Tokenized real estate allows investors to purchase fractional ownership of properties using blockchain technology, enhancing liquidity and transparency compared to traditional mortgage-backed securities (MBS), which pool home loans into tradeable assets but often lack direct asset control. Unlike MBS, tokenized real estate offers real-time settlement and reduced intermediaries, creating more accessible and efficient investment opportunities. Explore how these innovative financial instruments are transforming real estate investment dynamics.

Why it is important

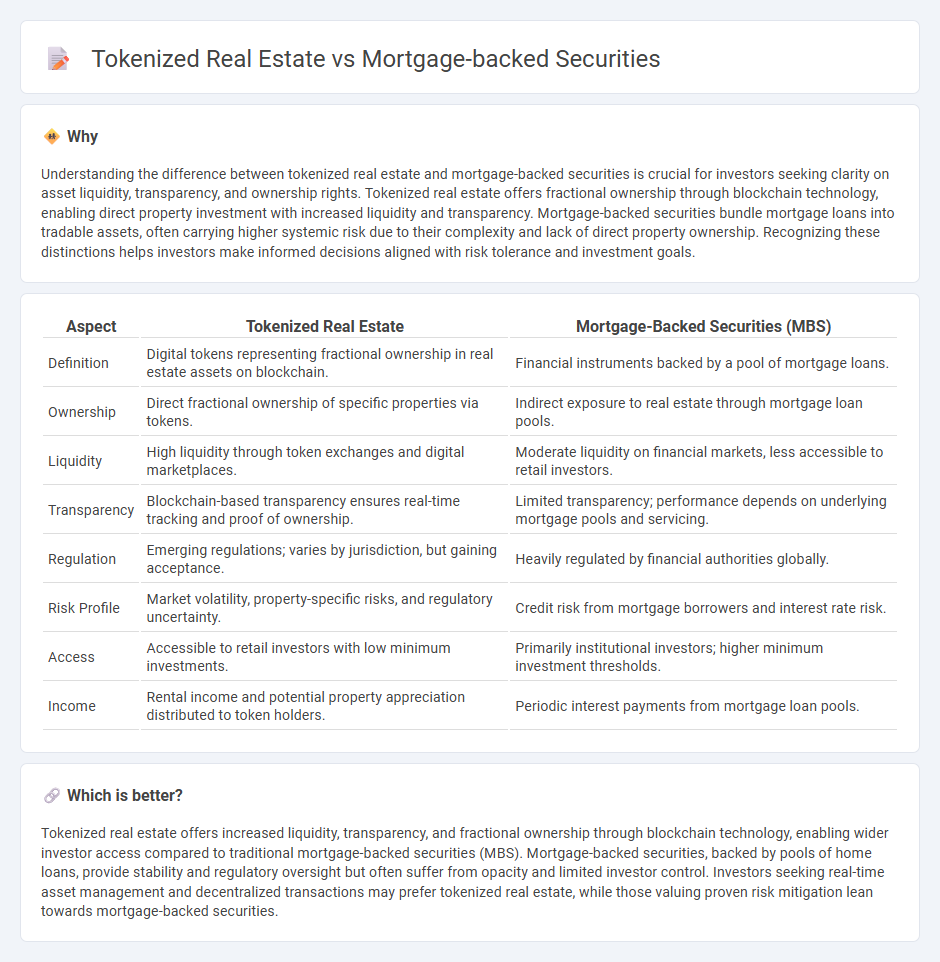

Understanding the difference between tokenized real estate and mortgage-backed securities is crucial for investors seeking clarity on asset liquidity, transparency, and ownership rights. Tokenized real estate offers fractional ownership through blockchain technology, enabling direct property investment with increased liquidity and transparency. Mortgage-backed securities bundle mortgage loans into tradable assets, often carrying higher systemic risk due to their complexity and lack of direct property ownership. Recognizing these distinctions helps investors make informed decisions aligned with risk tolerance and investment goals.

