De-dollarisation involves reducing reliance on the US dollar in international trade and finance, promoting alternative currencies to enhance economic sovereignty and mitigate exposure to dollar volatility. Re-dollarisation occurs when countries revert to using the US dollar due to its global stability, liquidity, and widespread acceptance, often driven by economic uncertainty or a lack of viable alternatives. Explore the factors influencing these opposing trends and their impact on global economic dynamics.

Why it is important

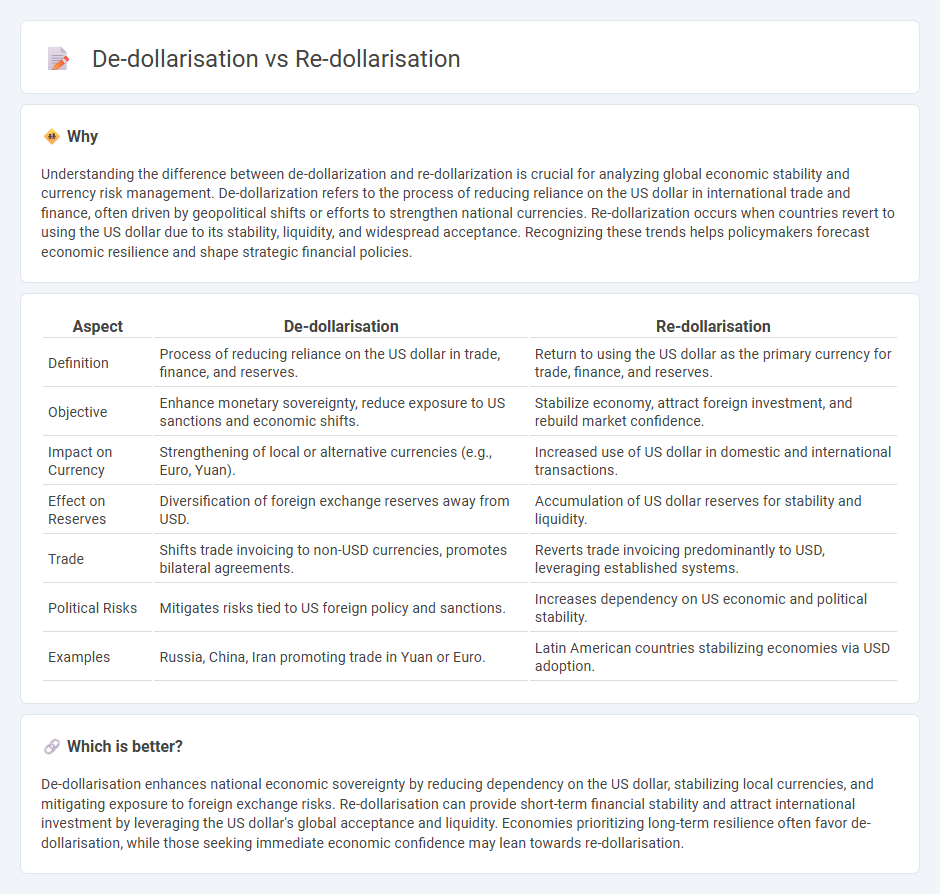

Understanding the difference between de-dollarization and re-dollarization is crucial for analyzing global economic stability and currency risk management. De-dollarization refers to the process of reducing reliance on the US dollar in international trade and finance, often driven by geopolitical shifts or efforts to strengthen national currencies. Re-dollarization occurs when countries revert to using the US dollar due to its stability, liquidity, and widespread acceptance. Recognizing these trends helps policymakers forecast economic resilience and shape strategic financial policies.

