Structured credit products are financial instruments created by pooling various debt obligations and dividing them into tranches with different risk and return profiles. Securitization involves transforming illiquid assets, such as loans or receivables, into tradable securities, enhancing liquidity and risk distribution. Explore the nuances and applications of structured credit and securitization to better understand their impact on financial markets.

Why it is important

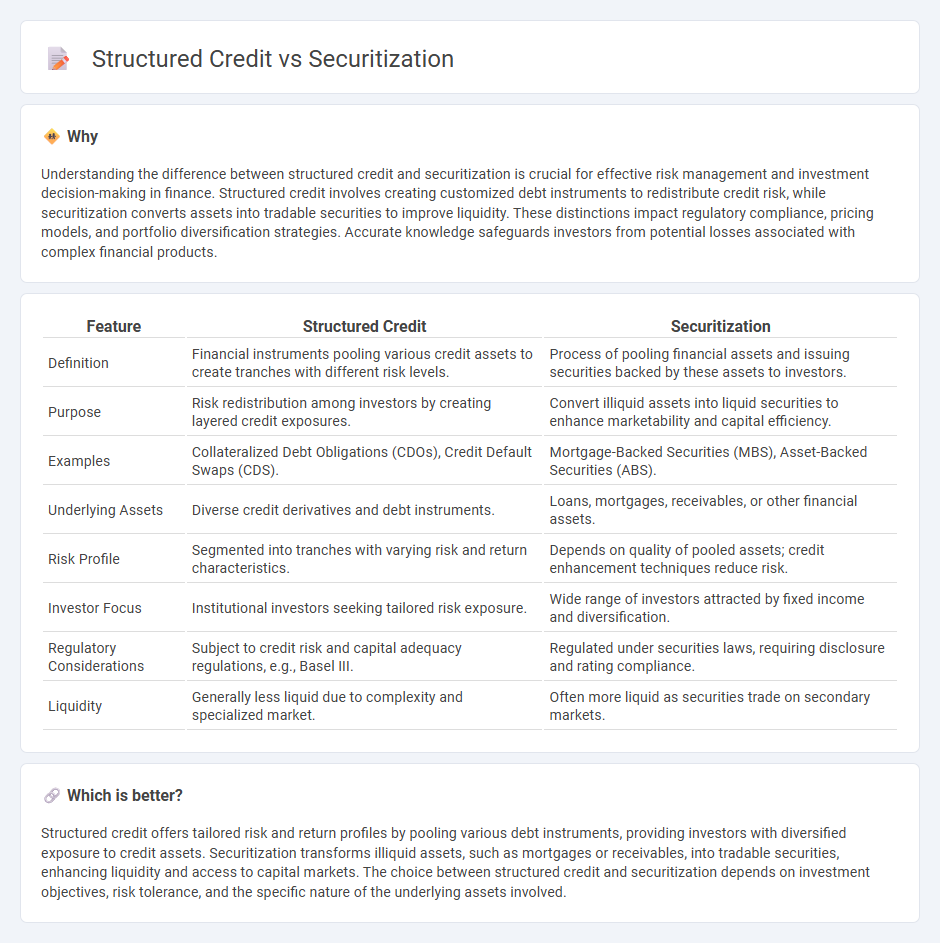

Understanding the difference between structured credit and securitization is crucial for effective risk management and investment decision-making in finance. Structured credit involves creating customized debt instruments to redistribute credit risk, while securitization converts assets into tradable securities to improve liquidity. These distinctions impact regulatory compliance, pricing models, and portfolio diversification strategies. Accurate knowledge safeguards investors from potential losses associated with complex financial products.

