Sweat equity marketplaces provide startups with a platform to exchange skills and labor for ownership stakes, enabling entrepreneurs to fund their ventures without immediate cash investment. Family and friends funding relies on personal relationships to secure initial capital, often offering more flexible terms but limited scalability. Explore more about how these funding options impact early-stage business growth and investor dynamics.

Why it is important

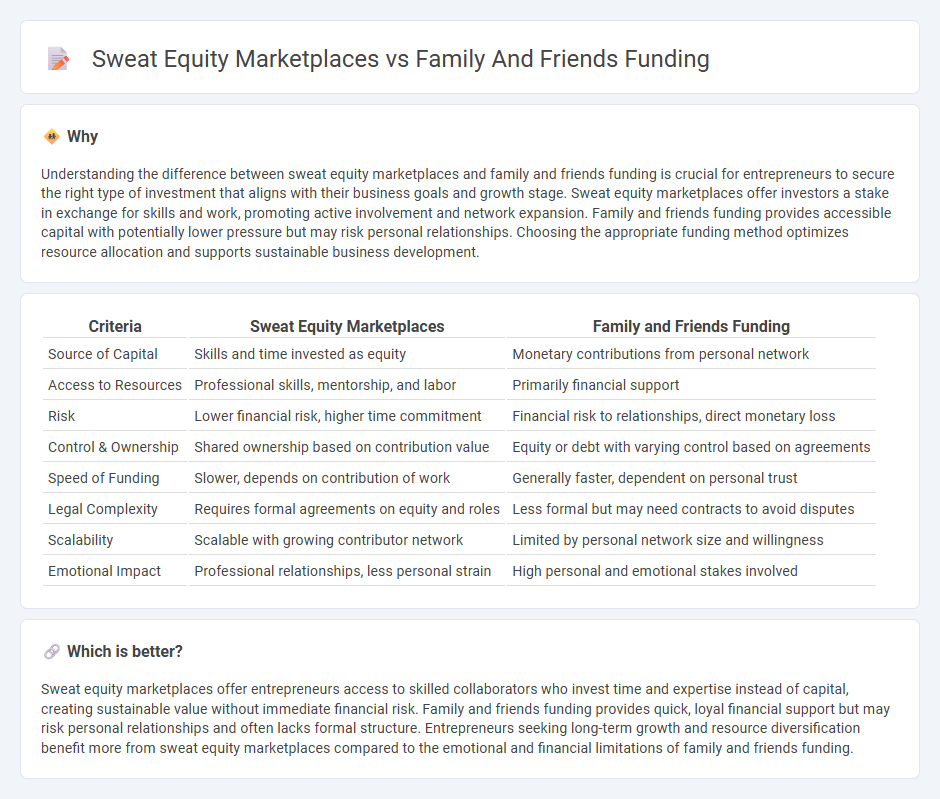

Understanding the difference between sweat equity marketplaces and family and friends funding is crucial for entrepreneurs to secure the right type of investment that aligns with their business goals and growth stage. Sweat equity marketplaces offer investors a stake in exchange for skills and work, promoting active involvement and network expansion. Family and friends funding provides accessible capital with potentially lower pressure but may risk personal relationships. Choosing the appropriate funding method optimizes resource allocation and supports sustainable business development.

Comparison Table

| Criteria | Sweat Equity Marketplaces | Family and Friends Funding |

|---|---|---|

| Source of Capital | Skills and time invested as equity | Monetary contributions from personal network |

| Access to Resources | Professional skills, mentorship, and labor | Primarily financial support |

| Risk | Lower financial risk, higher time commitment | Financial risk to relationships, direct monetary loss |

| Control & Ownership | Shared ownership based on contribution value | Equity or debt with varying control based on agreements |

| Speed of Funding | Slower, depends on contribution of work | Generally faster, dependent on personal trust |

| Legal Complexity | Requires formal agreements on equity and roles | Less formal but may need contracts to avoid disputes |

| Scalability | Scalable with growing contributor network | Limited by personal network size and willingness |

| Emotional Impact | Professional relationships, less personal strain | High personal and emotional stakes involved |

Which is better?

Sweat equity marketplaces offer entrepreneurs access to skilled collaborators who invest time and expertise instead of capital, creating sustainable value without immediate financial risk. Family and friends funding provides quick, loyal financial support but may risk personal relationships and often lacks formal structure. Entrepreneurs seeking long-term growth and resource diversification benefit more from sweat equity marketplaces compared to the emotional and financial limitations of family and friends funding.

Connection

Sweat equity marketplaces facilitate entrepreneurs exchanging skills and labor for ownership stakes, enabling startup growth without immediate capital. Family and friends funding often complements this by providing initial financial support based on trust and personal relationships. Together, these funding methods create a synergistic ecosystem that reduces reliance on traditional investors and accelerates business development.

Key Terms

**Family and Friends Funding:**

Family and friends funding provides early-stage startups with accessible capital through trusted personal networks, often involving flexible repayment terms and supportive investment. This funding option leverages established relationships, enabling entrepreneurs to secure initial resources without stringent evaluation criteria typical of formal investors. Explore how family and friends funding can jumpstart your venture and compare it with other startup financing methods.

Seed Capital

Family and friends funding provides early-stage seed capital by leveraging personal networks, offering flexible terms but limited scalability and professional guidance. Sweat equity marketplaces enable founders to exchange time and skills for ownership stakes, reducing upfront cash needs while attracting co-founders or collaborators with complementary expertise. Explore how these seed capital options can strategically accelerate your startup's growth.

Personal Networks

Family and friends funding leverages personal networks to provide early-stage capital through trusted relationships, often with flexible terms and lower pressure compared to institutional investors. Sweat equity marketplaces connect entrepreneurs with professionals who contribute time and expertise in exchange for ownership stakes, optimizing resource utilization without immediate cash outflows. Explore how these personal network-driven funding models can accelerate your startup's growth.

Source and External Links

A Guide to Friends & Family Funding for Startups - Family and friends funding typically involves raising early-stage capital from close connections either through business loans or equity investments, often informal but requiring clear agreements to avoid disputes.

Raising Startup Funds from Friends and Family - Structuring friends and family funding can include debt, equity, or a mix, but legal considerations such as securities laws and exemptions must be carefully addressed to secure the funds properly.

The Ultimate Guide to Friends and Family Rounds (2024) - Arc - Friends and family rounds involve raising capital from close personal connections in exchange for equity, typically the first external funding for startups, with founders giving around 10-15% of company equity in these rounds.

dowidth.com

dowidth.com