Carbon border taxes impose tariffs on imported goods based on their carbon emissions, aiming to prevent carbon leakage and encourage greener production practices globally. Greenhouse gas quotas set limits on emissions by capping the total allowable output and often involve tradeable permits to regulate polluters efficiently. Explore more about how these economic tools influence global climate policies and market dynamics.

Why it is important

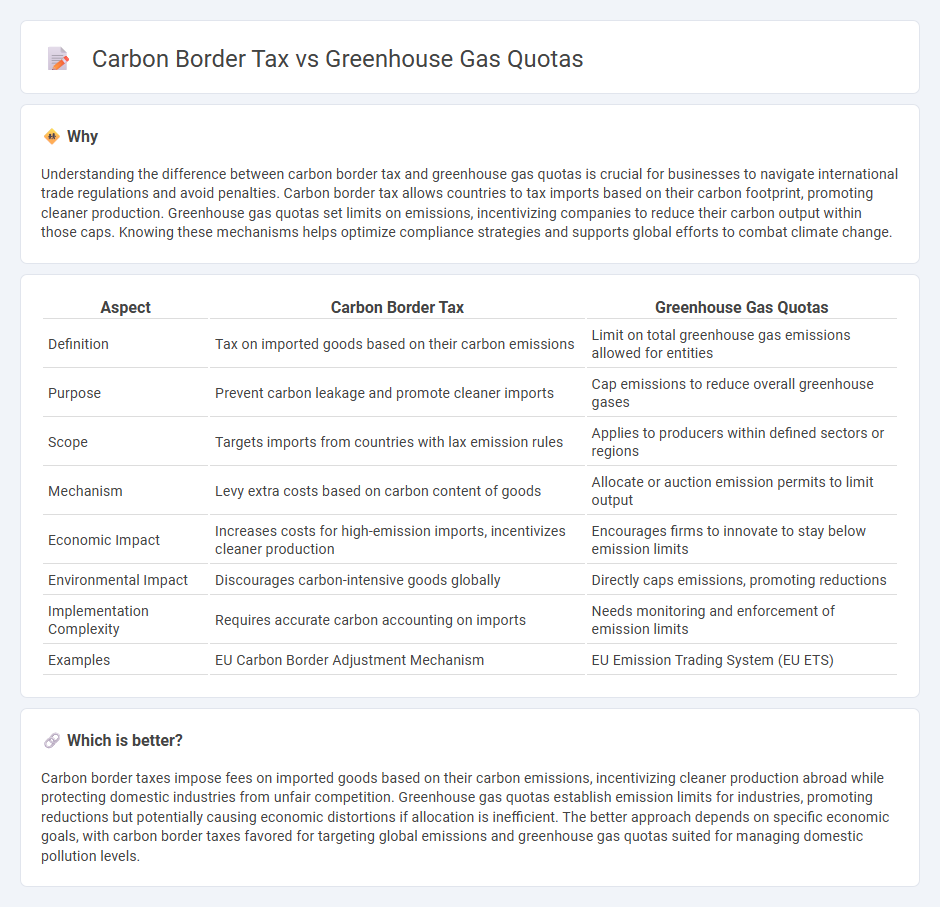

Understanding the difference between carbon border tax and greenhouse gas quotas is crucial for businesses to navigate international trade regulations and avoid penalties. Carbon border tax allows countries to tax imports based on their carbon footprint, promoting cleaner production. Greenhouse gas quotas set limits on emissions, incentivizing companies to reduce their carbon output within those caps. Knowing these mechanisms helps optimize compliance strategies and supports global efforts to combat climate change.

Comparison Table

| Aspect | Carbon Border Tax | Greenhouse Gas Quotas |

|---|---|---|

| Definition | Tax on imported goods based on their carbon emissions | Limit on total greenhouse gas emissions allowed for entities |

| Purpose | Prevent carbon leakage and promote cleaner imports | Cap emissions to reduce overall greenhouse gases |

| Scope | Targets imports from countries with lax emission rules | Applies to producers within defined sectors or regions |

| Mechanism | Levy extra costs based on carbon content of goods | Allocate or auction emission permits to limit output |

| Economic Impact | Increases costs for high-emission imports, incentivizes cleaner production | Encourages firms to innovate to stay below emission limits |

| Environmental Impact | Discourages carbon-intensive goods globally | Directly caps emissions, promoting reductions |

| Implementation Complexity | Requires accurate carbon accounting on imports | Needs monitoring and enforcement of emission limits |

| Examples | EU Carbon Border Adjustment Mechanism | EU Emission Trading System (EU ETS) |

Which is better?

Carbon border taxes impose fees on imported goods based on their carbon emissions, incentivizing cleaner production abroad while protecting domestic industries from unfair competition. Greenhouse gas quotas establish emission limits for industries, promoting reductions but potentially causing economic distortions if allocation is inefficient. The better approach depends on specific economic goals, with carbon border taxes favored for targeting global emissions and greenhouse gas quotas suited for managing domestic pollution levels.

Connection

Carbon border tax and greenhouse gas quotas are interconnected mechanisms aimed at reducing carbon emissions and promoting environmental sustainability. Carbon border tax imposes costs on imported goods based on their embodied carbon emissions, aligning import prices with domestic carbon regulations and preventing carbon leakage. Greenhouse gas quotas set limits on emissions for industries, creating a market for carbon allowances that incentivizes emission reductions and complements the border tax by ensuring consistent carbon pricing globally.

Key Terms

Emissions Cap

Emissions cap under greenhouse gas quotas strictly limits the total amount of permitted emissions by setting a quantitative threshold for emitters, fostering direct reductions within regulated entities. In contrast, the carbon border tax indirectly influences emissions by levying fees on imported goods based on their carbon footprint, aiming to equalize costs and discourage carbon-intensive production abroad. Explore the detailed impacts of emissions caps and carbon border taxes to understand their roles in global climate strategy.

Trade Competitiveness

Greenhouse gas quotas set limits on emissions for industries, directly impacting production costs and export prices, thereby influencing trade competitiveness by shaping market dynamics and compliance expenses. Carbon border tax imposes import tariffs based on the carbon footprint of goods, aiming to level the playing field for domestic producers facing stringent climate regulations while preventing carbon leakage in international trade. Explore how these mechanisms affect global trade competitiveness and regulatory strategies in evolving carbon markets.

Carbon Leakage

Greenhouse gas quotas set strict emission limits on industries to curb carbon output, directly targeting carbon leakage by preventing companies from relocating to countries with lax environmental regulations. Carbon border tax imposes tariffs on imported goods based on their carbon content, discouraging offshoring and leveling the economic playing field while indirectly combating carbon leakage. Explore how these policies intersect and their impact on global emissions reduction strategies for deeper insight.

Source and External Links

Climate Encyclopedia: Quota - This webpage describes greenhouse gas quotas as limits set on the amount of emissions a nation can produce within a specified period, often part of international agreements like the Kyoto Protocol.

EEX: GHG Quota - This platform offers trading in greenhouse gas reduction quotas, allowing companies to buy and sell credits related to emissions reductions.

STX Group: GHG Quota - STX provides services to help companies comply with greenhouse gas quota legislation, facilitating registration and trading of emission credits.

dowidth.com

dowidth.com