Supercore inflation measures the rise in prices of essential goods and services, excluding volatile sectors like food and energy, reflecting sustained demand pressures in the economy. Cost-push inflation occurs when rising production costs, such as wages or raw materials, force businesses to increase prices, reducing overall supply. Explore the differences between supercore and cost-push inflation to better understand their distinct impacts on economic stability.

Why it is important

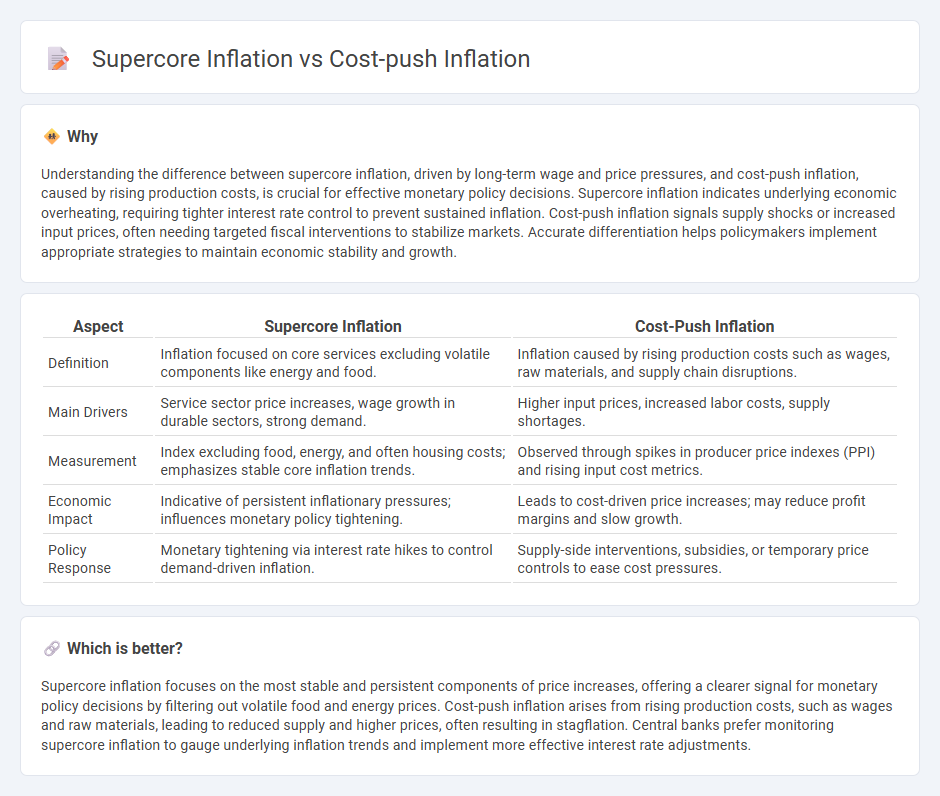

Understanding the difference between supercore inflation, driven by long-term wage and price pressures, and cost-push inflation, caused by rising production costs, is crucial for effective monetary policy decisions. Supercore inflation indicates underlying economic overheating, requiring tighter interest rate control to prevent sustained inflation. Cost-push inflation signals supply shocks or increased input prices, often needing targeted fiscal interventions to stabilize markets. Accurate differentiation helps policymakers implement appropriate strategies to maintain economic stability and growth.

Comparison Table

| Aspect | Supercore Inflation | Cost-Push Inflation |

|---|---|---|

| Definition | Inflation focused on core services excluding volatile components like energy and food. | Inflation caused by rising production costs such as wages, raw materials, and supply chain disruptions. |

| Main Drivers | Service sector price increases, wage growth in durable sectors, strong demand. | Higher input prices, increased labor costs, supply shortages. |

| Measurement | Index excluding food, energy, and often housing costs; emphasizes stable core inflation trends. | Observed through spikes in producer price indexes (PPI) and rising input cost metrics. |

| Economic Impact | Indicative of persistent inflationary pressures; influences monetary policy tightening. | Leads to cost-driven price increases; may reduce profit margins and slow growth. |

| Policy Response | Monetary tightening via interest rate hikes to control demand-driven inflation. | Supply-side interventions, subsidies, or temporary price controls to ease cost pressures. |

Which is better?

Supercore inflation focuses on the most stable and persistent components of price increases, offering a clearer signal for monetary policy decisions by filtering out volatile food and energy prices. Cost-push inflation arises from rising production costs, such as wages and raw materials, leading to reduced supply and higher prices, often resulting in stagflation. Central banks prefer monitoring supercore inflation to gauge underlying inflation trends and implement more effective interest rate adjustments.

Connection

Supercore inflation, which excludes volatile food and energy prices, closely reflects underlying cost-push inflation pressures arising from wage increases and rising input costs. Cost-push inflation drives up production expenses, leading businesses to raise prices across the board, subsequently influencing supercore inflation metrics. Monitoring these inflation types helps policymakers identify persistent inflation trends detached from supply shocks, enabling more targeted economic interventions.

Key Terms

Production Costs

Cost-push inflation occurs when rising production costs, such as higher wages or raw material prices, drive up overall price levels. Supercore inflation measures the persistent price increases in the economy, excluding volatile sectors like food and energy, reflecting sustained pressures on production costs. Explore the detailed differences and impacts of these inflation types to better understand economic trends.

Wages

Cost-push inflation occurs when rising wages lead to increased production costs, pushing prices higher across the economy. Supercore inflation measures price changes in sectors less affected by volatile items like food and energy, reflecting underlying wage-driven inflation pressures more accurately. Explore further to understand how wage dynamics influence inflation trends and economic policy decisions.

Core Services

Cost-push inflation occurs when rising production costs drive up prices, often impacting core services due to increased labor, energy, and material expenses. Supercore inflation specifically targets the inflation rate of core services, excluding volatile sectors like housing and healthcare, offering a clearer view of underlying price pressures in the service economy. Explore deeper insights into how core service inflation shapes monetary policy and economic stability by learning more about its dynamics.

Source and External Links

Cost-Push Inflation - Cost-push inflation occurs when rising prices are driven by higher production costs, such as increased wages and raw material prices, leading to a leftward shift in aggregate supply and higher overall price levels with reduced economic growth.

Cost-Push Inflation: Definition & Examples - It is inflation caused by increased costs of production passed on to consumers, typically occurring when demand remains constant, making goods more expensive due to factors like higher labor costs.

Causes of Inflation | Explainer | Education - Cost-push inflation happens when aggregate supply falls because of rising production costs (e.g., oil price hikes), causing firms to reduce output and raise prices, leading to inflation even if demand is stable.

dowidth.com

dowidth.com