal housing costs and generating steady rental income with lower initial investment. Explore detailed comparisons to determine which strategy best boosts your rental income and investment goals.

Owner-Occupied

The BRRRR strategy (Buy, Rehab, Rent, Refinance, Repeat) and House Hacking both offer pathways to real estate investment with a focus on owner-occupied properties, maximizing equity growth and cash flow. BRRRR emphasizes systematic property improvement and leveraging refinancing to scale investment portfolios, while House Hacking centers on living in a multi-unit property or renting parts of your home to reduce living expenses. Explore the nuances of each approach to determine which strategy aligns best with your financial goals and lifestyle.

Source and External Links

Understanding the BRRRR method of real estate investment - This article provides an overview of the BRRRR method, which involves buying distressed properties, rehabilitating them, renting them out, and using a cash-out refinance to fund future investments.

How to Use the BRRRR Method in Real Estate Investing - The BRRRR method is a real estate investment strategy that focuses on purchasing distressed properties, renovating them, renting them out, and refinancing to fund subsequent investments.

What is the BRRRR method (and how does it work)? - This article explains the BRRRR method as an alternative to traditional house flipping strategies, highlighting its potential for building wealth through repeated cycles of buying, rehabbing, renting, refinancing, and repeating.

dowidth.com

dowidth.com