Scrap metal arbitrage involves capitalizing on price disparities for recyclable metals across different markets to generate profit. Geographic arbitrage exploits cost-of-living and wage differences between regions, allowing individuals or businesses to maximize income and reduce expenses. Explore deeper insights into how these arbitrage strategies impact global economic dynamics.

Why it is important

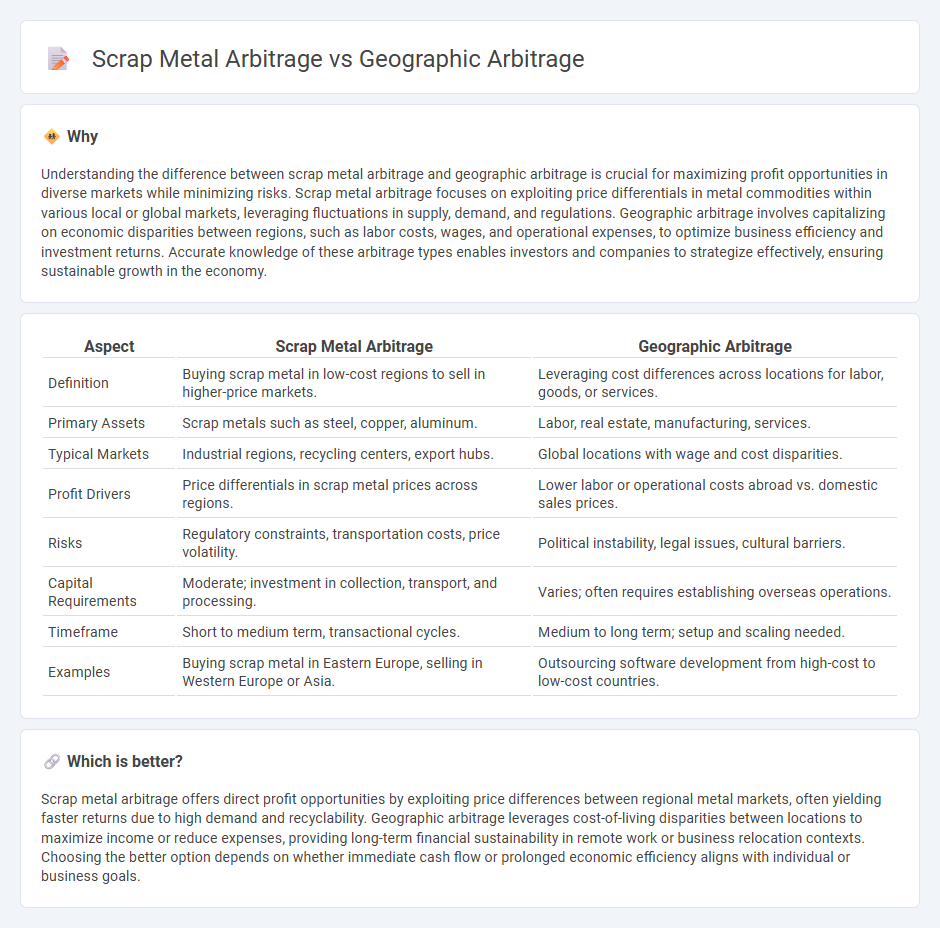

Understanding the difference between scrap metal arbitrage and geographic arbitrage is crucial for maximizing profit opportunities in diverse markets while minimizing risks. Scrap metal arbitrage focuses on exploiting price differentials in metal commodities within various local or global markets, leveraging fluctuations in supply, demand, and regulations. Geographic arbitrage involves capitalizing on economic disparities between regions, such as labor costs, wages, and operational expenses, to optimize business efficiency and investment returns. Accurate knowledge of these arbitrage types enables investors and companies to strategize effectively, ensuring sustainable growth in the economy.

Comparison Table

| Aspect | Scrap Metal Arbitrage | Geographic Arbitrage |

|---|---|---|

| Definition | Buying scrap metal in low-cost regions to sell in higher-price markets. | Leveraging cost differences across locations for labor, goods, or services. |

| Primary Assets | Scrap metals such as steel, copper, aluminum. | Labor, real estate, manufacturing, services. |

| Typical Markets | Industrial regions, recycling centers, export hubs. | Global locations with wage and cost disparities. |

| Profit Drivers | Price differentials in scrap metal prices across regions. | Lower labor or operational costs abroad vs. domestic sales prices. |

| Risks | Regulatory constraints, transportation costs, price volatility. | Political instability, legal issues, cultural barriers. |

| Capital Requirements | Moderate; investment in collection, transport, and processing. | Varies; often requires establishing overseas operations. |

| Timeframe | Short to medium term, transactional cycles. | Medium to long term; setup and scaling needed. |

| Examples | Buying scrap metal in Eastern Europe, selling in Western Europe or Asia. | Outsourcing software development from high-cost to low-cost countries. |

Which is better?

Scrap metal arbitrage offers direct profit opportunities by exploiting price differences between regional metal markets, often yielding faster returns due to high demand and recyclability. Geographic arbitrage leverages cost-of-living disparities between locations to maximize income or reduce expenses, providing long-term financial sustainability in remote work or business relocation contexts. Choosing the better option depends on whether immediate cash flow or prolonged economic efficiency aligns with individual or business goals.

Connection

Scrap metal arbitrage exploits price differences in metal markets across regions, while geographic arbitrage capitalizes on cost variances between locations. Both strategies leverage regional economic disparities to maximize profit margins by buying low in one area and selling high in another. This interconnected approach enhances supply chain efficiency and trade opportunities within the global economy.

Key Terms

Location advantage

Geographic arbitrage leverages cost differences across locations, such as labor or rent disparities, to maximize profitability by relocating business operations to lower-cost areas. Scrap metal arbitrage exploits variations in scrap metal prices between regions or markets, capitalizing on location-specific supply and demand dynamics to buy low and sell high. Explore the nuances of location advantage in these arbitrage strategies to enhance your investment approach.

Price differentials

Geographic arbitrage exploits price differentials across regions by sourcing goods or services where costs are lower and selling them in higher-priced markets, maximizing profit margins. Scrap metal arbitrage specifically targets price discrepancies in metal markets, capitalizing on variations in scrap metal values due to local demand, supply chain logistics, and recycling regulations. Explore deeper insights into geographic and scrap metal arbitrage strategies to optimize your investment returns.

Transportation costs

Geographic arbitrage exploits price differences across regions to maximize profits, often incurring substantial transportation costs that can erode margins. In scrap metal arbitrage, transportation expenses are critical due to the bulk and weight of materials, requiring efficient logistics to maintain profitability. Explore detailed strategies for minimizing transportation costs in both arbitrage types to enhance overall returns.

Source and External Links

What is Geographic Arbitrage? Definition, Best Countries & Benefits - Geographic arbitrage is the practice of earning income in a high-cost region while living or operating in a lower-cost area to maximize financial returns, including local, domestic, or international relocation strategies, enabled by technology and remote work.

How "Geographic Arbitrage" Can Make You Money - SmartAsset - Geographic arbitrage involves taking advantage of lower costs of living in different regions to stretch income further, a concept popularized by the FIRE movement for early retirement.

Geographic Arbitrage Will Accelerate Your Wealth Building. Is It ... - Geographic arbitrage helps accelerate wealth building by living in lower-cost cities or regions while earning similar income, allowing money to stretch further through reduced expenses and taxes.

dowidth.com

dowidth.com