Scrap metal arbitrage involves buying scrap metal at lower prices and selling it at higher market rates based on fluctuating commodity values, leveraging price discrepancies in metal markets. Retail arbitrage focuses on purchasing products from retail stores at discounted prices and reselling them online or in different markets for profit, capitalizing on retail price variations and consumer demand. Explore further to understand the economic impacts and strategies behind these distinct arbitrage methods.

Why it is important

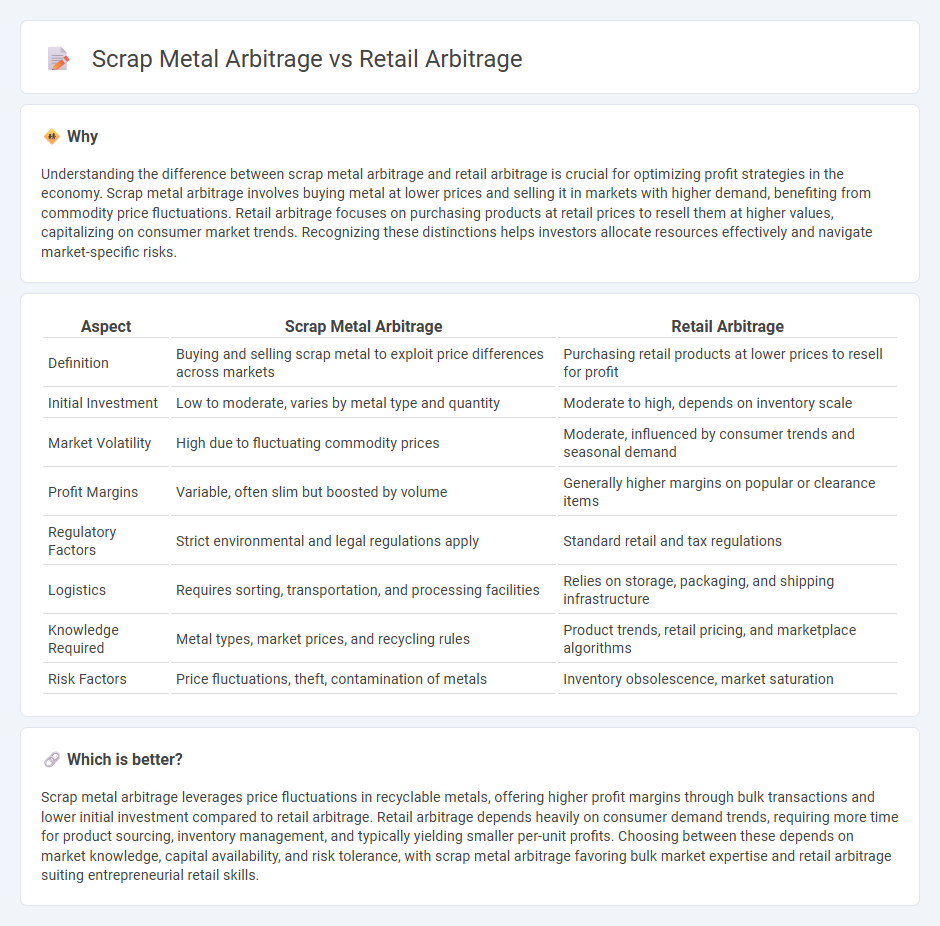

Understanding the difference between scrap metal arbitrage and retail arbitrage is crucial for optimizing profit strategies in the economy. Scrap metal arbitrage involves buying metal at lower prices and selling it in markets with higher demand, benefiting from commodity price fluctuations. Retail arbitrage focuses on purchasing products at retail prices to resell them at higher values, capitalizing on consumer market trends. Recognizing these distinctions helps investors allocate resources effectively and navigate market-specific risks.

Comparison Table

| Aspect | Scrap Metal Arbitrage | Retail Arbitrage |

|---|---|---|

| Definition | Buying and selling scrap metal to exploit price differences across markets | Purchasing retail products at lower prices to resell for profit |

| Initial Investment | Low to moderate, varies by metal type and quantity | Moderate to high, depends on inventory scale |

| Market Volatility | High due to fluctuating commodity prices | Moderate, influenced by consumer trends and seasonal demand |

| Profit Margins | Variable, often slim but boosted by volume | Generally higher margins on popular or clearance items |

| Regulatory Factors | Strict environmental and legal regulations apply | Standard retail and tax regulations |

| Logistics | Requires sorting, transportation, and processing facilities | Relies on storage, packaging, and shipping infrastructure |

| Knowledge Required | Metal types, market prices, and recycling rules | Product trends, retail pricing, and marketplace algorithms |

| Risk Factors | Price fluctuations, theft, contamination of metals | Inventory obsolescence, market saturation |

Which is better?

Scrap metal arbitrage leverages price fluctuations in recyclable metals, offering higher profit margins through bulk transactions and lower initial investment compared to retail arbitrage. Retail arbitrage depends heavily on consumer demand trends, requiring more time for product sourcing, inventory management, and typically yielding smaller per-unit profits. Choosing between these depends on market knowledge, capital availability, and risk tolerance, with scrap metal arbitrage favoring bulk market expertise and retail arbitrage suiting entrepreneurial retail skills.

Connection

Scrap metal arbitrage and retail arbitrage are connected through their common reliance on price differentials to generate profit by buying low and selling high. Both practices exploit market inefficiencies--scrap metal arbitrage capitalizes on regional variations in metal prices, while retail arbitrage leverages differences in retail pricing across locations or platforms. These arbitrage strategies contribute to economic dynamics by redistributing goods and materials in response to supply, demand, and pricing discrepancies.

Key Terms

Price Differential

Retail arbitrage capitalizes on significant price differentials between discounted retail products and their higher resale value in secondary markets, often leveraging clearance sales and online demand spikes. Scrap metal arbitrage exploits volatility in commodity prices and localized scrap availability, buying low-cost metals such as copper, aluminum, or steel and selling them where prices yield profitable margins. Explore deeper insights into pricing strategies and market dynamics behind these profitable arbitrage models.

Inventory Sourcing

Retail arbitrage involves purchasing discounted or clearance products from retail stores to resell at a higher price, relying heavily on consumer goods inventory sourcing and seasonal sales trends. Scrap metal arbitrage centers on acquiring recyclable metals from various sources such as industrial waste, old appliances, or construction debris, focusing on material quality, market price fluctuations, and availability. Explore detailed strategies on optimizing inventory sourcing for each arbitrage type to maximize profit margins.

Market Liquidity

Retail arbitrage benefits from high market liquidity due to the vast number of consumers and online platforms facilitating quick sales of goods at competitive prices. Scrap metal arbitrage faces fluctuating liquidity influenced by global commodity prices and recycling industry demand, making market timing crucial. Explore detailed comparisons to understand which arbitrage strategy aligns with your investment goals.

Source and External Links

A Complete Guide on Amazon Retail Arbitrage - SellerApp - Retail arbitrage is the practice of buying products at discounted prices from retail stores and reselling them for a profit on online marketplaces like Amazon by taking advantage of price differences between markets.

Smash Retail Arbitrage on Amazon (2025 Guide) - Repricer Express - Retail arbitrage involves purchasing items from one retailer and reselling them on platforms such as Amazon, Walmart, or eBay to earn a profit, requiring minimal upfront investment and flexible product selection.

Amazon Retail Arbitrage: How to Resell Products on Amazon in 2024 - This business model legally leverages the first-sale doctrine, allowing you to buy products from stores like Walmart and resell them as new on Amazon for a higher price, as long as the items are sold in their original condition.

dowidth.com

dowidth.com