Excess savings have surged globally as households and businesses accumulated reserves during periods of economic uncertainty, leading to a temporary boost in liquidity. Conversely, a credit crunch restricts access to financing, tightening credit conditions and slowing down investment and spending. Explore how these opposing forces shape economic recovery and financial stability.

Why it is important

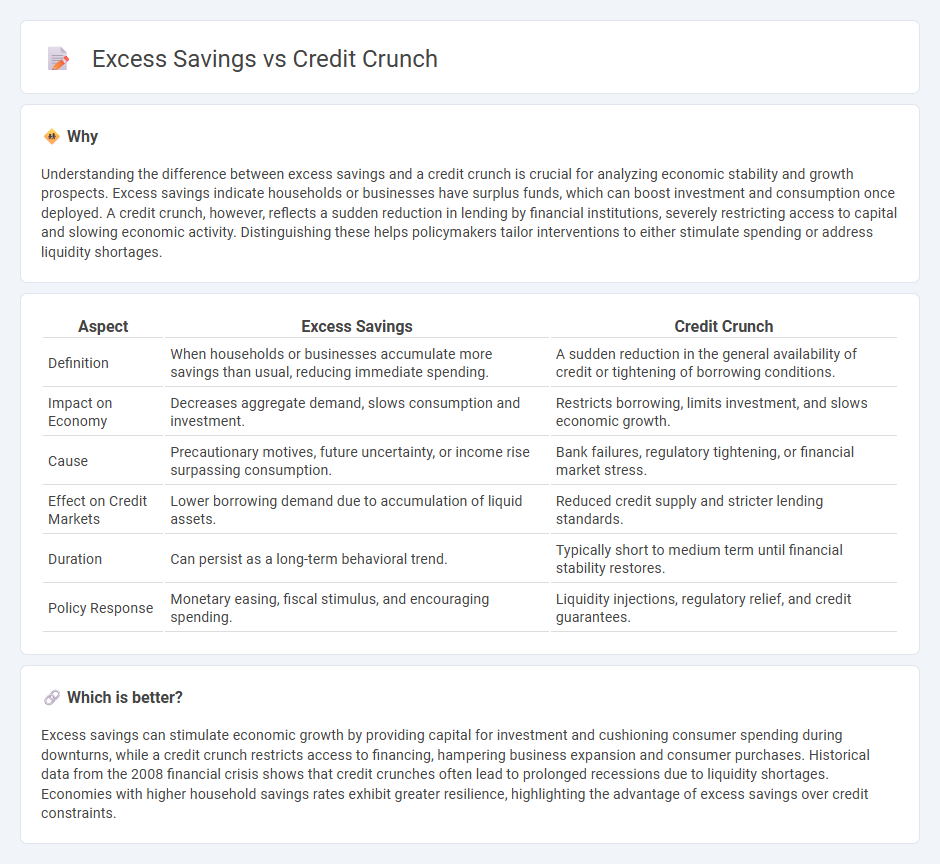

Understanding the difference between excess savings and a credit crunch is crucial for analyzing economic stability and growth prospects. Excess savings indicate households or businesses have surplus funds, which can boost investment and consumption once deployed. A credit crunch, however, reflects a sudden reduction in lending by financial institutions, severely restricting access to capital and slowing economic activity. Distinguishing these helps policymakers tailor interventions to either stimulate spending or address liquidity shortages.

Comparison Table

| Aspect | Excess Savings | Credit Crunch |

|---|---|---|

| Definition | When households or businesses accumulate more savings than usual, reducing immediate spending. | A sudden reduction in the general availability of credit or tightening of borrowing conditions. |

| Impact on Economy | Decreases aggregate demand, slows consumption and investment. | Restricts borrowing, limits investment, and slows economic growth. |

| Cause | Precautionary motives, future uncertainty, or income rise surpassing consumption. | Bank failures, regulatory tightening, or financial market stress. |

| Effect on Credit Markets | Lower borrowing demand due to accumulation of liquid assets. | Reduced credit supply and stricter lending standards. |

| Duration | Can persist as a long-term behavioral trend. | Typically short to medium term until financial stability restores. |

| Policy Response | Monetary easing, fiscal stimulus, and encouraging spending. | Liquidity injections, regulatory relief, and credit guarantees. |

Which is better?

Excess savings can stimulate economic growth by providing capital for investment and cushioning consumer spending during downturns, while a credit crunch restricts access to financing, hampering business expansion and consumer purchases. Historical data from the 2008 financial crisis shows that credit crunches often lead to prolonged recessions due to liquidity shortages. Economies with higher household savings rates exhibit greater resilience, highlighting the advantage of excess savings over credit constraints.

Connection

Excess savings lead to reduced consumer spending, which dampens economic growth and causes banks to tighten lending standards, triggering a credit crunch. During a credit crunch, businesses and consumers find it harder to obtain loans, further suppressing investment and consumption. This cyclical interaction between excess savings and restricted credit availability can slow economic recovery significantly.

Key Terms

Liquidity

Credit crunch occurs when banks reduce lending due to higher risk or regulatory constraints, leading to reduced liquidity in the financial system. Excess savings refer to households or corporations holding substantial surplus funds, which can either support liquidity if deployed or suppress it when held idle. Explore deeper insights on how liquidity dynamics influence economic stability and growth.

Interest rates

Credit crunch occurs when lenders tighten credit availability, leading to higher interest rates and reduced borrowing capacity. Excess savings increase the supply of loanable funds, which typically drives down interest rates and encourages investment. Explore how shifts in credit conditions and savings levels influence market interest rates and economic growth.

Bank lending

Credit crunch occurs when banks significantly reduce lending due to perceived risks or tighter regulations, limiting access to credit for businesses and consumers. Excess savings, on the other hand, represent a surplus of funds in the economy that could potentially increase bank deposits but may not translate into higher lending if banks remain cautious. Discover how these dynamics impact bank lending and economic growth by exploring detailed financial analyses.

Source and External Links

Credit crunch - Wikipedia - A credit crunch is a sudden reduction in the general availability of loans or a tightening of loan conditions that makes credit less available at any given official interest rate, often accompanied by lenders seeking less risky investments.

Credit Crunch Definition, Causes & Consequences - Study.com - A credit crunch occurs when banks become reluctant to lend money due to factors like a loss of confidence in the financial system, falling stock markets, or economic slowdown, resulting in higher borrowing costs and negative economic impacts such as increased unemployment.

What happens during a credit crunch and what that could mean for you - During a credit crunch, loans become harder to obtain as banks tighten lending standards, which can affect homeowners and business owners by limiting access to funds for expansion, leading to financial strain for those with less savings or higher debt levels.

dowidth.com

dowidth.com