Supercore inflation measures the persistent rise in prices by excluding volatile categories like food and energy, offering a clearer view of underlying inflation trends impacting economic policy. Sticky-price inflation focuses on prices that adjust slowly due to menu costs and contracts, influencing short-term monetary decisions and wage negotiations. Explore how understanding both inflation types is crucial for effective economic forecasting and policy-making.

Why it is important

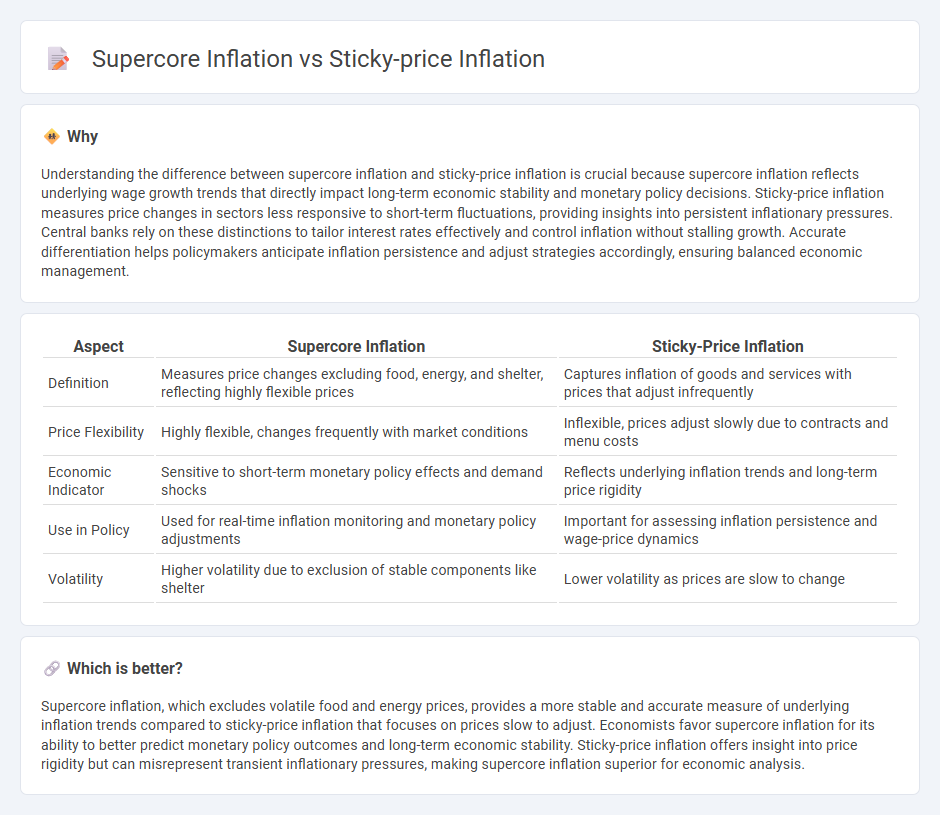

Understanding the difference between supercore inflation and sticky-price inflation is crucial because supercore inflation reflects underlying wage growth trends that directly impact long-term economic stability and monetary policy decisions. Sticky-price inflation measures price changes in sectors less responsive to short-term fluctuations, providing insights into persistent inflationary pressures. Central banks rely on these distinctions to tailor interest rates effectively and control inflation without stalling growth. Accurate differentiation helps policymakers anticipate inflation persistence and adjust strategies accordingly, ensuring balanced economic management.

Comparison Table

| Aspect | Supercore Inflation | Sticky-Price Inflation |

|---|---|---|

| Definition | Measures price changes excluding food, energy, and shelter, reflecting highly flexible prices | Captures inflation of goods and services with prices that adjust infrequently |

| Price Flexibility | Highly flexible, changes frequently with market conditions | Inflexible, prices adjust slowly due to contracts and menu costs |

| Economic Indicator | Sensitive to short-term monetary policy effects and demand shocks | Reflects underlying inflation trends and long-term price rigidity |

| Use in Policy | Used for real-time inflation monitoring and monetary policy adjustments | Important for assessing inflation persistence and wage-price dynamics |

| Volatility | Higher volatility due to exclusion of stable components like shelter | Lower volatility as prices are slow to change |

Which is better?

Supercore inflation, which excludes volatile food and energy prices, provides a more stable and accurate measure of underlying inflation trends compared to sticky-price inflation that focuses on prices slow to adjust. Economists favor supercore inflation for its ability to better predict monetary policy outcomes and long-term economic stability. Sticky-price inflation offers insight into price rigidity but can misrepresent transient inflationary pressures, making supercore inflation superior for economic analysis.

Connection

Supercore inflation, which excludes volatile food and energy prices, closely relates to sticky-price inflation because both reflect underlying, persistent price changes driven by wages and rent adjustments. Sticky-price inflation measures price changes in sectors where prices are rigid and adjust slowly, influencing long-term inflation expectations embedded in supercore inflation. Monitoring the interplay between these metrics helps economists gauge inflation persistence and anticipate central bank policy responses.

Key Terms

Price Rigidity

Sticky-price inflation measures the rate of inflation focusing on goods and services with prices that adjust infrequently, reflecting persistent price rigidity in sectors like housing and healthcare. Supercore inflation targets the most stable components of core inflation, excluding volatile items such as food and energy, highlighting underlying price rigidity in more durable goods and services. Explore further to understand how price rigidity shapes monetary policy decisions.

Core Services

Sticky-price inflation measures persistent price changes in services and goods with infrequent price adjustments, providing insight into underlying inflation trends. Supercore inflation isolates the most resilient service sectors, particularly core services excluding volatile items like housing and transportation, offering a clearer picture of long-term inflationary pressures. Explore our deep dive into how core services shape economic policy and inflation forecasting.

Wage-Price Spiral

Sticky-price inflation reflects slow-changing prices, often tied to long-term contracts and wage adjustments, making it a key factor in the wage-price spiral. Supercore inflation excludes volatile food and energy prices to capture underlying inflation trends driven primarily by core services and wages, emphasizing sustained labor cost pressures. Explore deeper insights on how these inflation measures influence economic policies and wage dynamics.

Source and External Links

What is sticky inflation? Definition, measurement & example - Sticky inflation refers to persistent increases in wages and prices of goods that do not change frequently or quickly, reflecting sustained inflation that is slow to adjust even when market conditions change.

Sticky-Price CPI - Federal Reserve Bank of Atlanta - The sticky-price CPI is a measure of inflation for items in the consumer price index that adjust prices infrequently, showing slower price changes compared to flexible prices and often used to gauge underlying inflation trends.

Sticky Price Inflation Index: An Alternative Core Inflation Measure - The sticky price inflation index measures inflation by focusing on prices that change less frequently, which are considered more forward-looking and reflect inflation expectations of price setters.

dowidth.com

dowidth.com