Micro flipping involves quick, small-scale property transactions aimed at rapid profit from minor renovations or price changes, typically requiring less capital and shorter time frames. Syndication pools resources from multiple investors to acquire larger, often multifamily or commercial properties, offering shared risk and passive income potential. Explore the advantages and differences of micro flipping and syndication to determine the best investment strategy for your real estate portfolio.

Why it is important

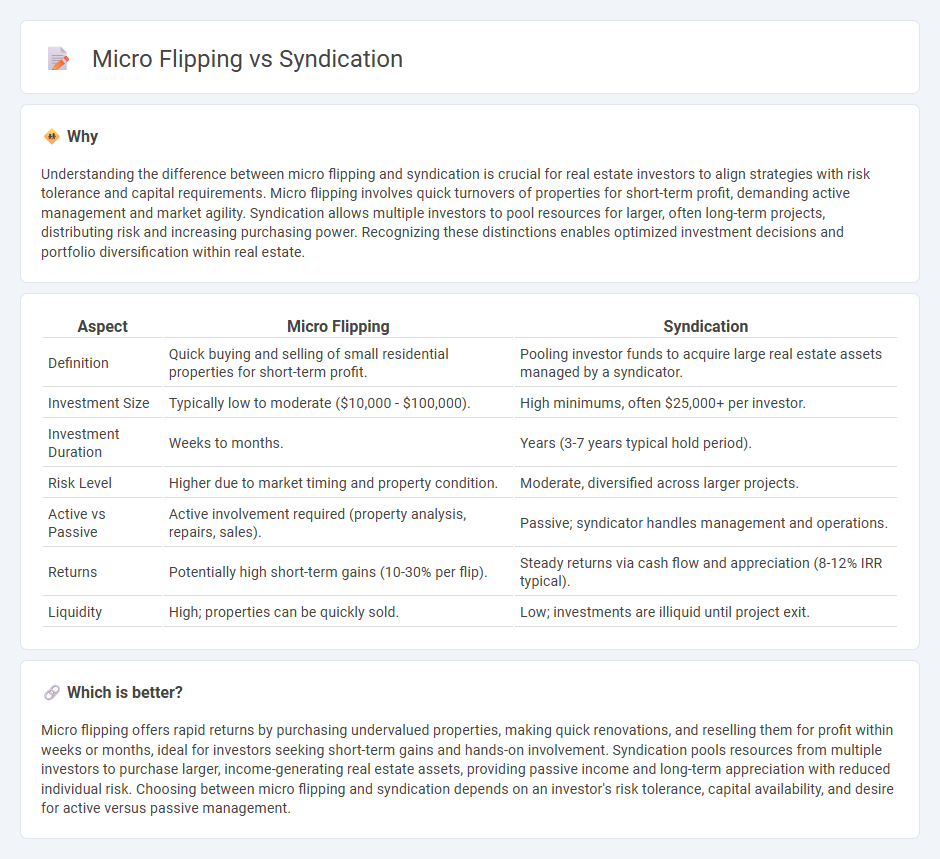

Understanding the difference between micro flipping and syndication is crucial for real estate investors to align strategies with risk tolerance and capital requirements. Micro flipping involves quick turnovers of properties for short-term profit, demanding active management and market agility. Syndication allows multiple investors to pool resources for larger, often long-term projects, distributing risk and increasing purchasing power. Recognizing these distinctions enables optimized investment decisions and portfolio diversification within real estate.

Comparison Table

| Aspect | Micro Flipping | Syndication |

|---|---|---|

| Definition | Quick buying and selling of small residential properties for short-term profit. | Pooling investor funds to acquire large real estate assets managed by a syndicator. |

| Investment Size | Typically low to moderate ($10,000 - $100,000). | High minimums, often $25,000+ per investor. |

| Investment Duration | Weeks to months. | Years (3-7 years typical hold period). |

| Risk Level | Higher due to market timing and property condition. | Moderate, diversified across larger projects. |

| Active vs Passive | Active involvement required (property analysis, repairs, sales). | Passive; syndicator handles management and operations. |

| Returns | Potentially high short-term gains (10-30% per flip). | Steady returns via cash flow and appreciation (8-12% IRR typical). |

| Liquidity | High; properties can be quickly sold. | Low; investments are illiquid until project exit. |

Which is better?

Micro flipping offers rapid returns by purchasing undervalued properties, making quick renovations, and reselling them for profit within weeks or months, ideal for investors seeking short-term gains and hands-on involvement. Syndication pools resources from multiple investors to purchase larger, income-generating real estate assets, providing passive income and long-term appreciation with reduced individual risk. Choosing between micro flipping and syndication depends on an investor's risk tolerance, capital availability, and desire for active versus passive management.

Connection

Micro flipping involves quickly buying and selling properties at a small scale to generate profit, often requiring minimal upfront capital. Syndication pools funds from multiple investors to acquire larger real estate assets, spreading risk and enabling access to bigger deals. Both strategies leverage collective resources and market timing to optimize returns in real estate investment.

Key Terms

Joint Venture

Syndication in real estate typically involves pooling funds from multiple investors to jointly purchase large properties, leveraging collective capital and shared risk in a joint venture structure. Micro flipping, on the other hand, entails quickly buying and reselling properties for profit with minimal holding time, often requiring less capital but higher market agility. Explore more about how joint ventures can optimize resource sharing and risk management in these investment strategies.

Quick Resale

Syndication involves pooling investor funds to acquire larger real estate assets, while micro flipping focuses on rapidly reselling properties for quick profit, often without major renovations. Quick resale strategies leverage market timing and pricing to maximize return on investment within days or weeks. Explore further to understand which approach best suits your investment goals.

Passive Investing

Syndication involves pooling funds from multiple investors to invest in large real estate projects, offering passive income with professional management and reduced individual risk. Micro flipping focuses on quickly buying, holding for a short period, and reselling properties for a profit, requiring more active involvement but still offering opportunities for passive investors through platforms that handle operations. Explore detailed strategies and benefits of each to enhance your passive investing portfolio.

dowidth.com

dowidth.com