The quits rate measures the percentage of workers voluntarily leaving their jobs, signaling confidence in the labor market, while jobless claims track the number of individuals filing for unemployment benefits, reflecting layoffs and job losses. A rising quits rate alongside falling jobless claims indicates a robust economy with strong job opportunities. Explore more insights to understand how these indicators shape economic trends.

Why it is important

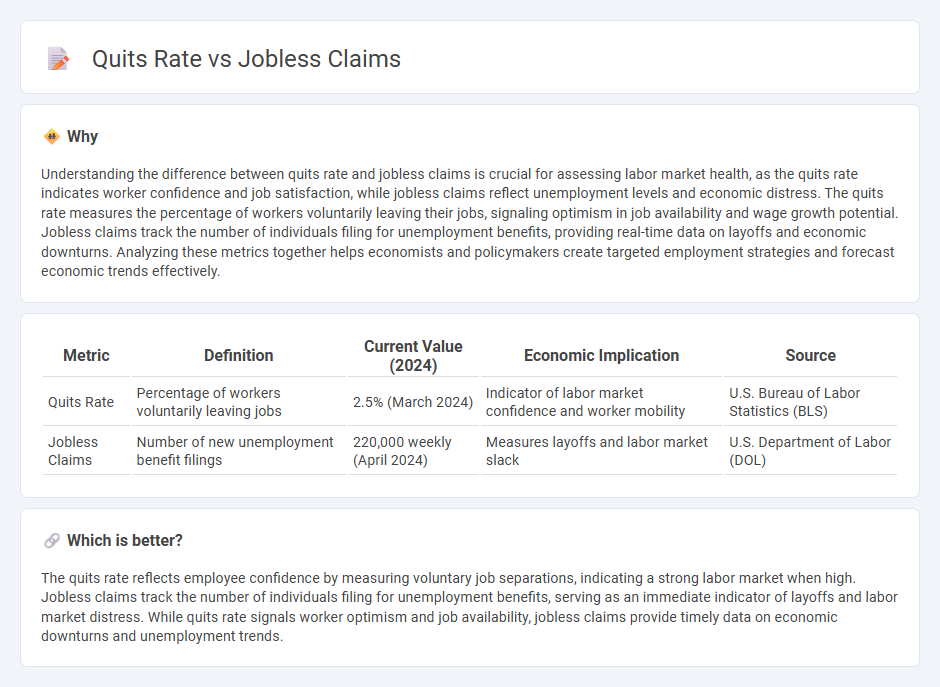

Understanding the difference between quits rate and jobless claims is crucial for assessing labor market health, as the quits rate indicates worker confidence and job satisfaction, while jobless claims reflect unemployment levels and economic distress. The quits rate measures the percentage of workers voluntarily leaving their jobs, signaling optimism in job availability and wage growth potential. Jobless claims track the number of individuals filing for unemployment benefits, providing real-time data on layoffs and economic downturns. Analyzing these metrics together helps economists and policymakers create targeted employment strategies and forecast economic trends effectively.

Comparison Table

| Metric | Definition | Current Value (2024) | Economic Implication | Source |

|---|---|---|---|---|

| Quits Rate | Percentage of workers voluntarily leaving jobs | 2.5% (March 2024) | Indicator of labor market confidence and worker mobility | U.S. Bureau of Labor Statistics (BLS) |

| Jobless Claims | Number of new unemployment benefit filings | 220,000 weekly (April 2024) | Measures layoffs and labor market slack | U.S. Department of Labor (DOL) |

Which is better?

The quits rate reflects employee confidence by measuring voluntary job separations, indicating a strong labor market when high. Jobless claims track the number of individuals filing for unemployment benefits, serving as an immediate indicator of layoffs and labor market distress. While quits rate signals worker optimism and job availability, jobless claims provide timely data on economic downturns and unemployment trends.

Connection

Quits rate and jobless claims provide critical insights into labor market dynamics, with a rising quits rate often signaling worker confidence and economic strength as employees voluntarily leave jobs for better opportunities. Conversely, increasing jobless claims indicate rising unemployment and potential economic distress, reflecting layoffs or business contractions. Analyzing the inverse relationship between a rising quits rate and stable or falling jobless claims helps economists gauge overall job market health and economic stability.

Key Terms

Unemployment Insurance

Jobless claims serve as a critical indicator of labor market distress by measuring the number of individuals filing for unemployment insurance benefits, while the quits rate reflects worker confidence through voluntary job separations. A rising quits rate typically signals strong employment conditions, whereas increasing jobless claims suggest escalating unemployment risks and potential economic slowdown. Explore the dynamics between unemployment insurance data and labor market trends to gain deeper insights into economic health.

Labor Turnover

Jobless claims provide a timely indicator of layoffs by measuring the number of individuals filing for unemployment benefits weekly, while the quits rate reflects voluntary separations, signaling worker confidence and labor market health. Labor turnover dynamics reveal trends in employment stability, with higher quits rates often indicating a robust job market and greater worker mobility compared to rising jobless claims, which suggest increased layoffs. Explore the intricate relationship between jobless claims and quits rate to better understand labor market conditions and economic outlook.

Voluntary Separation

Voluntary separation is primarily reflected in the quits rate, a key labor market indicator showing workers leaving jobs by choice, typically signaling confidence in job availability. Jobless claims measure involuntary separations or layoffs, providing insights into employer-driven workforce reductions. Explore how analyzing quits rate alongside jobless claims reveals deeper trends in labor market dynamics and workforce confidence.

Source and External Links

United States Initial Jobless Claims - Trading Economics - Initial jobless claims in the US recently fell to 227,000 as of early July 2025, marking the fourth consecutive weekly decline and indicating a relatively robust labor market despite economic uncertainties.

News Release - U.S. Department of Labor - Weekly unemployment insurance claims showed a decrease to 221,000 for the week ending July 12, 2025, with the insured unemployment rate steady at 1.3%, while the total number of insured unemployed rose slightly.

Initial Claims (ICSA) | FRED | St. Louis Fed - The seasonally adjusted initial jobless claims for the week ending July 12, 2025, stood at 221,000, reflecting recent declines from prior weeks and continuing the trend of softening claims numbers.

dowidth.com

dowidth.com