Shadow inflation refers to the hidden rise in prices of goods and services that may not be fully captured by official inflation metrics, impacting consumers' purchasing power. Asset inflation, on the other hand, involves price increases in financial assets like stocks, real estate, and bonds, often driven by monetary policy and investment trends. Explore further to understand how these two inflation types differently influence the economy and personal wealth.

Why it is important

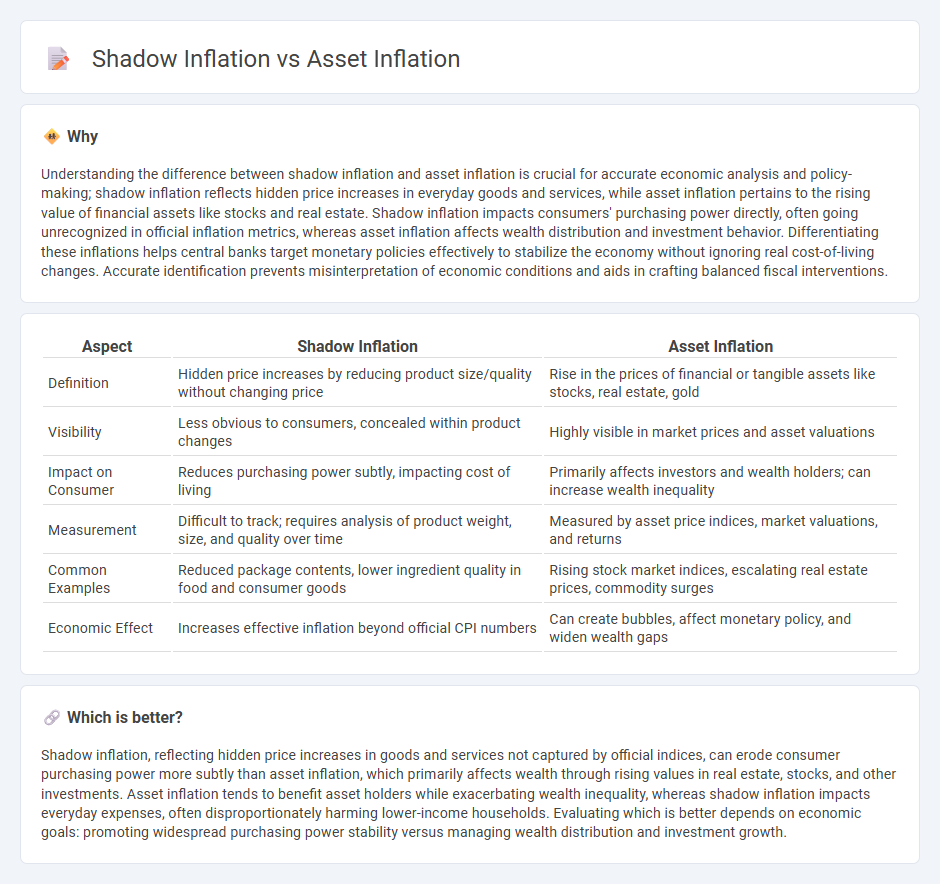

Understanding the difference between shadow inflation and asset inflation is crucial for accurate economic analysis and policy-making; shadow inflation reflects hidden price increases in everyday goods and services, while asset inflation pertains to the rising value of financial assets like stocks and real estate. Shadow inflation impacts consumers' purchasing power directly, often going unrecognized in official inflation metrics, whereas asset inflation affects wealth distribution and investment behavior. Differentiating these inflations helps central banks target monetary policies effectively to stabilize the economy without ignoring real cost-of-living changes. Accurate identification prevents misinterpretation of economic conditions and aids in crafting balanced fiscal interventions.

Comparison Table

| Aspect | Shadow Inflation | Asset Inflation |

|---|---|---|

| Definition | Hidden price increases by reducing product size/quality without changing price | Rise in the prices of financial or tangible assets like stocks, real estate, gold |

| Visibility | Less obvious to consumers, concealed within product changes | Highly visible in market prices and asset valuations |

| Impact on Consumer | Reduces purchasing power subtly, impacting cost of living | Primarily affects investors and wealth holders; can increase wealth inequality |

| Measurement | Difficult to track; requires analysis of product weight, size, and quality over time | Measured by asset price indices, market valuations, and returns |

| Common Examples | Reduced package contents, lower ingredient quality in food and consumer goods | Rising stock market indices, escalating real estate prices, commodity surges |

| Economic Effect | Increases effective inflation beyond official CPI numbers | Can create bubbles, affect monetary policy, and widen wealth gaps |

Which is better?

Shadow inflation, reflecting hidden price increases in goods and services not captured by official indices, can erode consumer purchasing power more subtly than asset inflation, which primarily affects wealth through rising values in real estate, stocks, and other investments. Asset inflation tends to benefit asset holders while exacerbating wealth inequality, whereas shadow inflation impacts everyday expenses, often disproportionately harming lower-income households. Evaluating which is better depends on economic goals: promoting widespread purchasing power stability versus managing wealth distribution and investment growth.

Connection

Shadow inflation, characterized by rising costs in non-transparent or hidden sectors, often drives asset inflation by increasing production and operational expenses that are passed onto asset prices such as real estate and stocks. As businesses face higher input costs not fully captured in official inflation metrics, investors seek hedges in tangible assets, pushing their valuations upward. This interconnected dynamic creates a feedback loop where concealed inflationary pressures elevate asset prices, distorting economic stability and investment risk assessments.

Key Terms

Asset prices

Asset inflation refers to the rising prices of tangible and financial assets like real estate, stocks, and commodities driven by factors such as monetary policy and increased demand. Shadow inflation, in contrast, captures hidden or indirect price increases embedded within goods and services, often unnoticed in standard inflation metrics. Explore the distinctions and implications of asset price movements to better understand their impact on the economy.

Purchasing power

Asset inflation drives up prices of assets such as real estate, stocks, and commodities, eroding purchasing power by increasing wealth inequality and making essential investments less accessible. Shadow inflation, often unseen in official statistics, reflects rising costs in everyday goods and services, diminishing consumers' ability to maintain their standard of living. Explore deeper insights into how these inflation types impact your purchasing power and financial decisions.

Hidden costs

Asset inflation occurs when the prices of assets such as real estate, stocks, and commodities rise rapidly, often fueled by excess liquidity and low interest rates. Shadow inflation, or hidden inflation, refers to the subtle increase in costs of goods and services that aren't immediately reflected in official inflation statistics, driven by factors like supply chain disruptions or reduced product quality. Explore in-depth analyses to understand how these forms of inflation impact purchasing power and economic stability.

Source and External Links

Asset Inflation Cycles: Modern-Day Form of Inflation - Asset inflation cycles, driven by rising prices of assets like stocks and real estate rather than consumer goods, have become a dominant feature of modern economies and are now explicitly addressed by monetary policies such as quantitative easing, which aim to elevate asset values above traditional economic fundamentals.

The Political Economy of Asset versus Consumer Inflation - Asset inflation is closely linked to financialization, where rising asset prices can stimulate consumer demand through the "wealth effect," but also exacerbate social stratification by making asset ownership--rather than employment or wages--increasingly central to life chances and economic security.

Forecasting Output and Inflation: The Role of Asset Prices - While some asset prices can predict inflation or output growth in certain countries and periods, their predictive power is inconsistent and historically unreliable, making it difficult to generalize their role in macroeconomic forecasting.

dowidth.com

dowidth.com