Entrepreneurship involves understanding the distinction between passive income streams, such as rental properties or affiliate marketing, and active income streams, like freelance consulting or retail sales. Passive income generates revenue with minimal ongoing effort, while active income requires continuous work to maintain cash flow. Explore these income models further to optimize your entrepreneurial strategy.

Why it is important

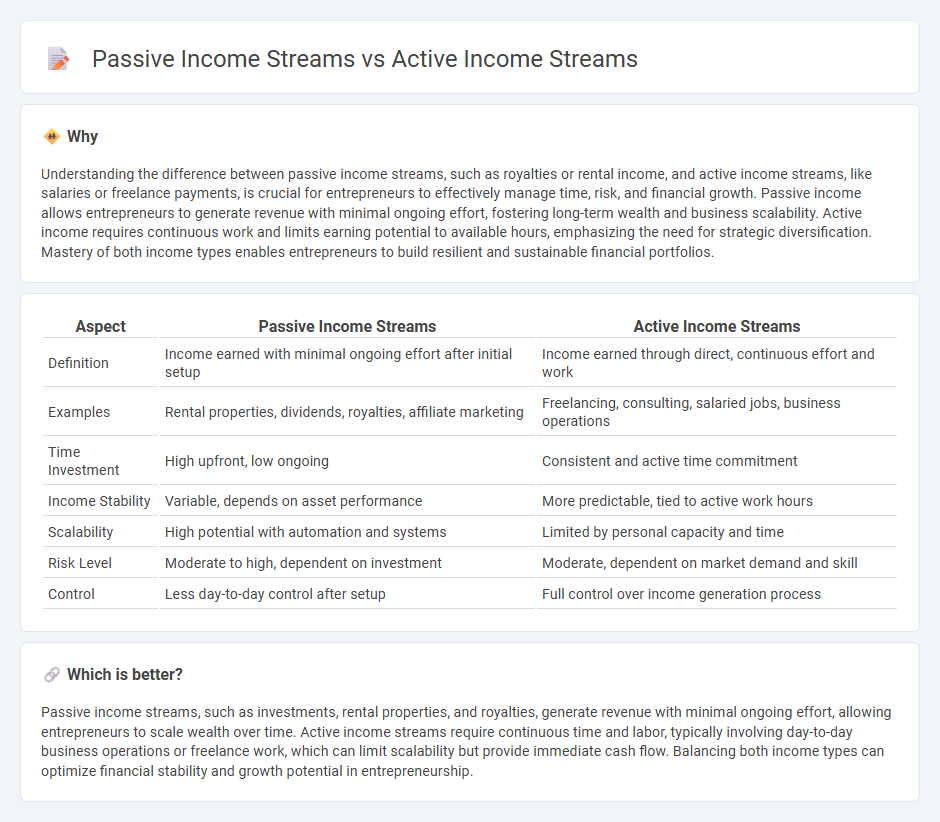

Understanding the difference between passive income streams, such as royalties or rental income, and active income streams, like salaries or freelance payments, is crucial for entrepreneurs to effectively manage time, risk, and financial growth. Passive income allows entrepreneurs to generate revenue with minimal ongoing effort, fostering long-term wealth and business scalability. Active income requires continuous work and limits earning potential to available hours, emphasizing the need for strategic diversification. Mastery of both income types enables entrepreneurs to build resilient and sustainable financial portfolios.

Comparison Table

| Aspect | Passive Income Streams | Active Income Streams |

|---|---|---|

| Definition | Income earned with minimal ongoing effort after initial setup | Income earned through direct, continuous effort and work |

| Examples | Rental properties, dividends, royalties, affiliate marketing | Freelancing, consulting, salaried jobs, business operations |

| Time Investment | High upfront, low ongoing | Consistent and active time commitment |

| Income Stability | Variable, depends on asset performance | More predictable, tied to active work hours |

| Scalability | High potential with automation and systems | Limited by personal capacity and time |

| Risk Level | Moderate to high, dependent on investment | Moderate, dependent on market demand and skill |

| Control | Less day-to-day control after setup | Full control over income generation process |

Which is better?

Passive income streams, such as investments, rental properties, and royalties, generate revenue with minimal ongoing effort, allowing entrepreneurs to scale wealth over time. Active income streams require continuous time and labor, typically involving day-to-day business operations or freelance work, which can limit scalability but provide immediate cash flow. Balancing both income types can optimize financial stability and growth potential in entrepreneurship.

Connection

Passive income streams complement active income streams by providing financial stability and diversification, reducing reliance on a single source of earnings. Entrepreneurs leverage active income to invest in assets such as rental properties, dividends, or online businesses that generate passive income over time. This strategic balance enhances cash flow, allowing reinvestment into active ventures for sustained business growth and risk management.

Key Terms

Time Investment

Active income streams require continuous time investment, as earnings depend on direct involvement or labor, such as freelance work or hourly jobs. Passive income streams generate revenue with minimal ongoing effort, often stemming from assets like rental properties, dividends, or royalties. Explore detailed strategies to maximize your earnings while balancing time commitment.

Scalability

Active income streams require continuous effort and time investment, often limiting scalability due to the finite number of hours available. Passive income streams, such as royalties, rental income, or online courses, offer higher scalability by generating revenue with minimal ongoing involvement. Explore effective strategies to maximize income scalability through passive streams.

Automation

Active income streams require continuous effort and time investment, such as freelancing or consulting, where earnings directly correlate with work hours. Passive income streams leverage automation through mechanisms like affiliate marketing, rental properties managed by property managers, or dividend-paying stocks, enabling earnings with minimal ongoing involvement. Explore strategies to automate income generation and maximize financial freedom.

Source and External Links

Passive vs. Active Income: Key Insights for Investors - Active income is earned through direct involvement and continuous effort, including sources like salaries, freelancing, business ownership, and active trading.

Blending Passive and Active Income Streams: The Key to ... - Active income requires direct participation, such as earnings from jobs, side hustles, or managing a business, and is fundamental for financial livelihood.

25 Passive Income Ideas To Make Extra Money In 2025 - Examples of active income include running a business or side hustles where ongoing effort is required, contrasting with passive income which needs minimal daily effort.

dowidth.com

dowidth.com