Comparison Table

| Feature | Structured Credit | Securitization |

|---|---|---|

| Definition | Financial instruments pooling various credit assets to create tranches with different risk levels. | Process of pooling financial assets and issuing securities backed by these assets to investors. |

| Purpose | Risk redistribution among investors by creating layered credit exposures. | Convert illiquid assets into liquid securities to enhance marketability and capital efficiency. |

| Examples | Collateralized Debt Obligations (CDOs), Credit Default Swaps (CDS). | Mortgage-Backed Securities (MBS), Asset-Backed Securities (ABS). |

| Underlying Assets | Diverse credit derivatives and debt instruments. | Loans, mortgages, receivables, or other financial assets. |

| Risk Profile | Segmented into tranches with varying risk and return characteristics. | Depends on quality of pooled assets; credit enhancement techniques reduce risk. |

| Investor Focus | Institutional investors seeking tailored risk exposure. | Wide range of investors attracted by fixed income and diversification. |

| Regulatory Considerations | Subject to credit risk and capital adequacy regulations, e.g., Basel III. | Regulated under securities laws, requiring disclosure and rating compliance. |

| Liquidity | Generally less liquid due to complexity and specialized market. | Often more liquid as securities trade on secondary markets. |

Which is better?

Structured credit offers tailored risk and return profiles by pooling various debt instruments, providing investors with diversified exposure to credit assets. Securitization transforms illiquid assets, such as mortgages or receivables, into tradable securities, enhancing liquidity and access to capital markets. The choice between structured credit and securitization depends on investment objectives, risk tolerance, and the specific nature of the underlying assets involved.

Connection

Structured credit involves pooling various debt instruments and slicing them into tranches with different risk levels, which are then sold to investors through the process of securitization. Securitization transforms illiquid assets like loans or receivables into tradable securities, enhancing liquidity and risk distribution in financial markets. This connection enables efficient capital flow, risk mitigation, and tailored investment opportunities within the finance sector.

Key Terms

Asset-backed Securities (ABS)

Asset-backed securities (ABS) are a core component of securitization, where financial assets like loans or receivables are pooled and repackaged into tradable instruments, offering diversified exposure and risk transfer. Structured credit involves complex financial products, including ABS, collateralized debt obligations (CDOs), and other derivatives that focus on credit risk management and enhancement through tranching and credit enhancements. Explore how ABS drive innovation in structured credit and risk allocation by learning more about their market dynamics and investment strategies.

Collateralized Debt Obligation (CDO)

Securitization involves pooling various financial assets like loans or receivables and issuing new securities backed by these pools, whereas structured credit specifically refers to the creation of complex financial instruments, with Collateralized Debt Obligations (CDOs) being a prime example that repackages different tranches of debt into tranches with varying risk and return profiles. CDOs aggregate diverse debt types such as mortgages, bonds, and loans into a single vehicle, enhancing liquidity and spreading credit risk while appealing to different investor risk appetites. Explore how the mechanisms of CDOs differ within securitization to gain a deeper understanding of structured credit markets.

Tranching

Securitization involves pooling various financial assets and dividing them into tranches with different risk and return profiles, allowing investors to select exposure according to their risk tolerance. Structured credit similarly uses tranching to allocate credit risk within complex debt instruments like collateralized loan obligations (CLOs) or collateralized debt obligations (CDOs), enhancing credit enhancement and investor targeting. Explore detailed comparisons on how tranching shapes risk distribution and investor appeal in both financial structures.

Source and External Links

Securitization - Wikipedia - Securitization is a financial practice that pools various types of contractual debt like mortgages, auto loans, or credit card debt and sells their related cash flows to investors as securities, which are repaid from the pooled debt's principal and interest payments, helping to mitigate individual credit risk through diversification and structured tranches.

Securitization (international relations) - Wikipedia - In international relations, securitization is the process by which state actors transform political issues into security concerns through speech acts that authorize extraordinary measures, contingent on the audience's acceptance regardless of the actual threat's presence.

Back to basics: What Is Securitization? - Finance & Development - Securitization involves pooling income-producing assets which are sold to a special purpose vehicle that issues tradable securities to investors, who receive payments funded by the asset cash flows, allowing the originator to remove assets from its balance sheet and transfer risk.

dowidth.com

dowidth.com