The gig economy thrives on flexible, task-based work facilitated by digital platforms, driving rapid economic participation and innovation. In contrast, the cash economy relies on informal, unrecorded transactions that often evade taxation and regulatory oversight, impacting economic transparency and growth. Explore more about how these contrasting economies shape modern financial landscapes.

Why it is important

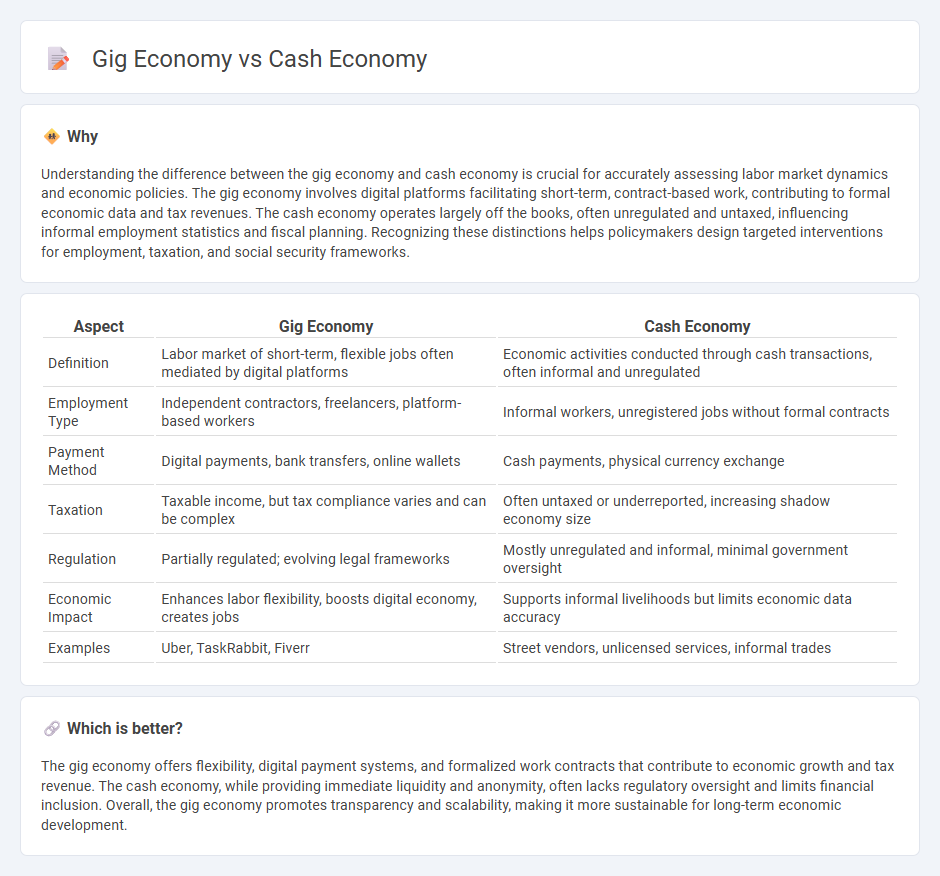

Understanding the difference between the gig economy and cash economy is crucial for accurately assessing labor market dynamics and economic policies. The gig economy involves digital platforms facilitating short-term, contract-based work, contributing to formal economic data and tax revenues. The cash economy operates largely off the books, often unregulated and untaxed, influencing informal employment statistics and fiscal planning. Recognizing these distinctions helps policymakers design targeted interventions for employment, taxation, and social security frameworks.

Comparison Table

| Aspect | Gig Economy | Cash Economy |

|---|---|---|

| Definition | Labor market of short-term, flexible jobs often mediated by digital platforms | Economic activities conducted through cash transactions, often informal and unregulated |

| Employment Type | Independent contractors, freelancers, platform-based workers | Informal workers, unregistered jobs without formal contracts |

| Payment Method | Digital payments, bank transfers, online wallets | Cash payments, physical currency exchange |

| Taxation | Taxable income, but tax compliance varies and can be complex | Often untaxed or underreported, increasing shadow economy size |

| Regulation | Partially regulated; evolving legal frameworks | Mostly unregulated and informal, minimal government oversight |

| Economic Impact | Enhances labor flexibility, boosts digital economy, creates jobs | Supports informal livelihoods but limits economic data accuracy |

| Examples | Uber, TaskRabbit, Fiverr | Street vendors, unlicensed services, informal trades |

Which is better?

The gig economy offers flexibility, digital payment systems, and formalized work contracts that contribute to economic growth and tax revenue. The cash economy, while providing immediate liquidity and anonymity, often lacks regulatory oversight and limits financial inclusion. Overall, the gig economy promotes transparency and scalability, making it more sustainable for long-term economic development.

Connection

The gig economy and cash economy intersect through informal work arrangements and cash-based transactions, where many gig workers receive payments outside traditional banking systems. This connection enhances economic flexibility but poses challenges for tax compliance and social security contributions. Both economies rely heavily on digital platforms and cash exchanges, influencing labor markets and fiscal policies globally.

Key Terms

Liquidity

The cash economy relies heavily on immediate liquidity, where transactions are often conducted in physical currency, allowing for instant access to funds without intermediary delays. In contrast, the gig economy depends on digital payment platforms that can introduce processing times and fees, affecting the speed at which workers receive earnings. Explore how liquidity management differs between these economies and impacts financial stability.

Flexibility

The gig economy offers unparalleled flexibility by allowing workers to choose projects, set their schedules, and quickly adapt to changing demands, unlike the cash economy, which often involves fixed hours and limited autonomy. This flexibility in the gig economy supports diverse income streams and personalized work-life balance, crucial for modern workforce dynamics. Explore how embracing gig work flexibility can transform your career path.

Income Stability

Cash economy workers often face irregular income due to the informal nature of their work and lack of contractual agreements. Gig economy participants experience variable earnings influenced by demand fluctuations and platform algorithms, challenging consistent income flows. Explore strategies to enhance income stability within these economic models.

Source and External Links

Why Cash Still Matters in Today's Economy - Despite the rise of digital payments, cash remains essential for about 20 million U.S. households--especially among the unbanked, underbanked, and low-income earners--serving as a reliable store of value and a backup during uncertain times, with ongoing legislative efforts to protect its use and promote financial inclusivity.

CASH ECONOMY definition in American English - A cash economy refers to an economic system or segment where financial transactions are conducted primarily in physical cash, rather than through electronic methods like debit, credit, or bank transfers.

Cashless society - A cashless society is one where financial transactions are carried out entirely through digital means, eliminating the use of physical cash, which raises issues around privacy, digital exclusion, and dependence on technology.

dowidth.com

dowidth.com