Price gouging involves raising prices excessively during emergencies, exploiting high demand and limited supply, while price discrimination sets varied prices based on consumer segments to maximize revenue. Both practices impact markets but differ fundamentally in intent and regulation. Explore how these pricing strategies affect economic fairness and market efficiency.

Why it is important

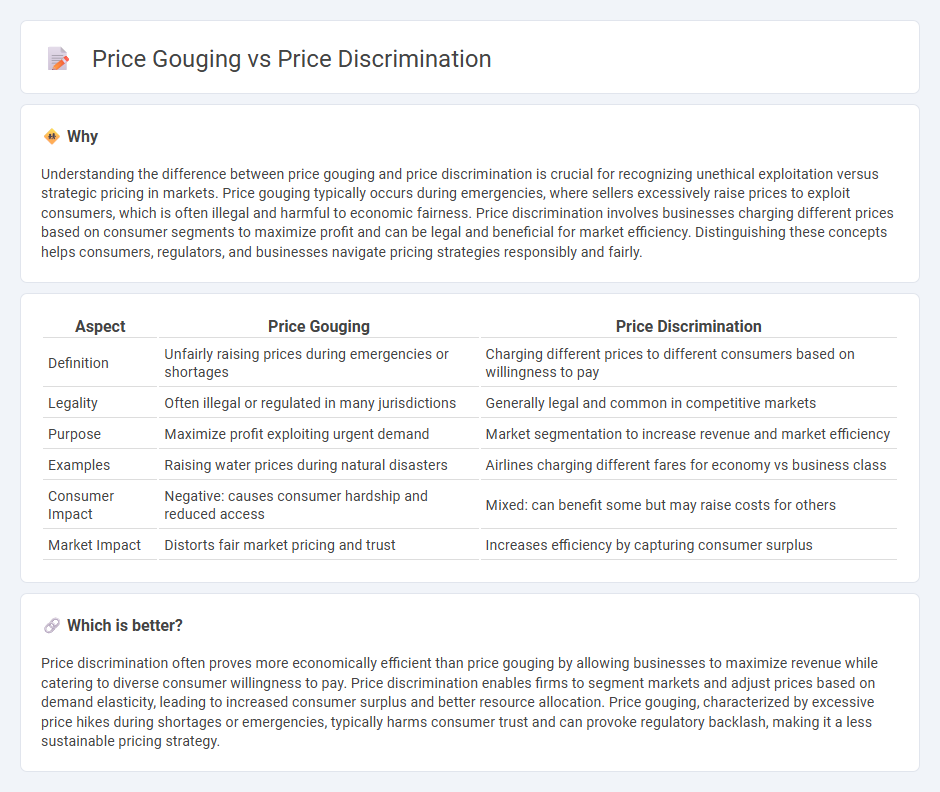

Understanding the difference between price gouging and price discrimination is crucial for recognizing unethical exploitation versus strategic pricing in markets. Price gouging typically occurs during emergencies, where sellers excessively raise prices to exploit consumers, which is often illegal and harmful to economic fairness. Price discrimination involves businesses charging different prices based on consumer segments to maximize profit and can be legal and beneficial for market efficiency. Distinguishing these concepts helps consumers, regulators, and businesses navigate pricing strategies responsibly and fairly.

Comparison Table

| Aspect | Price Gouging | Price Discrimination |

|---|---|---|

| Definition | Unfairly raising prices during emergencies or shortages | Charging different prices to different consumers based on willingness to pay |

| Legality | Often illegal or regulated in many jurisdictions | Generally legal and common in competitive markets |

| Purpose | Maximize profit exploiting urgent demand | Market segmentation to increase revenue and market efficiency |

| Examples | Raising water prices during natural disasters | Airlines charging different fares for economy vs business class |

| Consumer Impact | Negative: causes consumer hardship and reduced access | Mixed: can benefit some but may raise costs for others |

| Market Impact | Distorts fair market pricing and trust | Increases efficiency by capturing consumer surplus |

Which is better?

Price discrimination often proves more economically efficient than price gouging by allowing businesses to maximize revenue while catering to diverse consumer willingness to pay. Price discrimination enables firms to segment markets and adjust prices based on demand elasticity, leading to increased consumer surplus and better resource allocation. Price gouging, characterized by excessive price hikes during shortages or emergencies, typically harms consumer trust and can provoke regulatory backlash, making it a less sustainable pricing strategy.

Connection

Price gouging and price discrimination both involve charging different prices to consumers but differ in intent and legality, as price gouging exploits emergency situations by inflating prices excessively, whereas price discrimination strategically sets prices based on consumer segments to maximize profit. Economic frameworks identify price discrimination as a method to capture consumer surplus through tailored pricing models, while price gouging often violates consumer protection laws due to its exploitative nature. Understanding these concepts is crucial for regulators aiming to balance market efficiency and fair consumer treatment during supply shocks or crises.

Key Terms

Market Segmentation

Price discrimination and price gouging both involve charging different prices but differ significantly in intent and market dynamics. Price discrimination occurs through strategic market segmentation, allowing businesses to maximize revenue by charging varied prices based on consumer willingness to pay or demographic characteristics. Explore how companies ethically leverage market segmentation to optimize pricing strategies and avoid negative perceptions associated with price gouging.

Elasticity of Demand

Price discrimination involves charging different prices to customers based on their willingness to pay, leveraging elasticity of demand to maximize revenue by segmenting markets with varying price sensitivities. In contrast, price gouging refers to excessively high prices imposed during emergencies or shortages, often exploiting inelastic demand when consumers have limited alternatives. Explore how understanding demand elasticity helps differentiate ethical pricing strategies from exploitative practices.

Regulatory Intervention

Regulatory intervention in price discrimination targets unfair market advantages where sellers charge different prices based on customer segmentation, aiming to promote equity and prevent exploitation. Price gouging laws specifically prohibit excessive pricing during emergencies or shortages, protecting consumers from predatory conduct. Explore detailed regulations and case studies to understand the nuances of these policies.

Source and External Links

Price discrimination - Wikipedia - Price discrimination is a microeconomic pricing strategy where the same goods or services are sold at different prices to different buyers based on their market segment or willingness to pay, enabling firms to maximize profits and capture consumer surplus, with some forms regulated or illegal in certain jurisdictions.

Price Discrimination - Economics Help - Price discrimination involves charging different prices for the same good to different consumers, categorized into first-degree (individual pricing), second-degree (based on quantity or purchase timing), and third-degree (group-based discounts), often implemented through product versioning or timing strategies.

Price Discrimination | EBSCO Research Starters - Price discrimination is the practice of charging different prices for the same product based on factors like customer type or circumstances, with legal frameworks such as the Sherman Antitrust Act and Robinson-Patman Act regulating its application to prevent unfair monopolistic practices.

dowidth.com

dowidth.com