Revenue-based financing provides companies with capital repaid through a fixed percentage of ongoing revenue, offering flexible repayment without diluting equity. Mezzanine financing combines debt and equity features, typically involving subordinated loans with warrants or options, suitable for businesses seeking growth without immediate equity rounds. Discover detailed comparisons to determine which financing model aligns best with your company's strategic goals.

Why it is important

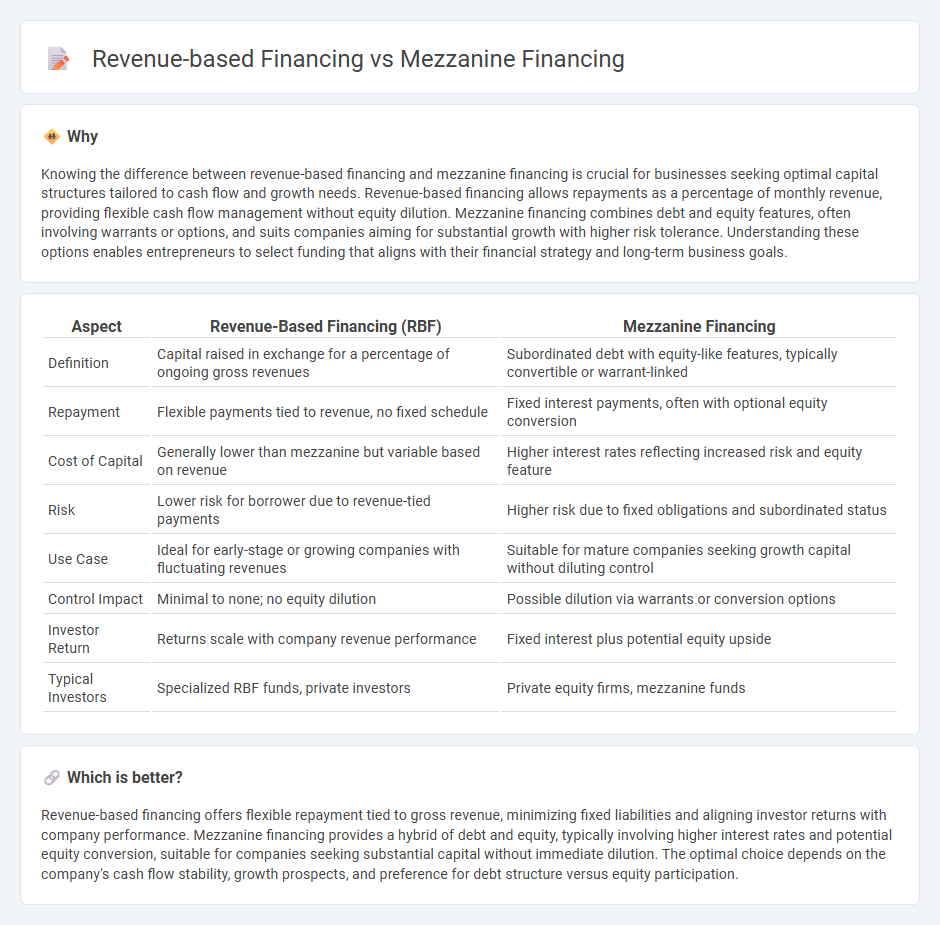

Knowing the difference between revenue-based financing and mezzanine financing is crucial for businesses seeking optimal capital structures tailored to cash flow and growth needs. Revenue-based financing allows repayments as a percentage of monthly revenue, providing flexible cash flow management without equity dilution. Mezzanine financing combines debt and equity features, often involving warrants or options, and suits companies aiming for substantial growth with higher risk tolerance. Understanding these options enables entrepreneurs to select funding that aligns with their financial strategy and long-term business goals.

Comparison Table

| Aspect | Revenue-Based Financing (RBF) | Mezzanine Financing |

|---|---|---|

| Definition | Capital raised in exchange for a percentage of ongoing gross revenues | Subordinated debt with equity-like features, typically convertible or warrant-linked |

| Repayment | Flexible payments tied to revenue, no fixed schedule | Fixed interest payments, often with optional equity conversion |

| Cost of Capital | Generally lower than mezzanine but variable based on revenue | Higher interest rates reflecting increased risk and equity feature |

| Risk | Lower risk for borrower due to revenue-tied payments | Higher risk due to fixed obligations and subordinated status |

| Use Case | Ideal for early-stage or growing companies with fluctuating revenues | Suitable for mature companies seeking growth capital without diluting control |

| Control Impact | Minimal to none; no equity dilution | Possible dilution via warrants or conversion options |

| Investor Return | Returns scale with company revenue performance | Fixed interest plus potential equity upside |

| Typical Investors | Specialized RBF funds, private investors | Private equity firms, mezzanine funds |

Which is better?

Revenue-based financing offers flexible repayment tied to gross revenue, minimizing fixed liabilities and aligning investor returns with company performance. Mezzanine financing provides a hybrid of debt and equity, typically involving higher interest rates and potential equity conversion, suitable for companies seeking substantial capital without immediate dilution. The optimal choice depends on the company's cash flow stability, growth prospects, and preference for debt structure versus equity participation.

Connection

Revenue-based financing and mezzanine financing both serve as hybrid funding solutions that blend elements of debt and equity to support business growth without immediate dilution of ownership. Revenue-based financing ties repayments directly to a company's revenue performance, providing flexible cash flow management, while mezzanine financing typically involves subordinated debt combined with equity warrants, offering higher returns to investors with increased risk. Both methods address the capital needs of expanding companies seeking alternative financing beyond traditional bank loans or pure equity investments.

Key Terms

Subordinated Debt

Mezzanine financing, a hybrid of debt and equity, is often structured as subordinated debt that ranks below senior loans but above equity in the capital stack, providing lenders with higher returns through interest and potential equity conversion. Revenue-based financing, typically non-dilutive and flexible, involves repayments tied to a fixed percentage of ongoing gross revenues without granting debt seniority, offering businesses growth-aligned payment schedules but less control over capital structure. Explore detailed comparisons of subordinated debt implications in mezzanine versus revenue-based financing for strategic funding decisions.

Equity Kicker

Mezzanine financing often includes an equity kicker, granting lenders the right to convert debt into equity or receive warrants, enhancing their potential returns beyond interest payments. Revenue-based financing typically lacks an equity kicker, instead providing investors with a fixed percentage of revenue until the agreed-upon return is achieved. Explore the nuances of equity kickers in these financing methods to determine the best fit for your capital strategy.

Revenue Share

Mezzanine financing involves debt that converts to equity if not repaid on time, often used by mature companies seeking growth capital without diluting ownership immediately. Revenue-based financing provides capital in exchange for a fixed percentage of ongoing gross revenues, making payments fluctuate with business performance and appealing to companies with consistent sales cycles. Explore more to understand which financing option aligns best with your revenue model and growth strategy.

Source and External Links

What is Mezzanine Financing | BDC.ca - Mezzanine financing is a hybrid of debt and equity financing that provides flexible repayment terms and ranks below secured debt in repayment priority, often used to fund acquisitions or growth without affecting debt-to-equity ratios.

Mezzanine Debt & Financing: The Complete Guide - Mezzanine debt bridges senior debt and equity, often used by companies to grow without diluting ownership, typically covering 5-25% of capital needs and ranking above equity but below senior loans.

Mezzanine Financing - Overview, Rate of Return, Benefits - It fills the capital gap between senior debt and equity, including interest and equity-like features such as warrants or conversion options, increasing total capital while providing tax-deductible interest payments.

dowidth.com

dowidth.com