Exit planning focuses on preparing a business owner's strategy for selling, transferring, or closing a company to maximize value and ensure a smooth transition. Turnaround strategy targets reversing a company's decline by restructuring operations, improving cash flow, and stabilizing financial health. Explore effective methods to choose the right approach for your business challenges.

Why it is important

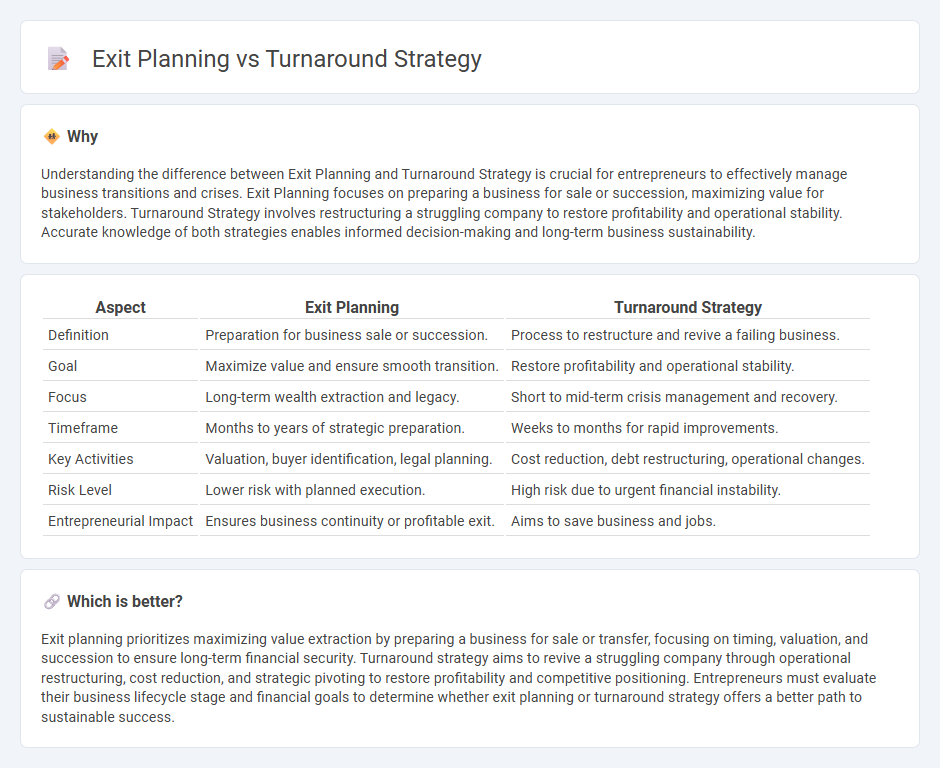

Understanding the difference between Exit Planning and Turnaround Strategy is crucial for entrepreneurs to effectively manage business transitions and crises. Exit Planning focuses on preparing a business for sale or succession, maximizing value for stakeholders. Turnaround Strategy involves restructuring a struggling company to restore profitability and operational stability. Accurate knowledge of both strategies enables informed decision-making and long-term business sustainability.

Comparison Table

| Aspect | Exit Planning | Turnaround Strategy |

|---|---|---|

| Definition | Preparation for business sale or succession. | Process to restructure and revive a failing business. |

| Goal | Maximize value and ensure smooth transition. | Restore profitability and operational stability. |

| Focus | Long-term wealth extraction and legacy. | Short to mid-term crisis management and recovery. |

| Timeframe | Months to years of strategic preparation. | Weeks to months for rapid improvements. |

| Key Activities | Valuation, buyer identification, legal planning. | Cost reduction, debt restructuring, operational changes. |

| Risk Level | Lower risk with planned execution. | High risk due to urgent financial instability. |

| Entrepreneurial Impact | Ensures business continuity or profitable exit. | Aims to save business and jobs. |

Which is better?

Exit planning prioritizes maximizing value extraction by preparing a business for sale or transfer, focusing on timing, valuation, and succession to ensure long-term financial security. Turnaround strategy aims to revive a struggling company through operational restructuring, cost reduction, and strategic pivoting to restore profitability and competitive positioning. Entrepreneurs must evaluate their business lifecycle stage and financial goals to determine whether exit planning or turnaround strategy offers a better path to sustainable success.

Connection

Exit planning and turnaround strategy are interconnected as both focus on maximizing business value during critical transitions. Exit planning prepares entrepreneurs for a successful departure by enhancing operational efficiency and financial health, often addressed through turnaround strategies aimed at reversing decline. Effective turnaround measures stabilize performance, thereby improving exit opportunities and valuation for stakeholders.

Key Terms

Restructuring

Turnaround strategy centers on restructuring operations to restore financial stability and improve profitability by addressing inefficiencies and reducing costs. Exit planning involves preparing a business for sale or transfer, often optimizing its value through strategic restructuring and operational improvements. Explore more to understand how tailored restructuring can facilitate successful turnaround or exit outcomes.

Divestiture

A turnaround strategy targets improving a struggling company's performance through operational restructuring, cost reduction, and asset optimization to restore profitability. Exit planning emphasizes strategically divesting assets or business units to maximize value realization and facilitate a smooth transition for stakeholders. Explore effective divestiture approaches to balance revitalization efforts with successful exit outcomes.

Valuation

Turnaround strategy centers on improving a struggling company's financial health to maximize its valuation through operational restructuring and cost optimization. Exit planning emphasizes strategically preparing a business for sale or transfer, enhancing its market value by addressing legal, financial, and organizational factors. Discover how mastering these approaches can significantly impact your business valuation and exit outcomes.

Source and External Links

Implementing turnaround strategies as an entrepreneurial process - A turnaround strategy consists of sequential management moves including situation analysis, leadership changes, cost reductions, asset sales, financial restructuring, and strategic redevelopment to restore profitability and improve liquidity and operating costs in struggling companies.

Righting the Ship - Four Phases of a Financial Turnaround Strategy - Effective turnaround strategies progress through crisis stabilization, leadership improvement, strategic realignment, organizational change, streamlining processes, and financial restructuring to recover business performance and restore stakeholder confidence.

Turnaround Recovery Strategies - Overview, Types, Examples - Turnaround strategies often involve focusing on core profitable activities, replacing top executives to inject new management perspective, cost-efficiency improvements, and restructuring operations, as illustrated by Harley-Davidson's response to the 2008 mortgage crisis.

dowidth.com

dowidth.com