De-dollarisation refers to efforts by countries to reduce reliance on the US dollar in international trade and finance, aiming to strengthen their own currencies and economic sovereignty. Currency substitution occurs when domestic economies extensively use foreign currencies alongside or instead of the local currency, often due to instability or lack of confidence in the national monetary system. Explore the nuances between de-dollarisation and currency substitution to understand their impact on global economic dynamics.

Why it is important

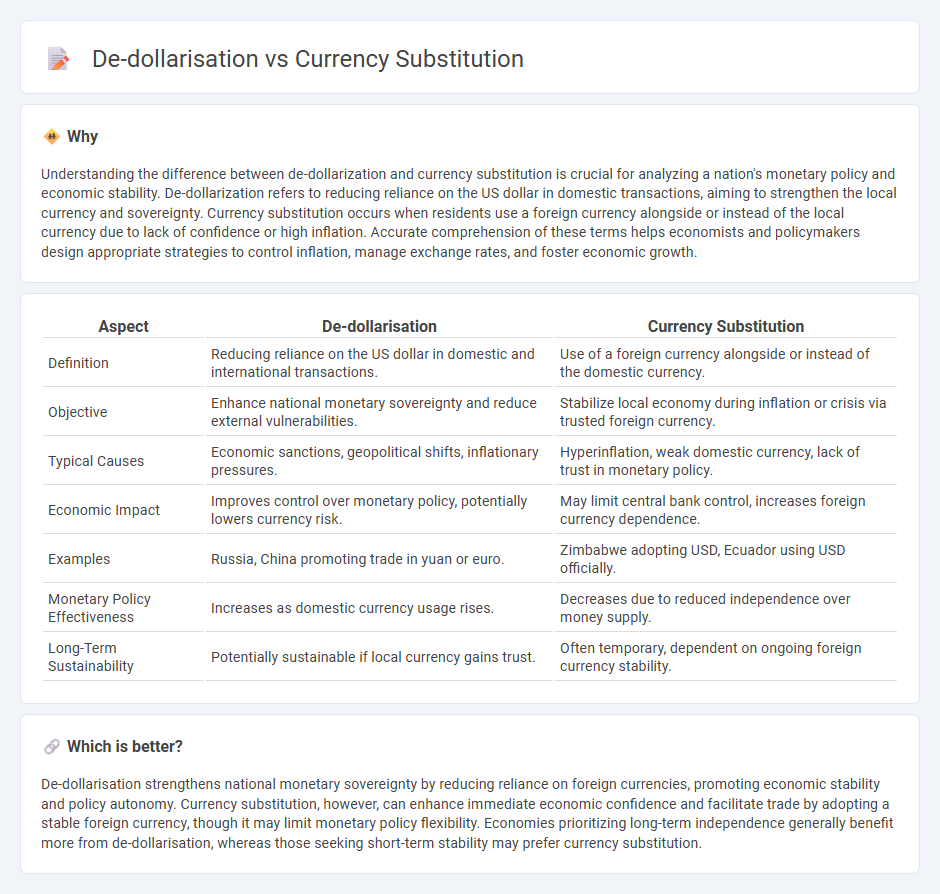

Understanding the difference between de-dollarization and currency substitution is crucial for analyzing a nation's monetary policy and economic stability. De-dollarization refers to reducing reliance on the US dollar in domestic transactions, aiming to strengthen the local currency and sovereignty. Currency substitution occurs when residents use a foreign currency alongside or instead of the local currency due to lack of confidence or high inflation. Accurate comprehension of these terms helps economists and policymakers design appropriate strategies to control inflation, manage exchange rates, and foster economic growth.

Comparison Table

| Aspect | De-dollarisation | Currency Substitution |

|---|---|---|

| Definition | Reducing reliance on the US dollar in domestic and international transactions. | Use of a foreign currency alongside or instead of the domestic currency. |

| Objective | Enhance national monetary sovereignty and reduce external vulnerabilities. | Stabilize local economy during inflation or crisis via trusted foreign currency. |

| Typical Causes | Economic sanctions, geopolitical shifts, inflationary pressures. | Hyperinflation, weak domestic currency, lack of trust in monetary policy. |

| Economic Impact | Improves control over monetary policy, potentially lowers currency risk. | May limit central bank control, increases foreign currency dependence. |

| Examples | Russia, China promoting trade in yuan or euro. | Zimbabwe adopting USD, Ecuador using USD officially. |

| Monetary Policy Effectiveness | Increases as domestic currency usage rises. | Decreases due to reduced independence over money supply. |

| Long-Term Sustainability | Potentially sustainable if local currency gains trust. | Often temporary, dependent on ongoing foreign currency stability. |

Which is better?

De-dollarisation strengthens national monetary sovereignty by reducing reliance on foreign currencies, promoting economic stability and policy autonomy. Currency substitution, however, can enhance immediate economic confidence and facilitate trade by adopting a stable foreign currency, though it may limit monetary policy flexibility. Economies prioritizing long-term independence generally benefit more from de-dollarisation, whereas those seeking short-term stability may prefer currency substitution.

Connection

De-dollarisation and currency substitution are interconnected phenomena where countries reduce reliance on the US dollar in favor of their own or alternative currencies to stabilize their economies and assert monetary sovereignty. Currency substitution often follows de-dollarisation efforts as local currencies replace foreign ones in daily transactions, financial contracts, and reserves, impacting exchange rates and inflation control. Both processes influence a nation's ability to implement independent monetary policies and affect international trade dynamics.

Key Terms

Exchange Rate Regime

Currency substitution occurs when residents of a country use a foreign currency alongside or instead of the domestic currency, often leading to a dual or multiple currency exchange rate regime that can undermine monetary policy effectiveness. De-dollarisation involves deliberate policy measures aimed at reducing reliance on the US dollar by promoting the domestic currency in international transactions and reserves, thereby stabilizing and strengthening the national exchange rate regime. Explore this topic further to understand the implications for monetary sovereignty and exchange rate management.

Monetary Sovereignty

Currency substitution occurs when residents of a country use a foreign currency alongside or instead of the domestic currency, often undermining monetary sovereignty by limiting the central bank's control over money supply and interest rates. De-dollarisation involves deliberate policy measures by governments to reduce reliance on the U.S. dollar in domestic and international transactions, thereby restoring monetary sovereignty and enhancing economic stability. Explore detailed strategies and impacts of these monetary phenomena to understand their role in national financial autonomy.

Foreign Currency Reserves

Currency substitution involves a country using a foreign currency alongside or instead of its domestic currency, which can lead to increased foreign currency reserves to stabilize the economy. In contrast, de-dollarization aims at reducing dependence on the US dollar by diversifying foreign currency reserves into other currencies or assets to enhance monetary sovereignty. Explore the dynamics of currency substitution and de-dollarization to understand their impact on foreign currency reserves management.

Source and External Links

Currency Substitution - Pros and Cons - Economics Help - Currency substitution occurs when an economy uses an alternative currency alongside or instead of its domestic currency, often to combat inflation and monetary instability, with examples including Ecuador, El Salvador, and Panama.

Currency Substitution in High Inflation Countries - IMF eLibrary - This paper examines how currency substitution, especially in high inflation contexts, can influence exchange rate policies and create challenges in maintaining a nominal anchor under flexible exchange rates.

IV Currency Substitution and Dollarization in - IMF eLibrary - Currency substitution is described as the use of foreign currency for transactions and as a store of value, with dollarization being a common form, affecting seigniorage revenues and monetary policy effectiveness.

dowidth.com

dowidth.com