Scrap metal arbitrage exploits price differences in physical metal markets, leveraging disparities between regional scrap metal values and processing costs to generate profit. Statistical arbitrage utilizes advanced mathematical models and historical price data to identify temporary mispricings in financial markets, executing high-frequency trades to capitalize on small price discrepancies. Explore in-depth strategies and market dynamics to fully understand the advantages and risks of both arbitrage approaches.

Why it is important

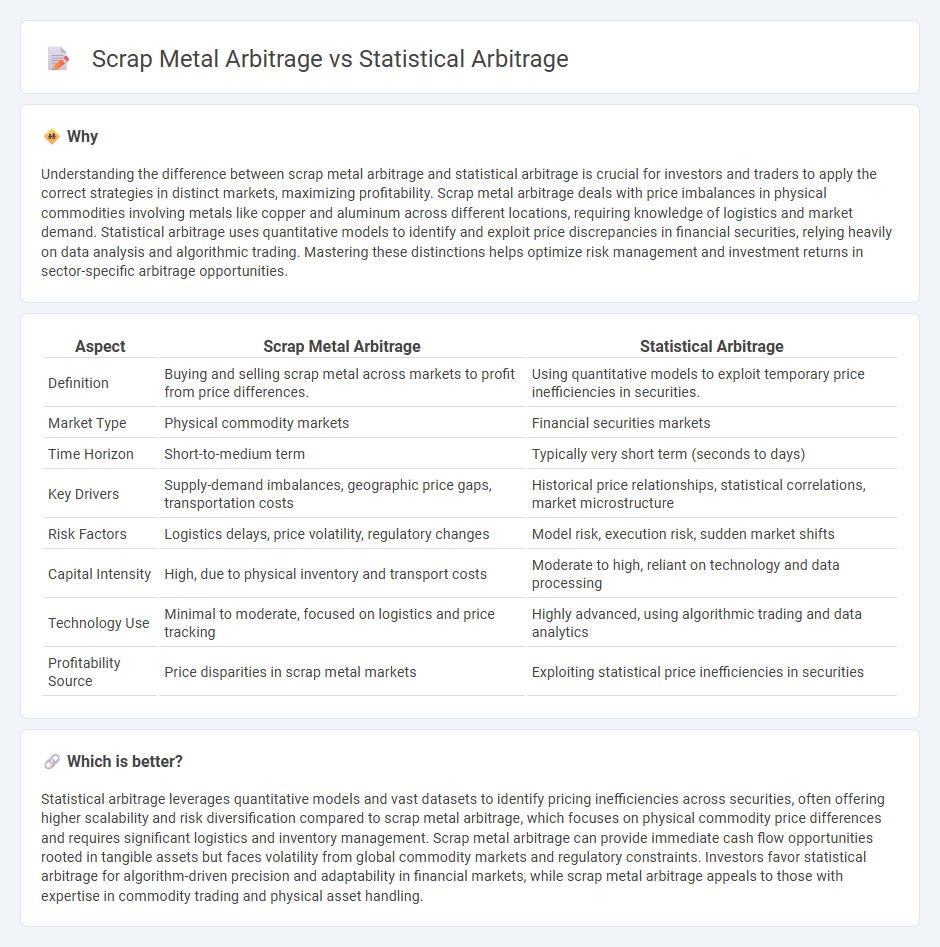

Understanding the difference between scrap metal arbitrage and statistical arbitrage is crucial for investors and traders to apply the correct strategies in distinct markets, maximizing profitability. Scrap metal arbitrage deals with price imbalances in physical commodities involving metals like copper and aluminum across different locations, requiring knowledge of logistics and market demand. Statistical arbitrage uses quantitative models to identify and exploit price discrepancies in financial securities, relying heavily on data analysis and algorithmic trading. Mastering these distinctions helps optimize risk management and investment returns in sector-specific arbitrage opportunities.

