Acquihires involve companies purchasing startups primarily to gain access to their talented teams, rapidly enhancing human capital and innovation capabilities within the acquiring firm. Accelerators, on the other hand, provide early-stage startups with mentorship, funding, and resources to accelerate their growth and market readiness in exchange for equity. Explore the distinct advantages and strategic impacts of acquihires versus accelerators to determine the best growth path for your entrepreneurial venture.

Why it is important

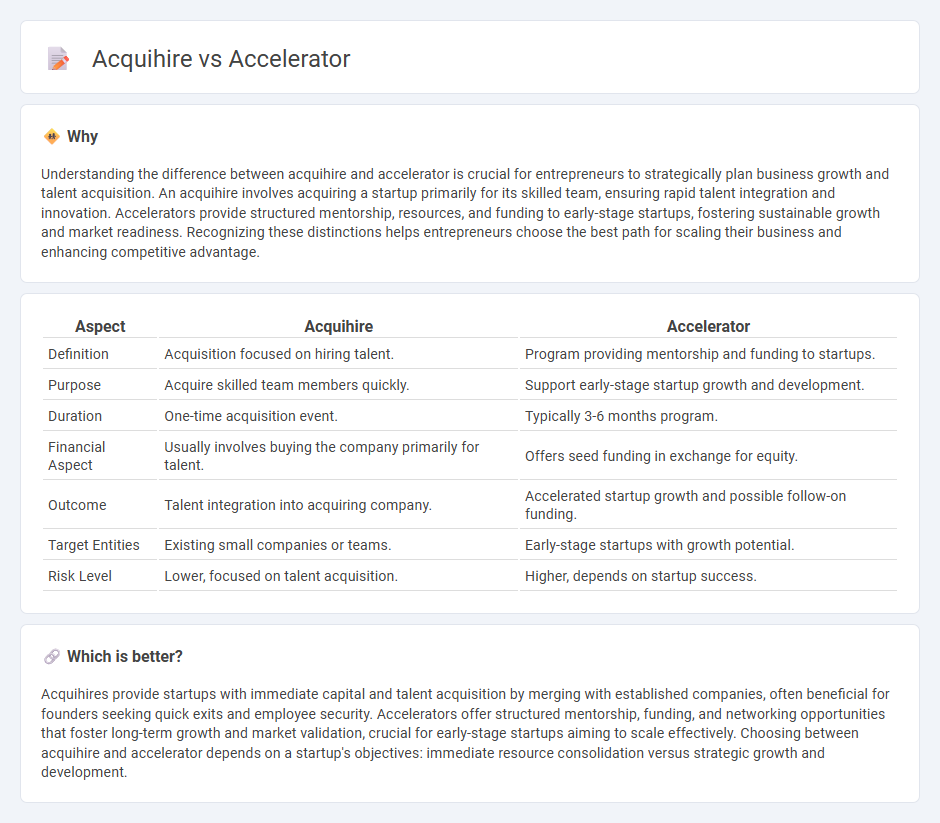

Understanding the difference between acquihire and accelerator is crucial for entrepreneurs to strategically plan business growth and talent acquisition. An acquihire involves acquiring a startup primarily for its skilled team, ensuring rapid talent integration and innovation. Accelerators provide structured mentorship, resources, and funding to early-stage startups, fostering sustainable growth and market readiness. Recognizing these distinctions helps entrepreneurs choose the best path for scaling their business and enhancing competitive advantage.

Comparison Table

| Aspect | Acquihire | Accelerator |

|---|---|---|

| Definition | Acquisition focused on hiring talent. | Program providing mentorship and funding to startups. |

| Purpose | Acquire skilled team members quickly. | Support early-stage startup growth and development. |

| Duration | One-time acquisition event. | Typically 3-6 months program. |

| Financial Aspect | Usually involves buying the company primarily for talent. | Offers seed funding in exchange for equity. |

| Outcome | Talent integration into acquiring company. | Accelerated startup growth and possible follow-on funding. |

| Target Entities | Existing small companies or teams. | Early-stage startups with growth potential. |

| Risk Level | Lower, focused on talent acquisition. | Higher, depends on startup success. |

Which is better?

Acquihires provide startups with immediate capital and talent acquisition by merging with established companies, often beneficial for founders seeking quick exits and employee security. Accelerators offer structured mentorship, funding, and networking opportunities that foster long-term growth and market validation, crucial for early-stage startups aiming to scale effectively. Choosing between acquihire and accelerator depends on a startup's objectives: immediate resource consolidation versus strategic growth and development.

Connection

Acquihires occur when companies purchase startups primarily to recruit their talented teams, often accelerating innovation and growth. Accelerators support early-stage startups by providing mentorship, resources, and funding to scale quickly. The connection lies in accelerators refining startups into attractive acquihire candidates for larger corporations seeking skilled entrepreneurs and innovative technologies.

Key Terms

Startup Growth

Accelerators provide structured programs offering funding, mentorship, and resources to rapidly scale startups through defined milestones and networking opportunities. Acquihires focus on acquiring startups primarily for their talent, integrating skilled teams into the acquiring company without prioritizing the startup's market growth or products. Explore the strategic advantages of accelerators and acquihires to determine the best growth path for your startup.

Talent Acquisition

Accelerators provide startups with mentorship, resources, and funding to rapidly scale their businesses, emphasizing growth and market validation. Acquihires focus primarily on talent acquisition by purchasing startups to integrate skilled teams into larger companies, often prioritizing expertise over product continuation. Explore the strategic benefits and implications of both models to optimize your talent acquisition approach.

Exit Strategy

Accelerators provide startups with mentorship, funding, and resources to scale rapidly, often culminating in a clear exit strategy through venture capital investments or public offerings. Acquihires prioritize talent acquisition by larger companies acquiring startups primarily for their skilled teams, focusing on integration rather than immediate financial exits. Explore detailed comparisons to understand which exit strategy aligns best with your startup's growth objectives.

Source and External Links

DOE Explains...Particle Accelerators - Department of Energy - Particle accelerators are devices that speed up particles to high energies for collisions or targeting, used in physics research at major labs like Fermilab and Brookhaven.

Accelerator - Wikipedia - "Accelerator" broadly refers to devices or substances that increase speed or reaction rates, including particle accelerators, gas pedals, startup accelerators, and more.

Accelerators | CERN - Accelerators are machines that propel charged particles near the speed of light for scientific experiments in particle physics, fundamental to CERN's research.

dowidth.com

dowidth.com