Locavesting focuses on channeling investments into local businesses and projects, promoting community development and economic resilience. Public equity financing involves raising capital from a broad pool of investors through stock markets, offering liquidity and access to larger funds. Discover the benefits and challenges of both financing methods to determine which suits your investment goals.

Why it is important

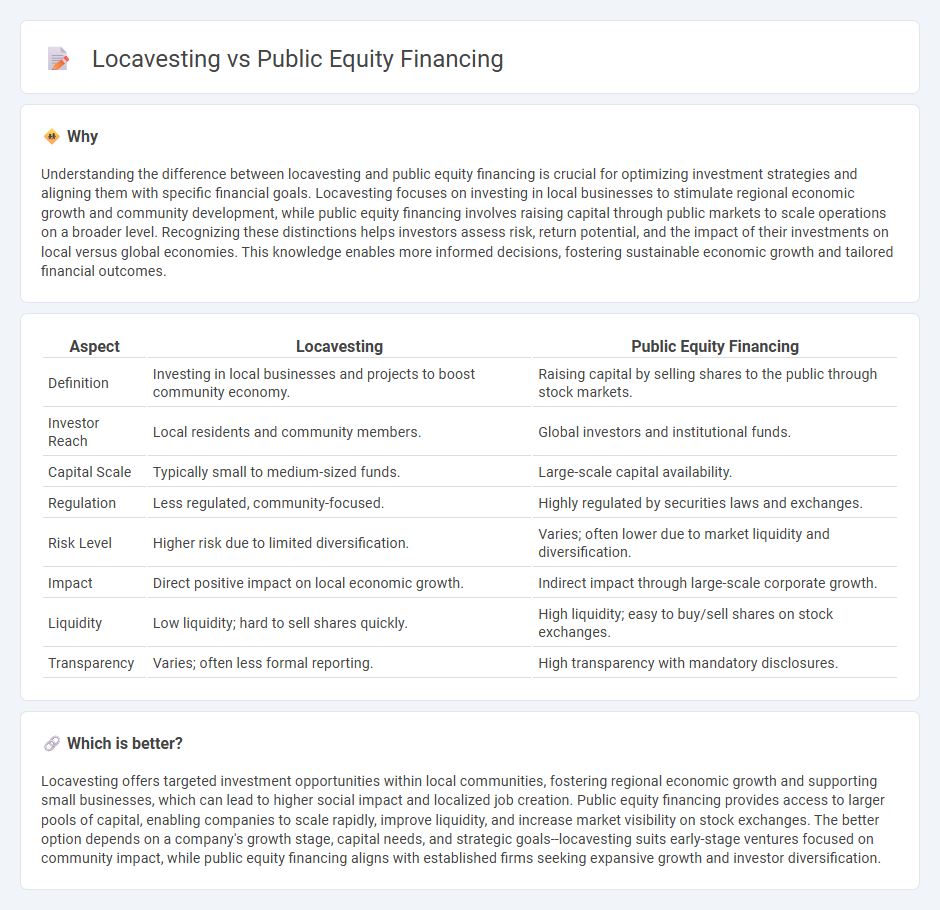

Understanding the difference between locavesting and public equity financing is crucial for optimizing investment strategies and aligning them with specific financial goals. Locavesting focuses on investing in local businesses to stimulate regional economic growth and community development, while public equity financing involves raising capital through public markets to scale operations on a broader level. Recognizing these distinctions helps investors assess risk, return potential, and the impact of their investments on local versus global economies. This knowledge enables more informed decisions, fostering sustainable economic growth and tailored financial outcomes.

Comparison Table

| Aspect | Locavesting | Public Equity Financing |

|---|---|---|

| Definition | Investing in local businesses and projects to boost community economy. | Raising capital by selling shares to the public through stock markets. |

| Investor Reach | Local residents and community members. | Global investors and institutional funds. |

| Capital Scale | Typically small to medium-sized funds. | Large-scale capital availability. |

| Regulation | Less regulated, community-focused. | Highly regulated by securities laws and exchanges. |

| Risk Level | Higher risk due to limited diversification. | Varies; often lower due to market liquidity and diversification. |

| Impact | Direct positive impact on local economic growth. | Indirect impact through large-scale corporate growth. |

| Liquidity | Low liquidity; hard to sell shares quickly. | High liquidity; easy to buy/sell shares on stock exchanges. |

| Transparency | Varies; often less formal reporting. | High transparency with mandatory disclosures. |

Which is better?

Locavesting offers targeted investment opportunities within local communities, fostering regional economic growth and supporting small businesses, which can lead to higher social impact and localized job creation. Public equity financing provides access to larger pools of capital, enabling companies to scale rapidly, improve liquidity, and increase market visibility on stock exchanges. The better option depends on a company's growth stage, capital needs, and strategic goals--locavesting suits early-stage ventures focused on community impact, while public equity financing aligns with established firms seeking expansive growth and investor diversification.

Connection

Locavesting promotes local economic growth by encouraging investments in community-based businesses and projects, which increases the demand for public equity financing to support business expansion. Public equity financing provides capital through shares, enabling local enterprises to scale operations and create jobs, reinforcing the locavesting cycle. The synergy between locavesting and public equity financing drives sustainable development by aligning investor interests with regional economic needs.

Key Terms

Public Stock Exchange

Public equity financing involves raising capital through the sale of shares on public stock exchanges like NYSE or NASDAQ, allowing companies to access broad investor bases and increased liquidity. Locavesting focuses on investing within local communities, prioritizing regional economic growth and social impact over widespread market exposure. Explore the advantages and strategic implications of each financing method to determine which aligns best with your investment goals.

Community Investment

Public equity financing allows companies to raise capital by selling shares on stock exchanges, enabling widespread investor participation and liquidity, benefiting both businesses and shareholders. Locavesting focuses on directing investment funds into local businesses and projects, fostering community development, job creation, and regional economic resilience through localized financial support. Explore the transformative impact of these investment strategies on community growth and financial inclusivity.

Regulatory Compliance

Public equity financing involves raising capital through the sale of shares to the public, requiring strict compliance with regulatory bodies like the SEC, including detailed disclosures, periodic reporting, and adherence to securities laws. Locavesting, which centers around investing in local businesses or communities, may face fewer complex federal regulations but still necessitates compliance with local investment and business laws. Explore the regulatory nuances further to understand which financing method aligns better with your investment goals.

Source and External Links

The Ultimate Guide to Equity Financing + Checklist - This guide explains public equity financing, including initial public offerings and stock issues, highlighting its liquidity and regulatory differences from private equity.

Public Equity Funds - Public equity funds are investment funds that raise money through an IPO to invest in securities, offering different liquidity options for investors.

Equity Financing - Equity financing involves selling company shares to raise capital, often used in startup stages to finance assets and operations, with public equity being a key method through IPOs.

dowidth.com

dowidth.com