Passive income streams generate earnings with minimal daily effort by leveraging investments or automated systems, whereas recurring revenue provides consistent, predictable income through ongoing customer subscriptions or contracts. Entrepreneurs often balance both to build financial stability and scalable business models. Explore more to understand which strategy aligns best with your entrepreneurial goals.

Why it is important

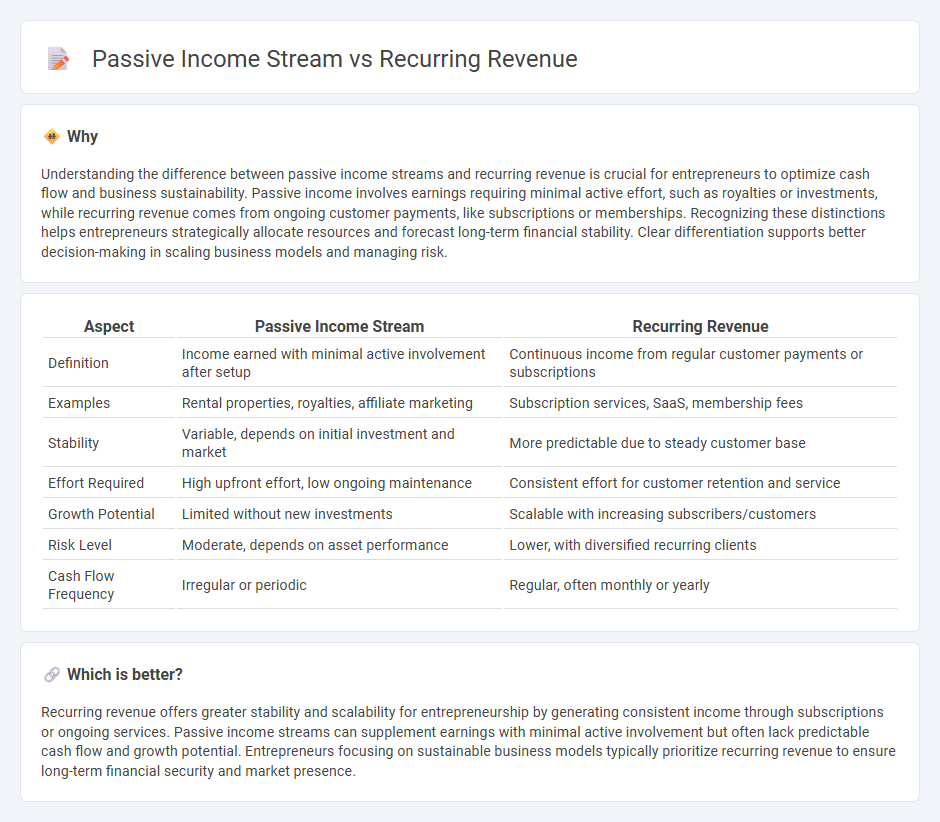

Understanding the difference between passive income streams and recurring revenue is crucial for entrepreneurs to optimize cash flow and business sustainability. Passive income involves earnings requiring minimal active effort, such as royalties or investments, while recurring revenue comes from ongoing customer payments, like subscriptions or memberships. Recognizing these distinctions helps entrepreneurs strategically allocate resources and forecast long-term financial stability. Clear differentiation supports better decision-making in scaling business models and managing risk.

Comparison Table

| Aspect | Passive Income Stream | Recurring Revenue |

|---|---|---|

| Definition | Income earned with minimal active involvement after setup | Continuous income from regular customer payments or subscriptions |

| Examples | Rental properties, royalties, affiliate marketing | Subscription services, SaaS, membership fees |

| Stability | Variable, depends on initial investment and market | More predictable due to steady customer base |

| Effort Required | High upfront effort, low ongoing maintenance | Consistent effort for customer retention and service |

| Growth Potential | Limited without new investments | Scalable with increasing subscribers/customers |

| Risk Level | Moderate, depends on asset performance | Lower, with diversified recurring clients |

| Cash Flow Frequency | Irregular or periodic | Regular, often monthly or yearly |

Which is better?

Recurring revenue offers greater stability and scalability for entrepreneurship by generating consistent income through subscriptions or ongoing services. Passive income streams can supplement earnings with minimal active involvement but often lack predictable cash flow and growth potential. Entrepreneurs focusing on sustainable business models typically prioritize recurring revenue to ensure long-term financial security and market presence.

Connection

Passive income streams and recurring revenue are interconnected concepts critical to sustainable entrepreneurship, as both generate consistent cash flow with minimal active involvement. Recurring revenue models, such as subscription services or membership fees, create reliable passive income by ensuring continuous payments over time. Entrepreneurs leverage these streams to stabilize earnings, scale business growth, and increase long-term financial independence.

Key Terms

Subscription Model

Subscription models generate recurring revenue by charging customers regularly for ongoing access to products or services, ensuring predictable cash flow and customer retention. Passive income streams may arise from subscription models when automated billing and minimal maintenance allow earnings with limited active management. Explore how subscription-based recurring revenue can build sustainable passive income for your business.

Royalties

Royalties generate recurring revenue by providing ongoing payments from intellectual property such as books, music, patents, or trademarks, creating a stable income stream linked to asset performance. Unlike purely passive income, royalties often require active management to maximize earnings through licensing agreements or market expansion. Explore how leveraging royalties can optimize your financial strategy and build sustainable wealth.

Licensing

Licensing generates recurring revenue by allowing businesses to earn consistent payments through agreements granting rights to use intellectual property, such as patents or trademarks. This model creates a predictable income stream without continuous active involvement, distinguishing it from traditional passive income that often requires upfront effort or investment. Explore more about how licensing can optimize your financial strategy and build sustainable wealth.

Source and External Links

Recurring revenue models explained - Stripe - Recurring revenue is a business model generating consistent, predictable income by charging customers regularly (monthly, quarterly, etc.) for ongoing access to products or services, emphasizing customer retention and automatic renewal.

What is Recurring Revenue? - DealHub - Recurring revenue is income from customers paying repeatedly on a consistent schedule, allowing businesses to predict cash flow accurately, reduce customer acquisition costs, and enhance customer loyalty through long-term relationships.

What is Recurring Revenue & Do You Need it? | Pipedrive - Recurring revenue relies on repeat purchases such as subscriptions or memberships, providing businesses with stable cash flow, higher customer lifetime value, and lower growth risk compared to one-time sales.

dowidth.com

dowidth.com