Comparison Table

| Aspect | De-dollarisation | Re-dollarisation |

|---|---|---|

| Definition | Process of reducing reliance on the US dollar in trade, finance, and reserves. | Return to using the US dollar as the primary currency for trade, finance, and reserves. |

| Objective | Enhance monetary sovereignty, reduce exposure to US sanctions and economic shifts. | Stabilize economy, attract foreign investment, and rebuild market confidence. |

| Impact on Currency | Strengthening of local or alternative currencies (e.g., Euro, Yuan). | Increased use of US dollar in domestic and international transactions. |

| Effect on Reserves | Diversification of foreign exchange reserves away from USD. | Accumulation of US dollar reserves for stability and liquidity. |

| Trade | Shifts trade invoicing to non-USD currencies, promotes bilateral agreements. | Reverts trade invoicing predominantly to USD, leveraging established systems. |

| Political Risks | Mitigates risks tied to US foreign policy and sanctions. | Increases dependency on US economic and political stability. |

| Examples | Russia, China, Iran promoting trade in Yuan or Euro. | Latin American countries stabilizing economies via USD adoption. |

Which is better?

De-dollarisation enhances national economic sovereignty by reducing dependency on the US dollar, stabilizing local currencies, and mitigating exposure to foreign exchange risks. Re-dollarisation can provide short-term financial stability and attract international investment by leveraging the US dollar's global acceptance and liquidity. Economies prioritizing long-term resilience often favor de-dollarisation, while those seeking immediate economic confidence may lean towards re-dollarisation.

Connection

De-dollarisation reduces global reliance on the US dollar by promoting alternative currencies for trade and reserve holdings, thereby challenging dollar dominance in international finance. Re-dollarisation occurs when countries or markets revert to using the US dollar due to its stability, liquidity, and widespread acceptance despite previous efforts to diversify currency usage. The dynamic interplay between de-dollarisation and re-dollarisation reflects shifting geopolitical influences, economic uncertainties, and market confidence in currency stability.

Key Terms

Currency Substitution

De-dollarisation involves reducing reliance on the US dollar in a country's economy to strengthen the local currency and monetary sovereignty, whereas re-dollarisation indicates a resurgence in dollar use due to economic instability or loss of confidence in local currency. Currency substitution occurs when residents prefer holding foreign currency like the US dollar over the domestic one, affecting monetary policy effectiveness and financial stability. Explore further insights into the impacts and strategies of dollarisation trends in various economies.

Monetary Sovereignty

De-dollarisation enhances monetary sovereignty by reducing dependency on the US dollar, allowing countries to regain control over their domestic monetary policies and mitigate external financial shocks. In contrast, re-dollarisation often signifies a retreat to dollar reliance during economic instability, undermining national currency strength and limiting central bank flexibility. Explore further to understand how these dynamics influence global economic autonomy and policy decisions.

Exchange Rate Policy

De-dollarisation involves reducing reliance on the US dollar in exchange rate policies to enhance monetary sovereignty and stabilize local currency markets. In contrast, re-dollarisation occurs when countries reintroduce or increase the use of the US dollar to restore confidence and manage financial instability. Discover more about how exchange rate strategies shape economic resilience worldwide.

Source and External Links

Is the Reign of the Dollar Coming to an End?: The Twenty-Fifth ... - Re-dollarisation refers to the complex dynamics around shifting away or back toward using the U.S. dollar as a dominant global currency, driven by factors like the US economy's weakening, sanctions policies, and emerging blocs such as BRICS promoting alternatives to the dollar system.

De-dollarization Or Re-dollarization? - RIA - Real Investment Advice - Contrary to de-dollarisation claims, evidence suggests a current trend of re-dollarization, supported by the rule of law, liquidity of US capital markets, and military-economic status that sustain the dollar's role as the primary reserve currency.

Dedollarisation - Wikipedia - Dedollarisation involves countries decreasing reliance on the US dollar for reserves, trade, and accounts, often by developing alternate financial systems as a response to US dominance in sanctions and control of global payment networks, highlighting ongoing geopolitical attempts to diminish dollar hegemony.

dowidth.com

dowidth.com