Exit planning focuses on preparing business owners for a successful transition or sale of their company, maximizing value and ensuring continuity. Strategic alliances involve partnerships between businesses to leverage resources, expand market reach, and drive growth without full ownership transfer. Discover more about how these distinct approaches can shape entrepreneurial success.

Why it is important

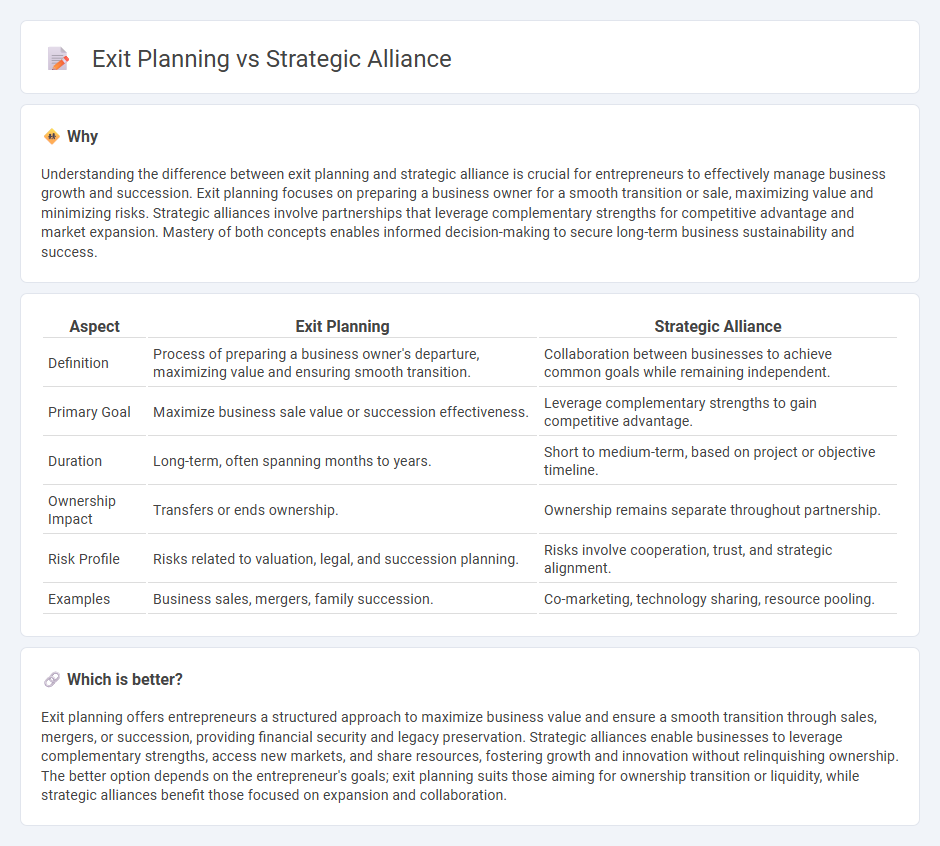

Understanding the difference between exit planning and strategic alliance is crucial for entrepreneurs to effectively manage business growth and succession. Exit planning focuses on preparing a business owner for a smooth transition or sale, maximizing value and minimizing risks. Strategic alliances involve partnerships that leverage complementary strengths for competitive advantage and market expansion. Mastery of both concepts enables informed decision-making to secure long-term business sustainability and success.

Comparison Table

| Aspect | Exit Planning | Strategic Alliance |

|---|---|---|

| Definition | Process of preparing a business owner's departure, maximizing value and ensuring smooth transition. | Collaboration between businesses to achieve common goals while remaining independent. |

| Primary Goal | Maximize business sale value or succession effectiveness. | Leverage complementary strengths to gain competitive advantage. |

| Duration | Long-term, often spanning months to years. | Short to medium-term, based on project or objective timeline. |

| Ownership Impact | Transfers or ends ownership. | Ownership remains separate throughout partnership. |

| Risk Profile | Risks related to valuation, legal, and succession planning. | Risks involve cooperation, trust, and strategic alignment. |

| Examples | Business sales, mergers, family succession. | Co-marketing, technology sharing, resource pooling. |

Which is better?

Exit planning offers entrepreneurs a structured approach to maximize business value and ensure a smooth transition through sales, mergers, or succession, providing financial security and legacy preservation. Strategic alliances enable businesses to leverage complementary strengths, access new markets, and share resources, fostering growth and innovation without relinquishing ownership. The better option depends on the entrepreneur's goals; exit planning suits those aiming for ownership transition or liquidity, while strategic alliances benefit those focused on expansion and collaboration.

Connection

Exit planning is essential in entrepreneurship to maximize the value of a business sale or transfer, while strategic alliances enhance a company's market position and operational capabilities, increasing its attractiveness to potential buyers. Effective strategic alliances can streamline exit planning by building robust networks, sharing resources, and expanding market reach, ultimately boosting business valuation. Entrepreneurs leveraging strategic alliances create more viable and scalable exit options, ensuring smoother transitions and greater financial returns.

Key Terms

Collaboration

Strategic alliances leverage collaborative partnerships between companies to share resources, expertise, and markets, driving mutual growth without full mergers or acquisitions. Exit planning involves preparing a business for ownership transition or sale, often prioritizing value maximization and smooth handovers over ongoing cooperation. Explore how collaboration enhances strategic alliances and informs exit strategies for sustainable business success.

Partnership

Strategic alliances involve forming partnerships to leverage complementary strengths, share resources, and achieve mutual growth without full business integration. Exit planning focuses on preparing a business owner's transition out of ownership, often through selling or handing over the enterprise, which may include establishing partnerships to maximize value. Discover more about how these approaches impact partnership dynamics and business continuity.

Divestiture

Strategic alliances enable companies to collaborate on joint ventures or projects, preserving ownership while sharing risks and resources, whereas exit planning through divestiture involves selling or spinning off business units to optimize portfolio value and focus on core operations. Divestiture as an exit strategy can improve financial performance by reallocating capital and streamlining organizational structure. Discover how strategic alliances and divestiture-driven exit planning can be leveraged to achieve your business growth and transformation goals.

Source and External Links

Strategic alliance - Wikipedia - A strategic alliance is a cooperative agreement between independent organizations to pursue shared objectives while remaining autonomous, often involving resource sharing, technology transfer, and shared risks without forming a legal partnership entity.

Types and Benefits of Strategic Alliances - Corporate Finance Institute - Strategic alliances are formal agreements between independent companies to collaborate on manufacturing, development, or sales, including joint ventures, equity alliances, and non-equity alliances as common types.

Strategic Alliances: Definition, Types, Benefits And Drawbacks - Indeed - Strategic alliances enable companies to work jointly to achieve mutual goals while remaining separate entities, enhancing market reach, sharing resources, and gaining competitive advantages without merging.

dowidth.com

dowidth.com