Yield farming generates returns by staking cryptocurrencies in decentralized finance platforms, leveraging blockchain technology to earn interest or new tokens. Forex trading involves buying and selling currency pairs on global markets, focusing on exchange rate fluctuations to profit from price movements. Explore the key differences and benefits between yield farming and forex to optimize your financial strategy.

Why it is important

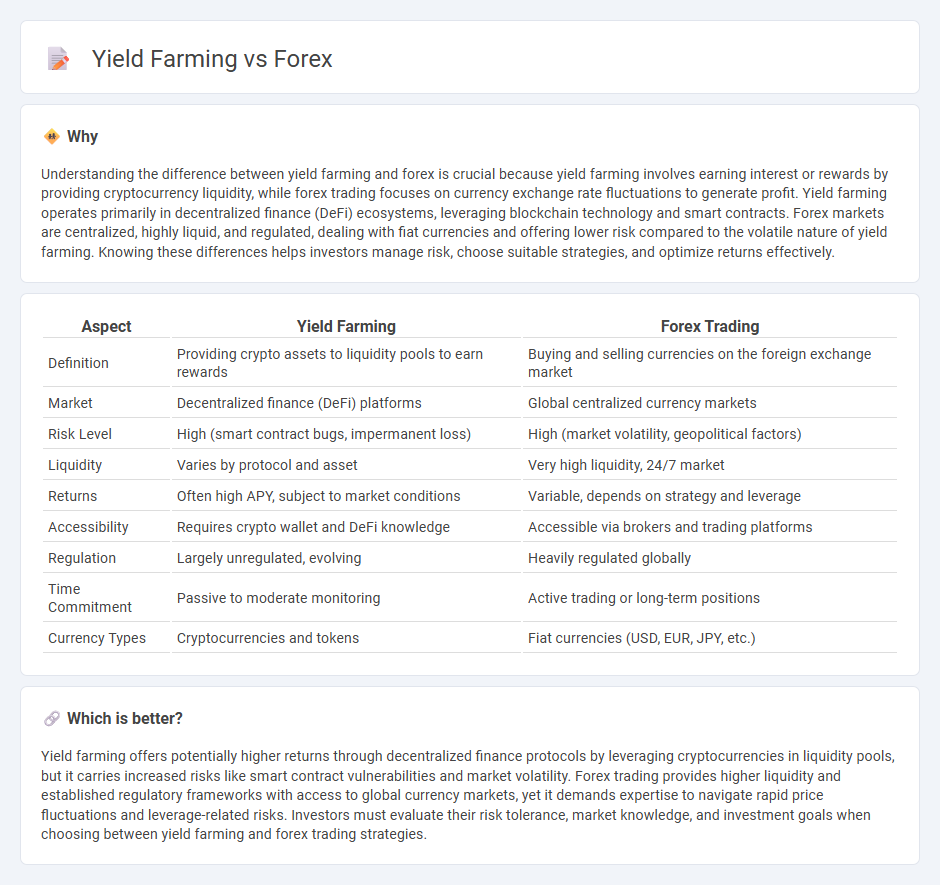

Understanding the difference between yield farming and forex is crucial because yield farming involves earning interest or rewards by providing cryptocurrency liquidity, while forex trading focuses on currency exchange rate fluctuations to generate profit. Yield farming operates primarily in decentralized finance (DeFi) ecosystems, leveraging blockchain technology and smart contracts. Forex markets are centralized, highly liquid, and regulated, dealing with fiat currencies and offering lower risk compared to the volatile nature of yield farming. Knowing these differences helps investors manage risk, choose suitable strategies, and optimize returns effectively.

Comparison Table

| Aspect | Yield Farming | Forex Trading |

|---|---|---|

| Definition | Providing crypto assets to liquidity pools to earn rewards | Buying and selling currencies on the foreign exchange market |

| Market | Decentralized finance (DeFi) platforms | Global centralized currency markets |

| Risk Level | High (smart contract bugs, impermanent loss) | High (market volatility, geopolitical factors) |

| Liquidity | Varies by protocol and asset | Very high liquidity, 24/7 market |

| Returns | Often high APY, subject to market conditions | Variable, depends on strategy and leverage |

| Accessibility | Requires crypto wallet and DeFi knowledge | Accessible via brokers and trading platforms |

| Regulation | Largely unregulated, evolving | Heavily regulated globally |

| Time Commitment | Passive to moderate monitoring | Active trading or long-term positions |

| Currency Types | Cryptocurrencies and tokens | Fiat currencies (USD, EUR, JPY, etc.) |

Which is better?

Yield farming offers potentially higher returns through decentralized finance protocols by leveraging cryptocurrencies in liquidity pools, but it carries increased risks like smart contract vulnerabilities and market volatility. Forex trading provides higher liquidity and established regulatory frameworks with access to global currency markets, yet it demands expertise to navigate rapid price fluctuations and leverage-related risks. Investors must evaluate their risk tolerance, market knowledge, and investment goals when choosing between yield farming and forex trading strategies.

Connection

Yield farming and forex trading share a common foundation in leveraging market opportunities to maximize returns, with yield farming utilizing decentralized finance (DeFi) protocols to earn interest or tokens by providing liquidity, while forex trading involves buying and selling currency pairs to profit from exchange rate fluctuations. Both strategies depend on market volatility and liquidity, where forex markets offer high liquidity and frequent price movements, and yield farming rewards liquidity providers with native tokens or interest generated from trading fees. Risk management techniques, such as diversifying positions and monitoring market conditions, are crucial in both realms to optimize returns and mitigate potential losses.

Key Terms

Exchange Rate

Forex trading involves exchanging one currency for another at current exchange rates, seeking profit from fluctuations in currency values driven by economic indicators and geopolitical events. Yield farming, while primarily centered on cryptocurrency, relies on exchange rates between tokens to maximize returns by locking assets in DeFi protocols. Explore detailed insights on how exchange rates impact forex and yield farming strategies to optimize your financial decisions.

Liquidity Pool

Forex trading involves currency exchange markets with varying liquidity levels influenced by global economic factors, while yield farming depends on liquidity pools within decentralized finance (DeFi) platforms that aggregate tokens to facilitate smart contract operations and earn rewards. Liquidity pools in yield farming provide simultaneous asset availability, reducing slippage and enabling passive income through transaction fees and incentives, whereas forex relies on market depth and trading volume for liquidity. Explore detailed insights on liquidity pool mechanics and strategies to maximize returns in both forex and yield farming ecosystems.

Leverage

Leverage in forex trading allows investors to control large positions with a small amount of capital, often reaching ratios of 100:1 or higher, amplifying both potential gains and risks. Yield farming leverage typically involves borrowing assets to increase liquidity provision in DeFi platforms, magnifying yields but exposing investors to liquidation risks and volatile interest rates. Explore deeper insights into managing leverage strategies effectively in forex and yield farming for optimized returns.

Source and External Links

What is Forex and Why Trade It? - FOREX.com US - Forex trading involves buying and selling currencies in pairs, with prices determined by interbank trading globally 24 hours a day during market hours, allowing traders to speculate on currency strength and weakness.

What is Forex (FX) Trading and How Does it Work? - IG - Forex trading is the exchange of one currency for another, with traders buying or selling currency pairs based on expected price movements, and profiting from changes in exchange rates minus the spread between buy and sell prices.

Foreign exchange market - Wikipedia - The foreign exchange market is a global decentralized market for trading currencies including spot and forward transactions, enabling currency exchange at current or pre-agreed future rates.

dowidth.com

dowidth.com