Zombie companies are businesses that generate just enough revenue to continue operating but lack the financial strength to invest in growth or innovation, often burdened by high debt levels and declining market relevance. In contrast, startup companies focus on rapid innovation and scalable growth, aiming to disrupt markets with new technologies and business models while attracting venture capital investment. Explore more to understand how these contrasting entities impact economic resilience and competitive dynamics.

Why it is important

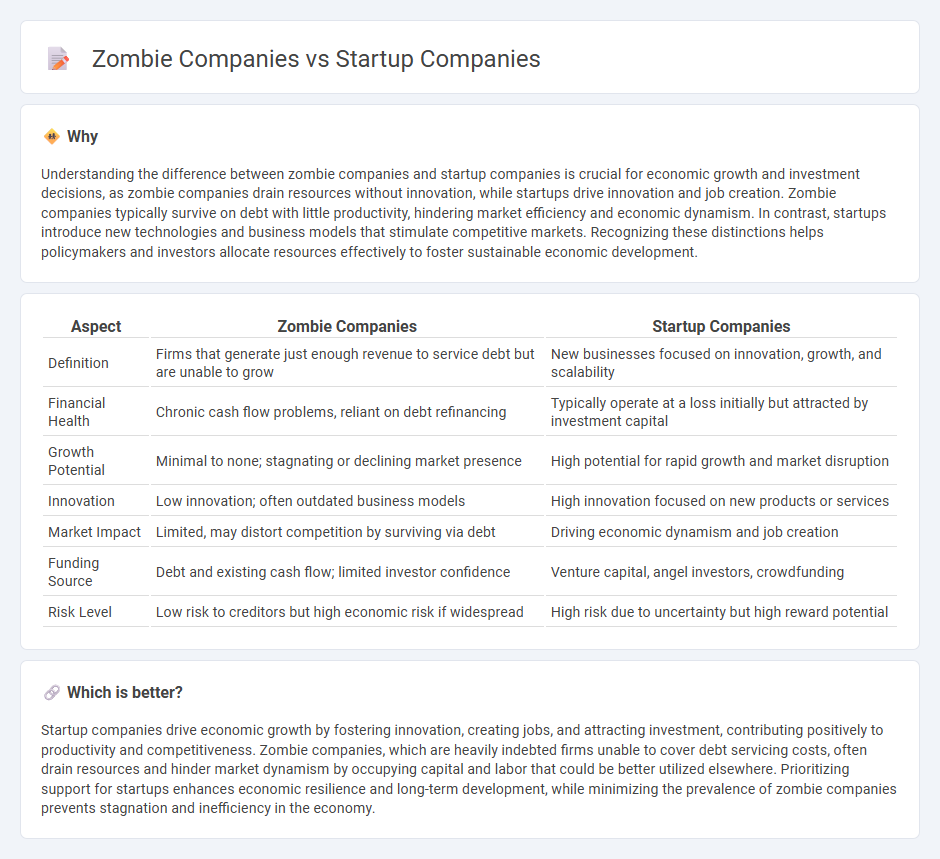

Understanding the difference between zombie companies and startup companies is crucial for economic growth and investment decisions, as zombie companies drain resources without innovation, while startups drive innovation and job creation. Zombie companies typically survive on debt with little productivity, hindering market efficiency and economic dynamism. In contrast, startups introduce new technologies and business models that stimulate competitive markets. Recognizing these distinctions helps policymakers and investors allocate resources effectively to foster sustainable economic development.

Comparison Table

| Aspect | Zombie Companies | Startup Companies |

|---|---|---|

| Definition | Firms that generate just enough revenue to service debt but are unable to grow | New businesses focused on innovation, growth, and scalability |

| Financial Health | Chronic cash flow problems, reliant on debt refinancing | Typically operate at a loss initially but attracted by investment capital |

| Growth Potential | Minimal to none; stagnating or declining market presence | High potential for rapid growth and market disruption |

| Innovation | Low innovation; often outdated business models | High innovation focused on new products or services |

| Market Impact | Limited, may distort competition by surviving via debt | Driving economic dynamism and job creation |

| Funding Source | Debt and existing cash flow; limited investor confidence | Venture capital, angel investors, crowdfunding |

| Risk Level | Low risk to creditors but high economic risk if widespread | High risk due to uncertainty but high reward potential |

Which is better?

Startup companies drive economic growth by fostering innovation, creating jobs, and attracting investment, contributing positively to productivity and competitiveness. Zombie companies, which are heavily indebted firms unable to cover debt servicing costs, often drain resources and hinder market dynamism by occupying capital and labor that could be better utilized elsewhere. Prioritizing support for startups enhances economic resilience and long-term development, while minimizing the prevalence of zombie companies prevents stagnation and inefficiency in the economy.

Connection

Zombie companies, characterized by their inability to cover debt servicing costs and relying on continuous borrowing, create an economic drag by misallocating resources that could otherwise fund innovative startup companies. High levels of zombie firms reduce overall market dynamism, limiting venture capital inflows and constraining the growth potential of emerging startups that drive technological advancement and job creation. The coexistence of zombie companies and startups highlights systemic inefficiencies in capital markets, where financial institutions may prefer supporting failing entities over nurturing high-risk but high-reward new ventures.

Key Terms

Venture Capital

Startup companies attract significant Venture Capital investment due to their high growth potential and innovative business models, often disrupting traditional markets. In contrast, zombie companies, which generate just enough revenue to service debt without growing, pose a risk to Venture Capital as they tie up resources without promising returns. Explore how Venture Capitalists differentiate between promising startups and risky zombie firms to optimize portfolio performance.

Creative Destruction

Startup companies drive creative destruction by introducing innovative technologies and business models that disrupt established markets, fostering economic growth and efficiency. Zombie companies, by contrast, survive primarily through debt refinancing despite lacking profitability, stifling competition and hampering market dynamism. Explore how creative destruction differentiates vibrant startups from stagnant zombies and shapes the future economic landscape.

Debt Overhang

Startup companies often face manageable debt overhangs that enable them to leverage new investments for growth and innovation. In contrast, zombie companies are burdened with excessive debt overhang that stifles operational efficiency and prevents debt restructuring or expansion. Explore further insights on how debt overhang shapes the trajectory of startup versus zombie companies.

Source and External Links

100 Top Startups to Watch in 2025 | Fast-Growing & VC-Backed - This list includes startups like Snappr, Wonolo, and Touchland, recognized for innovation in AI, recruiting, and personal wellness, each with significant funding and notable investors.

25 Fastest Growing Companies & Startups (2025) - Highlights fast-growing startups like Perplexity AI, ZeroTier, and Deepgram, focusing on network security, speech recognition, and AI-driven conversational technologies.

Top 905 USA Startups -- Newly Funded & Hiring - Offers a comprehensive directory of 905 startups in the USA, including AI automation platforms, robotics companies like Gecko Robotics, and startups across multiple tech sectors with active funding and hiring.

dowidth.com

dowidth.com