Bootstrapped SaaS companies grow using personal savings and revenue reinvestment, focusing on profitability and sustainable scaling without external equity dilution. Venture-funded SaaS startups secure capital from investors to accelerate growth, prioritize rapid market expansion, and often accept higher risk for larger returns. Explore the key differences between bootstrapped and venture-funded SaaS models to determine the best path for your entrepreneurial journey.

Why it is important

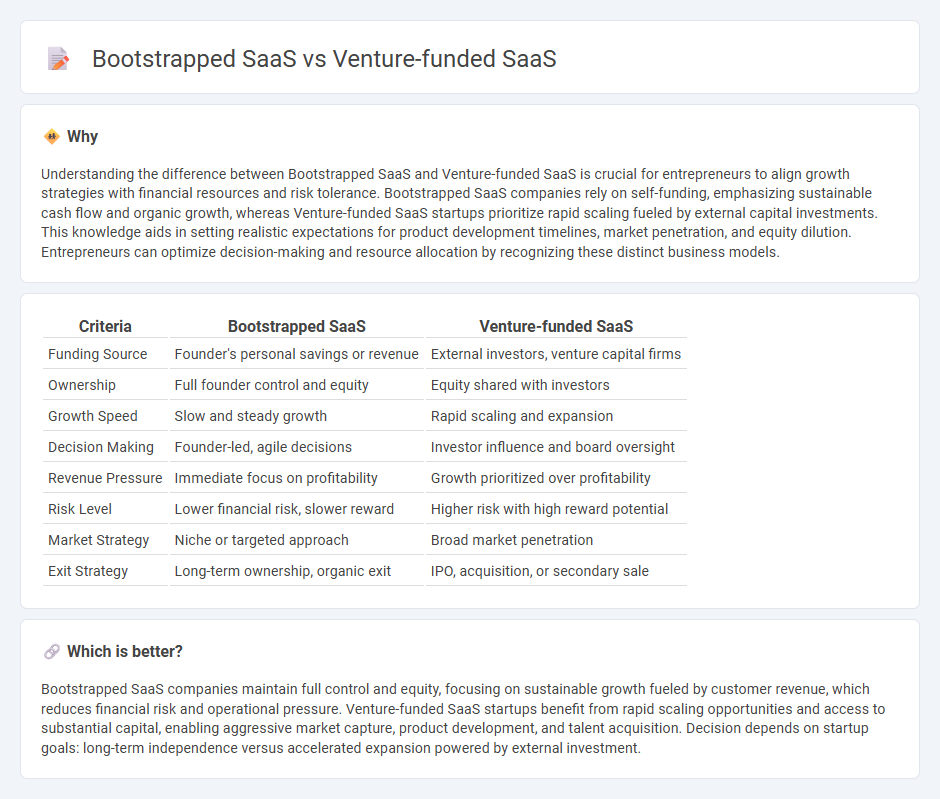

Understanding the difference between Bootstrapped SaaS and Venture-funded SaaS is crucial for entrepreneurs to align growth strategies with financial resources and risk tolerance. Bootstrapped SaaS companies rely on self-funding, emphasizing sustainable cash flow and organic growth, whereas Venture-funded SaaS startups prioritize rapid scaling fueled by external capital investments. This knowledge aids in setting realistic expectations for product development timelines, market penetration, and equity dilution. Entrepreneurs can optimize decision-making and resource allocation by recognizing these distinct business models.

Comparison Table

| Criteria | Bootstrapped SaaS | Venture-funded SaaS |

|---|---|---|

| Funding Source | Founder's personal savings or revenue | External investors, venture capital firms |

| Ownership | Full founder control and equity | Equity shared with investors |

| Growth Speed | Slow and steady growth | Rapid scaling and expansion |

| Decision Making | Founder-led, agile decisions | Investor influence and board oversight |

| Revenue Pressure | Immediate focus on profitability | Growth prioritized over profitability |

| Risk Level | Lower financial risk, slower reward | Higher risk with high reward potential |

| Market Strategy | Niche or targeted approach | Broad market penetration |

| Exit Strategy | Long-term ownership, organic exit | IPO, acquisition, or secondary sale |

Which is better?

Bootstrapped SaaS companies maintain full control and equity, focusing on sustainable growth fueled by customer revenue, which reduces financial risk and operational pressure. Venture-funded SaaS startups benefit from rapid scaling opportunities and access to substantial capital, enabling aggressive market capture, product development, and talent acquisition. Decision depends on startup goals: long-term independence versus accelerated expansion powered by external investment.

Connection

Bootstrapped SaaS companies rely on internal cash flow and customer funding, fostering sustainable growth and operational efficiency, while venture-funded SaaS startups benefit from significant capital injections to accelerate market penetration and product development. Both models engage in iterative innovation cycles and customer-centric product refinement, driving the SaaS industry forward through different strategic approaches. The connection lies in their shared focus on scalable software solutions and metrics like Monthly Recurring Revenue (MRR) and Customer Acquisition Cost (CAC) to optimize growth trajectories.

Key Terms

Equity Dilution

Venture-funded SaaS companies often experience significant equity dilution as they raise multiple funding rounds to scale rapidly, sacrificing ownership stakes to external investors. Bootstrapped SaaS businesses maintain full control and avoid dilution by reinvesting profits and growing organically, though this approach may limit access to substantial capital for faster expansion. Explore in-depth how equity dilution impacts founders' control and long-term value in different SaaS funding models.

Capital Efficiency

Venture-funded SaaS companies often prioritize rapid growth, leveraging substantial external capital to scale operations, invest in customer acquisition, and accelerate product development. Bootstrapped SaaS businesses emphasize capital efficiency by carefully managing expenses and maintaining profitability without relying on outside funding, often resulting in slower but sustainable growth. Explore detailed strategies and metrics to optimize capital efficiency in both venture-funded and bootstrapped SaaS models.

Growth Trajectory

Venture-funded SaaS companies often experience rapid growth trajectories driven by significant capital investments, enabling aggressive market expansion and accelerated product development. Bootstrapped SaaS businesses prioritize sustainable growth, focusing on profitability and organic scaling without external funding pressures. Explore the detailed strategies and long-term impacts on growth trajectories to understand which model suits your SaaS venture.

Source and External Links

What is SaaS Venture Capital (VC)? Risks and Alternatives - Venture capital funding for SaaS companies involves equity investments in high-growth startups, attracted by SaaS's scalability, recurring revenue, and capital efficiency, with $92.6 billion invested globally in 2024; VCs prefer SaaS firms demonstrating strong customer focus and consistent growth.

28 VC Firms That Invest in US Based SaaS Businesses - Leading VC firms like Accel Partners, Forum Ventures, and Insight Partners provide funding at various stages from pre-seed to growth for SaaS startups, often offering mentorship and community support alongside capital, specializing in diverse SaaS segments including B2B, vertical SaaS, and applied AI.

7 top venture capital firms that invest in SaaS - The SaaS investment landscape is characterized by a $92.6 billion VC inflow in 2024 and diverse investment strategies by top VC firms such as Tiger Global, Sequoia Capital, and Andreessen Horowitz, focusing on different stages from pre-seed to late growth with strong relationship management and data-driven evaluation approaches.

dowidth.com

dowidth.com