Comparison Table

| Aspect | Tokenized Real Estate | Mortgage-Backed Securities (MBS) |

|---|---|---|

| Definition | Digital tokens representing fractional ownership in real estate assets on blockchain. | Financial instruments backed by a pool of mortgage loans. |

| Ownership | Direct fractional ownership of specific properties via tokens. | Indirect exposure to real estate through mortgage loan pools. |

| Liquidity | High liquidity through token exchanges and digital marketplaces. | Moderate liquidity on financial markets, less accessible to retail investors. |

| Transparency | Blockchain-based transparency ensures real-time tracking and proof of ownership. | Limited transparency; performance depends on underlying mortgage pools and servicing. |

| Regulation | Emerging regulations; varies by jurisdiction, but gaining acceptance. | Heavily regulated by financial authorities globally. |

| Risk Profile | Market volatility, property-specific risks, and regulatory uncertainty. | Credit risk from mortgage borrowers and interest rate risk. |

| Access | Accessible to retail investors with low minimum investments. | Primarily institutional investors; higher minimum investment thresholds. |

| Income | Rental income and potential property appreciation distributed to token holders. | Periodic interest payments from mortgage loan pools. |

Which is better?

Tokenized real estate offers increased liquidity, transparency, and fractional ownership through blockchain technology, enabling wider investor access compared to traditional mortgage-backed securities (MBS). Mortgage-backed securities, backed by pools of home loans, provide stability and regulatory oversight but often suffer from opacity and limited investor control. Investors seeking real-time asset management and decentralized transactions may prefer tokenized real estate, while those valuing proven risk mitigation lean towards mortgage-backed securities.

Connection

Tokenized real estate transforms property assets into digital tokens, enhancing liquidity and accessibility for investors, while mortgage-backed securities (MBS) pool mortgage loans to create tradable financial products. Both leverage underlying real estate to provide investment opportunities, with tokenization offering fractional ownership and MBS distributing mortgage payment risks. This connection enables diversified portfolio strategies that combine innovative blockchain-based assets with traditional fixed-income instruments.

Key Terms

Securitization

Mortgage-backed securities (MBS) represent pools of traditional mortgage loans bundled into securities sold to investors, with cash flows generated from debt repayments. Tokenized real estate applies blockchain technology to securitize property assets, enabling fractional ownership and increased liquidity through digital tokens. Explore how securitization methods are evolving to transform real estate investment dynamics.

Blockchain

Mortgage-backed securities are traditional financial instruments pooling home loans into bonds, offering structured credit risk through centralized financial institutions. Tokenized real estate leverages blockchain technology to fractionalize property ownership, enhancing liquidity, transparency, and accessibility while reducing transaction costs. Explore the transformative impact of blockchain on real estate investments to understand its potential benefits and challenges.

Liquidity

Mortgage-backed securities (MBS) offer a traditional investment vehicle with moderate liquidity, traded on established financial markets but often facing liquidity constraints during market stress. Tokenized real estate leverages blockchain technology to enhance liquidity by enabling fractional ownership and 24/7 trading on digital platforms, providing faster asset transfer and access to a broader investor base. Explore the comparative liquidity advantages and market dynamics of these investment forms to make informed decisions.

Source and External Links

Mortgage-Backed Securities and Collateralized Mortgage Obligations - Mortgage-backed securities (MBS) are debt obligations representing claims to cash flows from pools of residential mortgage loans, issued through securitization by government and private entities, with various structures like pass-through certificates and collateralized mortgage obligations (CMOs) that distribute payments by tranches.

Mortgage-Backed Securities: A Guide | Quicken Loans - An MBS is an investment in bundled home mortgages sold by original lenders to another entity, offering diversification since the risk is spread over many mortgages, but carries risks revealed in the 2008 crisis; types include pass-throughs, CMOs, and stripped MBSs.

Understanding Mortgage-Backed Securities Investing - MBS are backed by pools of mortgages whose principal and interest payments are passed monthly to investors, with unique characteristics including monthly payments of interest and principal, fluctuating payment flows, and prepayment risk especially sensitive to interest rate changes.

dowidth.com

dowidth.com