A liquidity crunch occurs when financial institutions face a severe shortage of cash to meet immediate demands, significantly tightening credit conditions and hampering economic activity. Stagflation combines stagnant economic growth, high unemployment, and rising inflation, creating a challenging environment for policymakers. Explore the nuances and impacts of liquidity crunch and stagflation for a deeper understanding of economic challenges.

Why it is important

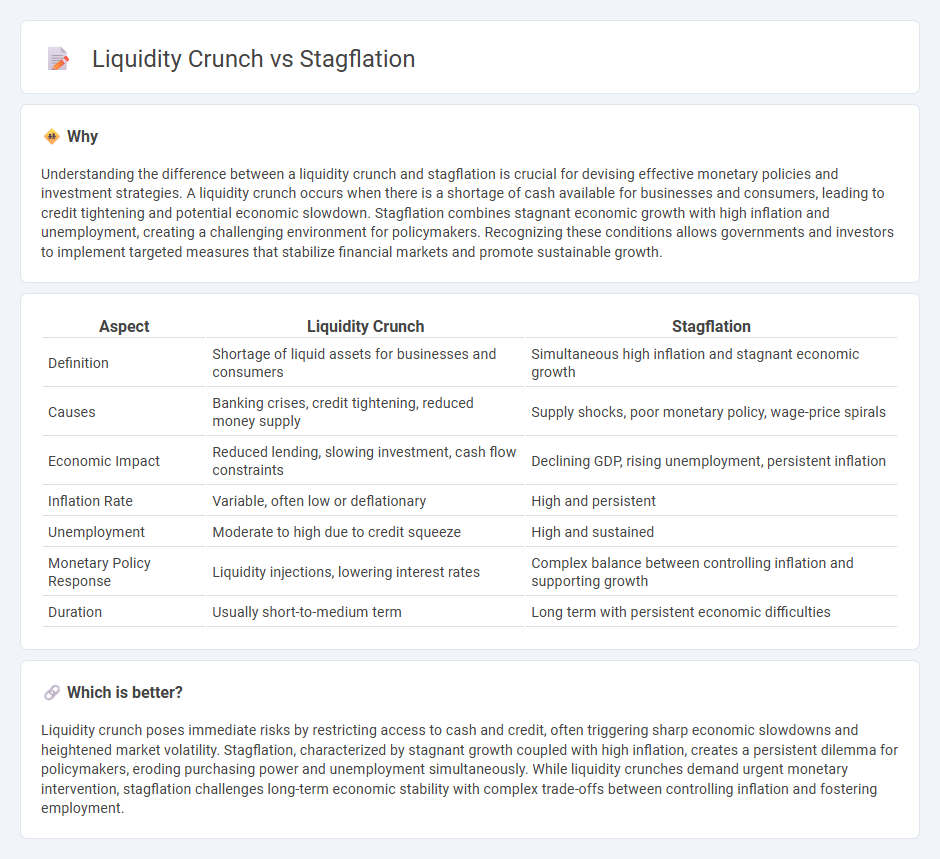

Understanding the difference between a liquidity crunch and stagflation is crucial for devising effective monetary policies and investment strategies. A liquidity crunch occurs when there is a shortage of cash available for businesses and consumers, leading to credit tightening and potential economic slowdown. Stagflation combines stagnant economic growth with high inflation and unemployment, creating a challenging environment for policymakers. Recognizing these conditions allows governments and investors to implement targeted measures that stabilize financial markets and promote sustainable growth.

Comparison Table

| Aspect | Liquidity Crunch | Stagflation |

|---|---|---|

| Definition | Shortage of liquid assets for businesses and consumers | Simultaneous high inflation and stagnant economic growth |

| Causes | Banking crises, credit tightening, reduced money supply | Supply shocks, poor monetary policy, wage-price spirals |

| Economic Impact | Reduced lending, slowing investment, cash flow constraints | Declining GDP, rising unemployment, persistent inflation |

| Inflation Rate | Variable, often low or deflationary | High and persistent |

| Unemployment | Moderate to high due to credit squeeze | High and sustained |

| Monetary Policy Response | Liquidity injections, lowering interest rates | Complex balance between controlling inflation and supporting growth |

| Duration | Usually short-to-medium term | Long term with persistent economic difficulties |

Which is better?

Liquidity crunch poses immediate risks by restricting access to cash and credit, often triggering sharp economic slowdowns and heightened market volatility. Stagflation, characterized by stagnant growth coupled with high inflation, creates a persistent dilemma for policymakers, eroding purchasing power and unemployment simultaneously. While liquidity crunches demand urgent monetary intervention, stagflation challenges long-term economic stability with complex trade-offs between controlling inflation and fostering employment.

Connection

Liquidity crunch restricts the availability of cash and credit in financial markets, causing businesses to reduce investment and consumer spending to decline. Stagflation, characterized by stagnant economic growth and high inflation, often worsens as limited liquidity disrupts supply chains and raises borrowing costs. This interconnected dynamic creates a challenging environment for policymakers aiming to stimulate growth without exacerbating inflation.

Key Terms

**Stagflation:**

Stagflation occurs when an economy experiences stagnant growth, high unemployment, and rising inflation simultaneously, creating a complex challenge for policymakers. Persistent supply-side shocks, such as increased commodity prices, often trigger stagflation, leading to decreased consumer purchasing power and squeezed corporate profit margins. Explore deeper insights into the causes and impacts of stagflation for a comprehensive understanding of this economic phenomenon.

Inflation

Stagflation combines stagnant economic growth, high unemployment, and persistent inflation, causing prices to rise despite weak demand, while a liquidity crunch restricts access to cash, impacting spending but not necessarily driving inflation directly. Inflation during stagflation erodes purchasing power and complicates monetary policy since raising interest rates to curb inflation may worsen unemployment. Explore how inflation dynamics differ fundamentally between stagflation and liquidity crunch scenarios to deepen your understanding.

Unemployment

Stagflation combines stagnant economic growth, high inflation, and rising unemployment, leading to prolonged joblessness and reduced labor market opportunities. In contrast, a liquidity crunch disrupts cash flow, causing companies to tighten budgets and often trigger layoffs, which directly increases unemployment rates. Explore more to understand how these economic challenges uniquely impact employment dynamics.

Source and External Links

Overview, Examples, Why Stagflation is Feared - Stagflation is an economic condition marked by high inflation, slow economic growth, and sustained high unemployment, creating a challenging policy dilemma because measures to control inflation may worsen unemployment, and vice versa, with notable historical examples such as the 1970s U.S. stagflation.

Is the worst of both worlds returning? Understanding stagflation risk - Stagflation involves the painful combination of high inflation and stagnant or declining economic growth, typically accompanied by rising unemployment, resulting in a high "misery index" which sums inflation and unemployment rates, defying normal economic patterns.

Stagflation - Wikipedia - Stagflation is the coexistence of high inflation, stagnant economic growth, and elevated unemployment, first coined in the 1960s and widely recognized after the 1973 oil crisis; it challenges traditional economic theories and poses difficult policy choices between controlling inflation and unemployment.

dowidth.com

dowidth.com