Comparison Table

| Aspect | Scrap Metal Arbitrage | Statistical Arbitrage |

|---|---|---|

| Definition | Buying and selling scrap metal across markets to profit from price differences. | Using quantitative models to exploit temporary price inefficiencies in securities. |

| Market Type | Physical commodity markets | Financial securities markets |

| Time Horizon | Short-to-medium term | Typically very short term (seconds to days) |

| Key Drivers | Supply-demand imbalances, geographic price gaps, transportation costs | Historical price relationships, statistical correlations, market microstructure |

| Risk Factors | Logistics delays, price volatility, regulatory changes | Model risk, execution risk, sudden market shifts |

| Capital Intensity | High, due to physical inventory and transport costs | Moderate to high, reliant on technology and data processing |

| Technology Use | Minimal to moderate, focused on logistics and price tracking | Highly advanced, using algorithmic trading and data analytics |

| Profitability Source | Price disparities in scrap metal markets | Exploiting statistical price inefficiencies in securities |

Which is better?

Statistical arbitrage leverages quantitative models and vast datasets to identify pricing inefficiencies across securities, often offering higher scalability and risk diversification compared to scrap metal arbitrage, which focuses on physical commodity price differences and requires significant logistics and inventory management. Scrap metal arbitrage can provide immediate cash flow opportunities rooted in tangible assets but faces volatility from global commodity markets and regulatory constraints. Investors favor statistical arbitrage for algorithm-driven precision and adaptability in financial markets, while scrap metal arbitrage appeals to those with expertise in commodity trading and physical asset handling.

Connection

Scrap metal arbitrage and statistical arbitrage connect through their reliance on price discrepancies and market inefficiencies to generate profit. Scrap metal arbitrage exploits differences in scrap metal prices across geographic regions or markets, while statistical arbitrage uses quantitative models to identify and exploit temporary price divergences in financial instruments. Both strategies depend on rapid data analysis and transactions to capitalize on short-term arbitrage opportunities in their respective markets.

Key Terms

Quantitative models

Statistical arbitrage employs quantitative models analyzing historical price data and market correlations to identify short-term mispricing opportunities, relying heavily on algorithms and statistical methods. Scrap metal arbitrage involves physical trading, focusing on regional price discrepancies for metals like copper and aluminum, with less emphasis on complex quantitative modeling but more on logistics and supply chain factors. Explore detailed quantitative strategies and market dynamics to better understand the comparative advantages of both arbitrage approaches.

Price inefficiencies

Statistical arbitrage exploits price inefficiencies by using quantitative models to identify mispricings in financial markets, aiming to profit from the convergence of asset prices. Scrap metal arbitrage leverages discrepancies in metal prices across geographic locations or market segments, capitalizing on physical commodity price differentials and logistical factors. Explore these strategies further to understand their unique mechanisms and profit potential.

Physical commodity

Statistical arbitrage leverages quantitative models and historical price data to identify mispricings in financial markets, while scrap metal arbitrage involves exploiting price differentials in physical commodities like aluminum, copper, and steel across regions or supply chains. Physical commodity arbitrage requires in-depth knowledge of logistics, storage costs, and market demand, contrasting with the purely data-driven nature of statistical arbitrage. Explore the complexities of physical commodity arbitrage to understand its unique challenges and opportunities.

Source and External Links

The Power of Statistical Arbitrage in Finance - PyQuant News - Statistical arbitrage uses quantitative models to identify and exploit temporary price discrepancies between related financial instruments, typically relying on mean reversion principles to capture profits from short-term market inefficiencies.

Statistical arbitrage - Wikipedia - Statistical arbitrage is a class of short-term trading strategies employing mean reversion models on broadly diversified portfolios, often involving hundreds to thousands of securities, and is usually implemented using automated, high-frequency trading systems to capture small, consistent gains.

What is Statistical Arbitrage? | CQF - Statistical arbitrage is a quantitative trading strategy that profits from deviations from expected statistical relationships between related securities, relying on sophisticated mathematical models and large-scale data analysis to identify and exploit mispricings.

dowidth.com

dowidth.com