Passive income streams generate earnings through various activities such as rental properties, online businesses, or royalties, providing financial flexibility and independence. Dividend investing focuses on acquiring stocks that regularly distribute company profits to shareholders, offering steady cash flow and the potential for capital appreciation. Discover how aligning these strategies can enhance your entrepreneurial success and financial growth.

Why it is important

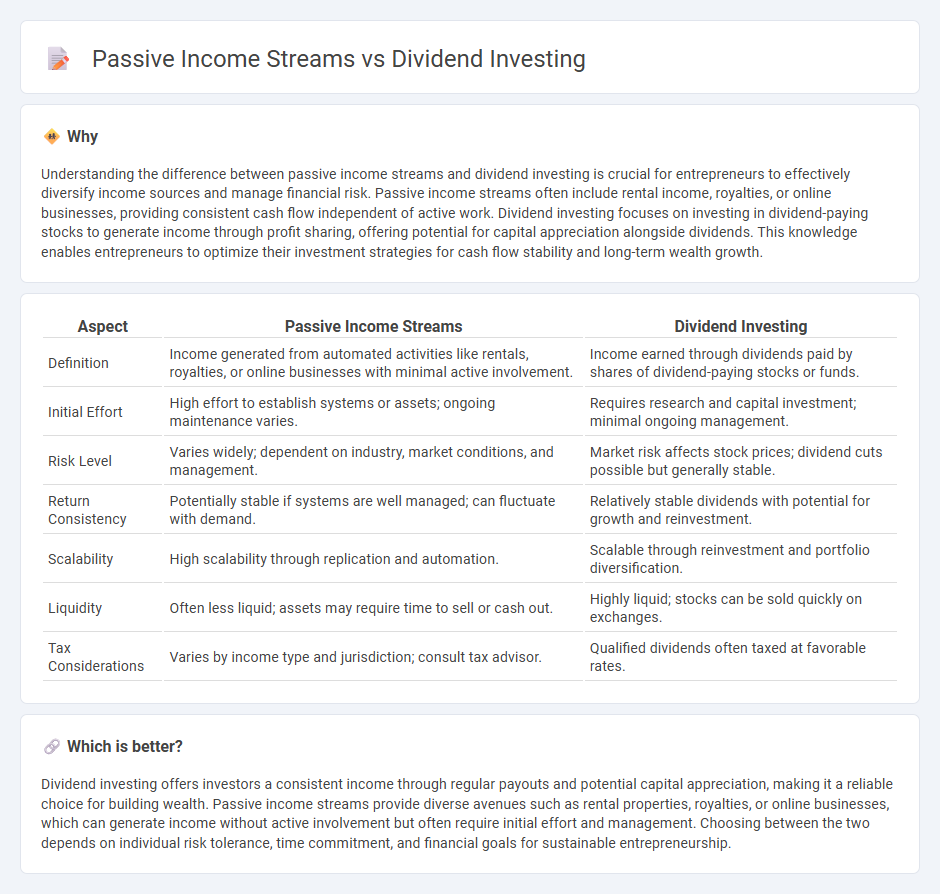

Understanding the difference between passive income streams and dividend investing is crucial for entrepreneurs to effectively diversify income sources and manage financial risk. Passive income streams often include rental income, royalties, or online businesses, providing consistent cash flow independent of active work. Dividend investing focuses on investing in dividend-paying stocks to generate income through profit sharing, offering potential for capital appreciation alongside dividends. This knowledge enables entrepreneurs to optimize their investment strategies for cash flow stability and long-term wealth growth.

Comparison Table

| Aspect | Passive Income Streams | Dividend Investing |

|---|---|---|

| Definition | Income generated from automated activities like rentals, royalties, or online businesses with minimal active involvement. | Income earned through dividends paid by shares of dividend-paying stocks or funds. |

| Initial Effort | High effort to establish systems or assets; ongoing maintenance varies. | Requires research and capital investment; minimal ongoing management. |

| Risk Level | Varies widely; dependent on industry, market conditions, and management. | Market risk affects stock prices; dividend cuts possible but generally stable. |

| Return Consistency | Potentially stable if systems are well managed; can fluctuate with demand. | Relatively stable dividends with potential for growth and reinvestment. |

| Scalability | High scalability through replication and automation. | Scalable through reinvestment and portfolio diversification. |

| Liquidity | Often less liquid; assets may require time to sell or cash out. | Highly liquid; stocks can be sold quickly on exchanges. |

| Tax Considerations | Varies by income type and jurisdiction; consult tax advisor. | Qualified dividends often taxed at favorable rates. |

Which is better?

Dividend investing offers investors a consistent income through regular payouts and potential capital appreciation, making it a reliable choice for building wealth. Passive income streams provide diverse avenues such as rental properties, royalties, or online businesses, which can generate income without active involvement but often require initial effort and management. Choosing between the two depends on individual risk tolerance, time commitment, and financial goals for sustainable entrepreneurship.

Connection

Passive income streams often include dividend investing, where investors receive regular payments from shares without active management. Dividend investing provides a steady cash flow that entrepreneurs can reinvest into new ventures, enhancing financial stability and growth potential. This connection allows entrepreneurs to leverage passive income for sustained business expansion and diversification.

Key Terms

Dividend Yield

Dividend investing offers a focused approach to generating passive income by targeting stocks with high dividend yields, providing consistent cash flow through regular payouts. This strategy emphasizes selecting reliable companies with strong dividend histories, allowing investors to benefit from both capital appreciation and income generation. Explore more about optimizing your portfolio for dividend yield to maximize passive income streams.

Portfolio Diversification

Dividend investing enhances portfolio diversification by providing steady income through shares of companies with consistent payout histories, reducing reliance on capital gains alone. Passive income streams, such as rental properties or online businesses, spread financial risk across various asset classes and revenue sources beyond traditional markets. Explore comprehensive strategies to optimize your portfolio diversification and maximize your investment returns.

Cash Flow

Dividend investing generates consistent cash flow through regular payouts from shares in stable companies, offering predictable income streams. Passive income streams encompass a broader range of sources like rental properties, royalties, and online businesses, which may yield variable cash flow but diversify risk. Explore the unique advantages and strategies of each to maximize your cash flow potential.

Source and External Links

Is Dividend Investing Worth It? The Complete Guide - Dividend investing is a strategy focused on buying stocks that pay regular dividends, providing steady income through earnings distributions, and appealing to those seeking financial stability and growth.

How to Develop a Dividend Investing Strategy - VanEck - Dividend investing involves acquiring stocks that pay consistent dividends and can follow strategies like dividend growth, dividend value, or high-yield investing, each with different risk and return profiles.

What is Dividend Investing & Qualified Dividends | Equifax - Dividend investing entails buying stocks from companies that distribute portions of their profits regularly, with returns coming from both dividend payments and potential capital appreciation.

dowidth.com

dowidth.com