House hacking enables investors to live in a property while renting out portions to cover mortgage costs, maximizing cash flow early on with minimal upfront investment. Buy and hold focuses on acquiring rental properties for long-term appreciation and steady passive income, benefiting from property value growth over time. Explore the advantages and strategies of each approach to optimize your real estate investment portfolio.

Why it is important

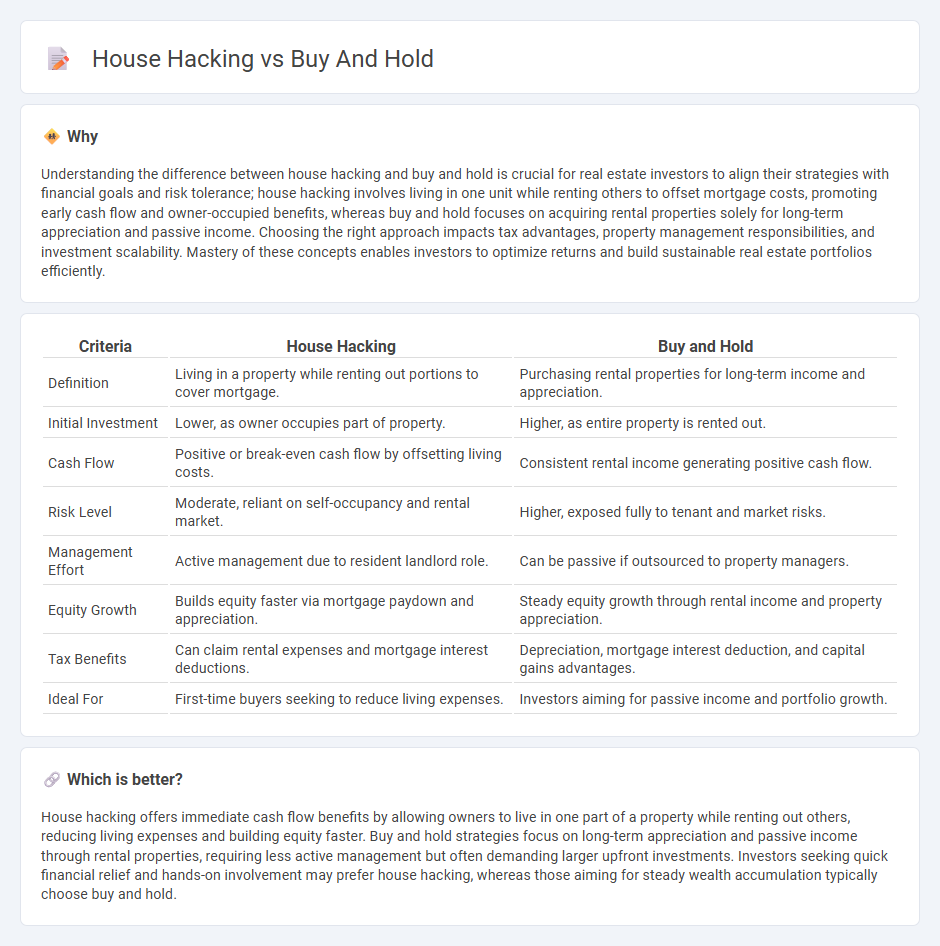

Understanding the difference between house hacking and buy and hold is crucial for real estate investors to align their strategies with financial goals and risk tolerance; house hacking involves living in one unit while renting others to offset mortgage costs, promoting early cash flow and owner-occupied benefits, whereas buy and hold focuses on acquiring rental properties solely for long-term appreciation and passive income. Choosing the right approach impacts tax advantages, property management responsibilities, and investment scalability. Mastery of these concepts enables investors to optimize returns and build sustainable real estate portfolios efficiently.

Comparison Table

| Criteria | House Hacking | Buy and Hold |

|---|---|---|

| Definition | Living in a property while renting out portions to cover mortgage. | Purchasing rental properties for long-term income and appreciation. |

| Initial Investment | Lower, as owner occupies part of property. | Higher, as entire property is rented out. |

| Cash Flow | Positive or break-even cash flow by offsetting living costs. | Consistent rental income generating positive cash flow. |

| Risk Level | Moderate, reliant on self-occupancy and rental market. | Higher, exposed fully to tenant and market risks. |

| Management Effort | Active management due to resident landlord role. | Can be passive if outsourced to property managers. |

| Equity Growth | Builds equity faster via mortgage paydown and appreciation. | Steady equity growth through rental income and property appreciation. |

| Tax Benefits | Can claim rental expenses and mortgage interest deductions. | Depreciation, mortgage interest deduction, and capital gains advantages. |

| Ideal For | First-time buyers seeking to reduce living expenses. | Investors aiming for passive income and portfolio growth. |

Which is better?

House hacking offers immediate cash flow benefits by allowing owners to live in one part of a property while renting out others, reducing living expenses and building equity faster. Buy and hold strategies focus on long-term appreciation and passive income through rental properties, requiring less active management but often demanding larger upfront investments. Investors seeking quick financial relief and hands-on involvement may prefer house hacking, whereas those aiming for steady wealth accumulation typically choose buy and hold.

Connection

House hacking serves as an entry strategy for real estate investors to generate rental income while living in the property, reducing personal housing costs. This approach often leads to the buy and hold strategy, where investors retain properties long-term to build equity and benefit from ongoing rental cash flow. Both methods focus on leveraging real estate assets to create passive income streams and wealth accumulation.

Key Terms

Cash Flow

Buy and hold real estate strategy focuses on acquiring properties to generate consistent rental income and long-term appreciation, optimizing cash flow through stable tenant occupancy and property management. House hacking involves purchasing a multi-unit property, living in one unit while renting out others to cover mortgage and expenses, maximizing cash flow by reducing personal housing costs. Discover detailed comparisons and strategic insights to maximize your real estate cash flow potential.

Equity

House hacking accelerates equity building by leveraging rental income to offset mortgage costs, effectively turning a primary residence into an income-producing asset. Buy and hold investing accumulates equity more slowly through property appreciation and principal mortgage paydown, relying on market growth over time. Explore how combining these strategies can maximize your real estate equity potential.

Owner-Occupancy

Owner-occupancy plays a critical role in both buy and hold and house hacking strategies, significantly impacting mortgage options and tax benefits. Buy and hold investors typically rent out properties entirely, while house hacking involves living in part of the property to reduce personal housing costs and leverage owner-occupant loan advantages. Explore the benefits and nuances of owner-occupancy to determine which investment approach best aligns with your financial goals.

Source and External Links

Buy and hold - Wikipedia - Buy and hold is an investment strategy where an investor purchases assets (stocks, real estate, etc.) and holds them long-term, aiming for price appreciation regardless of short-term market volatility, and avoiding frequent trading or market timing.

Buy-and-hold as an investing strategy: Weigh the pluses and minuses - This approach is designed for investors willing to accept market risks in exchange for potential long-term gains, typically by purchasing quality stocks or funds and retaining them through market ups and downs.

What is buy-and-hold real estate investing? | Rocket Mortgage - In real estate, buy and hold means acquiring investment property and holding it for many years, generating rental income and building equity while benefiting from potential tax advantages and property appreciation.

dowidth.com

dowidth.com